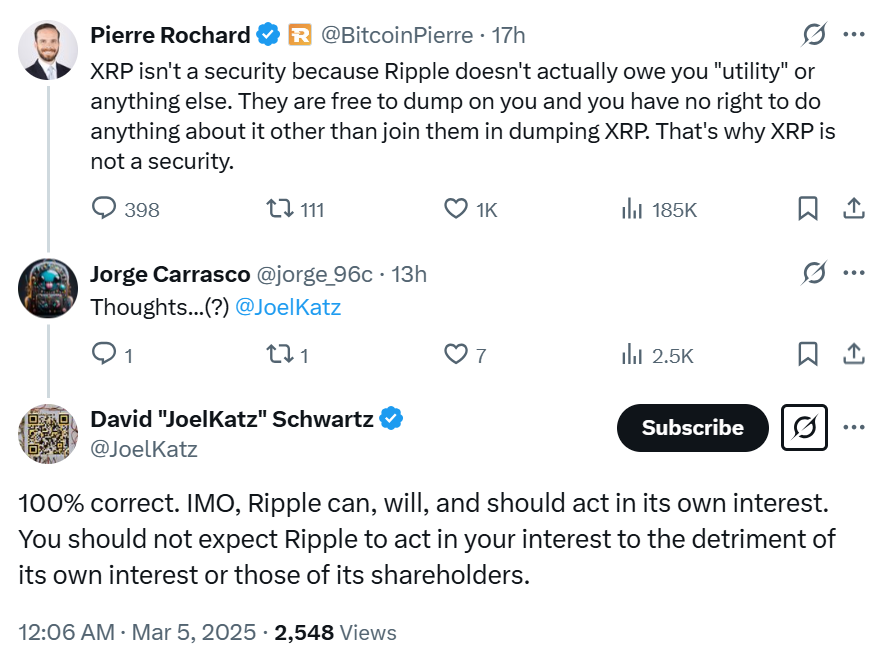

David “JoelKatz” Schwartz, the Chief Technology Officer (CTO) of Ripple, has defended the company’s right to sell XRP, stating that Ripple will always act in its own interest. His comments came in response to criticism that Ripple’s ongoing sales of XRP could negatively impact investors.

“Ripple can, will, and should act in its own interest,” Schwartz asserted, emphasizing that investors should not expect the company to prioritize their financial interests over its own.

XRP Not a Security, Says Industry Expert

The debate was ignited by Pierre Rochard, Vice President of Research at Riot Platforms, who pointed out that XRP holders have no claim to any “utility” or rights from Ripple. He warned that investors should not assume they are investing in Ripple itself but merely acquiring tokens that the company can sell at will.

Schwartz agreed, reinforcing that Ripple has no obligation to act on behalf of XRP holders. This perspective aligns with Ripple’s longstanding argument that XRP is not a security, a point of contention in the ongoing regulatory discussions surrounding the asset.

Dormant XRP Wallet Raises Questions

Investor concerns were further amplified after blockchain investigator ZachXBT revealed a dormant XRP wallet potentially linked to Ripple co-founder Chris Larsen. The wallet holds over 2.7 billion XRP ($7.18 billion) and was largely inactive for the past six years.

Notably, in January 2025, addresses tied to Larsen moved over $109 million worth of XRP to exchanges, sparking speculation about potential large-scale sales. However, the inactivity of most of these addresses suggests Larsen may no longer have access to these funds.

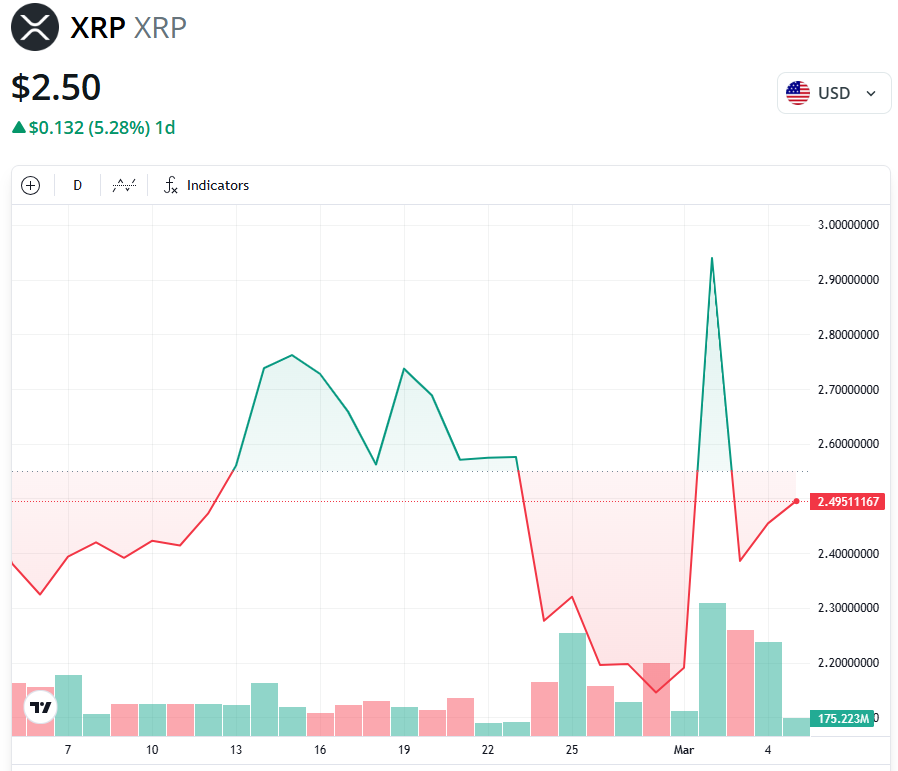

XRP’s Rally Stalls Despite Trump’s Crypto Reserve Plan

XRP saw a brief price surge on March 3, following an announcement by U.S. President Donald Trump. His administration directed its Working Group on Digital Assets to include XRP, Cardano, and Solana in the U.S. Crypto Strategic Reserve, alongside Bitcoin.

Despite this bullish news, XRP failed to reclaim the $3.00 mark, peaking at $2.99 on March 2 before dropping to $2.50. Analysts remain cautious, warning that Trump’s proposed reserve still requires congressional approval—a process that could lead to delays and investor uncertainty.