JP Mullin responds to collapse and insider allegations by pledging to burn his personal token allocation.

Mantra’s OM token has seen a sharp decline, crashing over 90% from its weekly high and erasing $5 billion in value. The sudden drop led to widespread backlash and allegations of insider activity. Amid this turmoil, CEO JP Mullin announced on April 15 that he plans to burn his entire personal allocation of 772,000 OM tokens to restore trust and accountability.

Team Tokens Not Yet Vested

In response to a community call to delay token unlocks, Mullin clarified that team tokens are not due to vest until 2027—30 months after Mantra Chain’s mainnet launch in October 2024. He emphasized that his burn pledge only affects his personal share, while team tokens remain locked. He also suggested a community-controlled mechanism as an alternative to a full burn.

Crypto Banter’s Ran Neuner warned that eliminating incentives could demotivate teams, calling Mullin’s move “a mistake.” Mullin replied that rebuilding trust was more important than personal gain and reiterated his commitment to the project. A screenshot shared by Mullin shows his entire 772,081 OM allocation staked on Fluxtra.

Scam Allegations Fuel Tensions

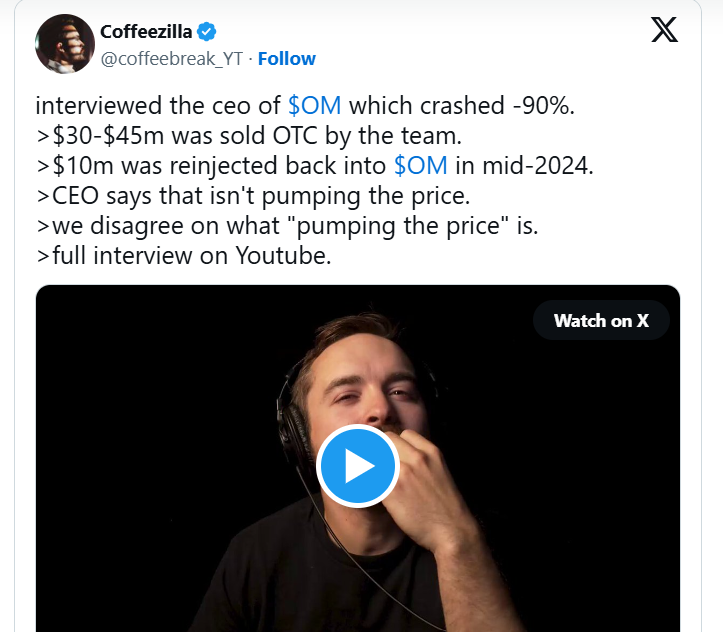

YouTuber and scam investigator Coffeezilla intensified scrutiny by alleging that the Mantra team had sold $25–$45 million in OM via over-the-counter deals at steep discounts, later using $5–$10 million to buy back tokens. He labelled this a form of price manipulation—an accusation Mullin firmly denied.

Low Liquidity Deepens Crash

According to crypto.news, OM’s crash was worsened by low liquidity and forced liquidations. Market depth dropped from $290 million to a mere $473,000, and $21 million in long positions were liquidated on OKX alone. At the time of writing, OM trades at $0.7479—still down 88% in a week. The team is now focusing on recovery strategies, including buybacks and burns, to revive the token’s value.