Institutions to use crypto and money market fund tokens as collateral under Dubai’s digital asset rules

Standard Chartered and cryptocurrency exchange OKX have announced a new pilot programme allowing institutional clients to use crypto assets and tokenised money market funds (MMFs) as collateral. Launched under the oversight of Dubai’s Virtual Asset Regulatory Authority (VARA), the initiative aims to enhance collateral management while ensuring regulatory compliance and security.

Custody and Compliance under DIFC Oversight

The pilot programme, announced on 10 April, is being run with Standard Chartered acting as a regulated custodian within the Dubai International Financial Centre (DIFC). The solution enables off-exchange collateral usage, with custody placed in a globally systemically important bank, increasing trust and transparency.

This move is part of broader efforts to modernise financial infrastructure and integrate digital assets more deeply into institutional workflows. “Our collaboration with OKX to enable the use of cryptocurrencies and tokenised MMFs as collateral represents a significant step forward,” said Margaret Harwood-Jones, global head of financing and securities services at Standard Chartered. She added that the bank’s custody infrastructure ensures “the highest standards of security and regulatory compliance.”

Franklin Templeton Provides Tokenised Asset Access

The programme is being supported by crypto-friendly asset manager Franklin Templeton, with its onchain assets forming part of the initial offering. OKX clients will gain access to these digital instruments, created by Franklin Templeton’s in-house digital assets team.

Roger Bayston, head of digital assets at Franklin Templeton, emphasised the importance of blockchain-native assets: “By ensuring assets are minted onchain, we enable true ownership, allowing them to move and settle at blockchain speed — eliminating the need for traditional infrastructure.”

Franklin Templeton’s participation is the first in what is expected to be a series of tokenised MMFs available to institutional clients through the programme.

Brevan Howard Among First to Join Pilot

Brevan Howard Digital, the digital assets arm of hedge fund Brevan Howard, is one of the first institutions to participate in the pilot. Ryan Taylor, group head of compliance at Brevan Howard, welcomed the initiative: “As a significant investor in the digital assets space, we are thrilled to partner with industry leaders to further grow and evolve the crypto ecosystem globally.”

Institutional Confidence in Crypto Collateral Rising

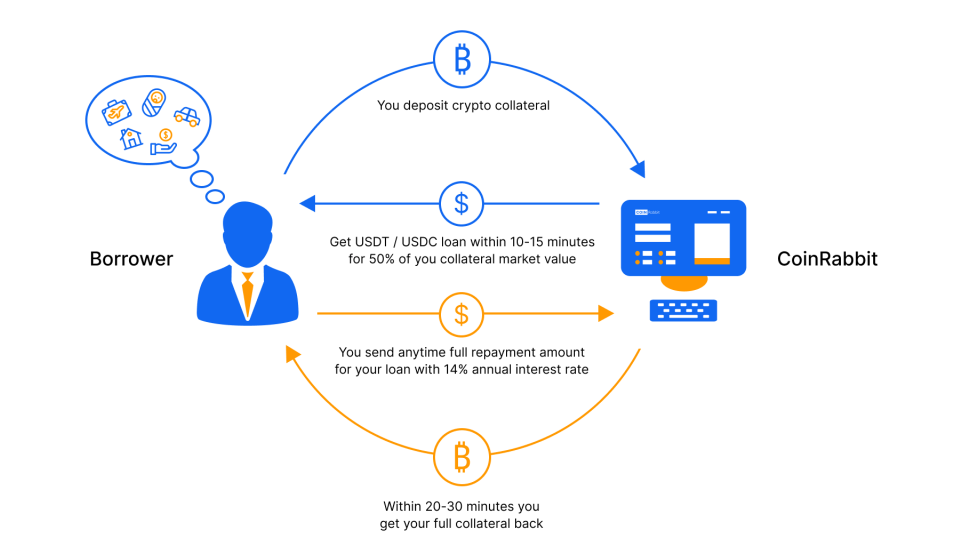

Collateral in crypto lending typically involves blockchain-based assets pledged to secure loans. Despite the volatility of digital currencies, institutions are increasingly exploring their use in formal financial systems.

The Standard Chartered-OKX initiative is seen as part of a broader trend of institutionalisation and innovation within the crypto industry. By providing a regulated environment and robust custody mechanisms, the pilot aims to attract more traditional finance players into the digital asset space.