Tether, the issuer of the world’s largest stablecoin USDt, reported a mixed financial picture for 2025, with profits declining year on year even as its holdings of US Treasurys climbed to their highest level ever. The company’s latest financial report highlights a strategic shift toward safer, highly liquid assets amid growing global demand for digital dollars.

Profits Fall Despite Strong Balance Sheet

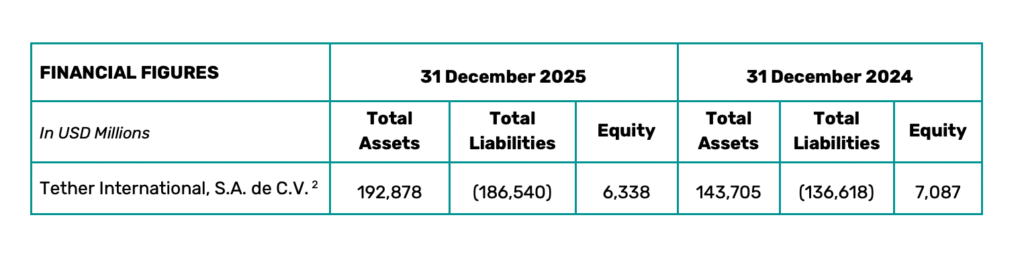

According to a report released on Friday and prepared by accounting firm BDO, Tether recorded net profits of over $10 billion in 2025. This marks a drop of roughly 23% compared to the $13 billion the company reported in 2024. In absolute terms, profits declined by about $3 billion year on year.

Tether CEO Paolo Ardoino downplayed the importance of headline profit figures, saying the company’s focus in 2025 was less about scale and more about building a resilient structure behind its growth. He suggested that long term stability and asset quality mattered more than short term earnings fluctuations, especially as the stablecoin market matures and comes under closer scrutiny.

US Treasury Holdings Reach $122 Billion

While profits fell, Tether’s balance sheet continued to expand in other areas. The company said its direct holdings of US Treasurys surpassed $122 billion in 2025, the highest level in its history. Tether described this as part of an ongoing shift toward low risk, highly liquid assets.

This growing exposure to US government debt is closely watched by the crypto market, as it reflects how stablecoin issuers manage reserves that back billions of dollars in circulating tokens. For Tether, Treasurys now form a core pillar of its reserve strategy, reinforcing USDt’s role as a widely used digital proxy for the US dollar.

$50 Billion in New USDt Issued

Over the past 12 months, Tether issued around $50 billion worth of new USDt, reflecting sustained demand for the stablecoin. Ardoino said this growth was driven by rising global demand for US dollars outside traditional banking systems.

He pointed to regions where financial infrastructure is slow, fragmented, or difficult to access, arguing that USDt has become a practical alternative for payments, savings, and cross border transfers. In his view, the stablecoin functions as a kind of monetary network that operates beyond the limits of conventional finance.

USDt’s Role in the Crypto Market

USDt remains a critical piece of the crypto ecosystem. It is currently the third largest cryptocurrency by market capitalization, behind Bitcoin and Ether. According to CoinMarketCap, USDt’s market value stands at $185.51 billion.

Because USDt is widely used as a trading pair, liquidity tool, and source of collateral, traders and exchanges pay close attention to Tether’s reserves and profitability. Confidence in the stablecoin is closely tied to confidence in the broader market, particularly during periods of volatility when participants rely on stablecoins to move in and out of risk assets.

Gold Reserves and XAUt Backing

Beyond US Treasurys, Tether has continued to build exposure to gold. The company issues a gold backed stablecoin called XAUt, and as of September 2025, it reported around $12 billion in gold exposure linked to this product.

Tether holds 520,089 troy ounces of gold to back XAUt tokens, equivalent to roughly 16.2 metric tons. This gold is held separately from a broader reserve of about 130 metric tons of physical gold, which is worth around $22 billion at current market prices.

A Tether spokesperson said the gold backing each XAUt token is stored independently and is eligible for physical delivery upon redemption. This structure is designed to ensure transparency and maintain confidence among holders who view gold as a hedge against inflation and financial instability.

Focus on Structure Over Scale

Taken together, Tether’s 2025 results suggest a company prioritizing asset quality and reserve strength over rapid profit growth. While earnings declined from the previous year, the record level of US Treasury holdings and continued issuance of USDt point to sustained demand and a more conservative reserve strategy.

As regulators and market participants continue to scrutinize stablecoins, Tether’s emphasis on liquidity, low risk assets, and diversified reserves is likely to remain central to its narrative in the year ahead.