XRP’s price rally in 2025 mirrors its historic surge in 2024, with whale flows, technical breakouts, and bullish momentum aligning once again.

XRP Surges 55% Since April Bottom

XRP has seen an impressive rebound of over 55% since hitting a local low of approximately $1.61 in April 2025. Currently priced at $2.52, the cryptocurrency is flashing strong bullish continuation signals, both technically and on-chain.

This recent surge has been fuelled by renewed investor interest, particularly from large holders known as ‘whales’. Analysts are pointing to similarities with XRP’s remarkable 2024 rally, when the token surged from below $0.50 to over $3.50 in a matter of months.

Whale Flows Flip Positive for First Time in Months

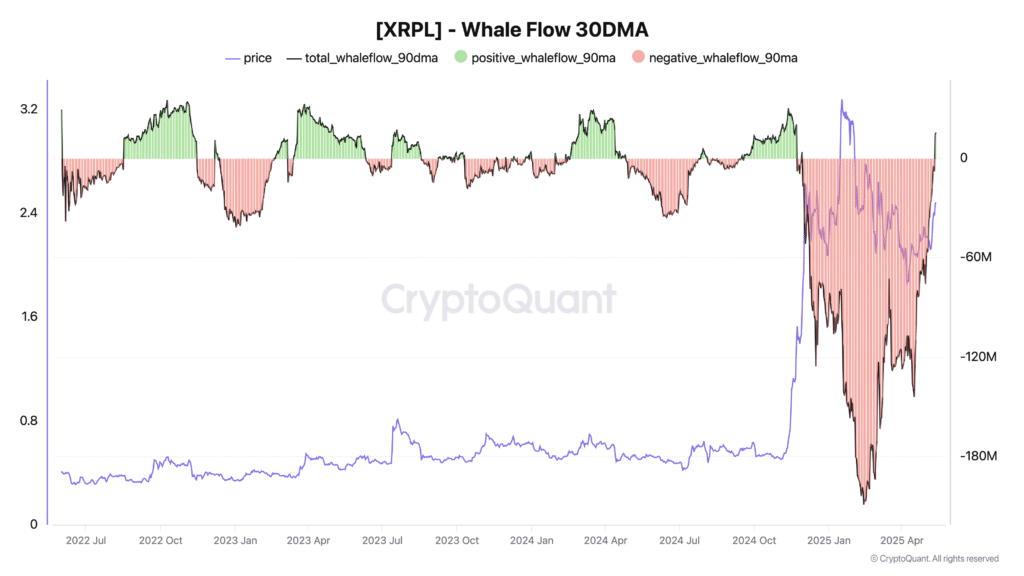

According to data from CryptoQuant, XRP whale wallets, those holding significant quantities of the token, had been offloading their holdings since November 2024. This sustained selling pressure contributed to XRP’s sharp correction from its January 2025 high of $3.55 to below $2.00.

However, as of mid-May 2025, the trend has taken a positive turn. The 90-day moving average of net whale flows has moved into positive territory for the first time in six months, signalling a potential reversal.

Historically, a flip from negative to positive net flows among whales has coincided with the formation of price bottoms and the start of strong upward trends. A notable example occurred in mid-2024, when XRP rallied nearly 400% after similar whale accumulation patterns emerged.

Technical Breakout Hints at $3.45 Target

From a technical perspective, XRP has broken out of a multi-month falling wedge pattern on the 3-day chart, a classic bullish reversal setup. This wedge, formed between December 2024 and early May 2025, saw price action compress alongside declining volume, indicating a phase of accumulation.

The breakout occurred in early May near the $2.25 level, just above the 50-period exponential moving average (EMA), which now acts as a key support zone. Based on the wedge’s height, the projected price target lies near $3.45, marking an additional 40% potential gain from current levels.

Adding to the bullish outlook, XRP’s relative strength index (RSI) has rebounded above 57, indicating renewed buying interest and positive momentum.

Resistance at $2.80 May Slow Momentum

Despite the optimistic setup, some analysts caution that the path to $3.45 may not be smooth. Analyst Mags has highlighted a key resistance level near $2.80, which could temporarily cap XRP’s upward movement.

In the near term, the price may consolidate above its 50-day EMA as the market digests recent gains and prepares for the next leg up. Such a consolidation phase would be in line with previous patterns, where whale inflows initiated a gradual accumulation period before major breakouts occurred.

CryptoQuant analyst Kripto Mavsimi noted, “The pace of outflows is slowing, and the bars are curling upward. It’s not a full reversal yet, but it’s the first real sign of stabilization in months.”

Early Signs of a Potential Bull Run

Market observers see this period as a potential base-building phase for XRP, possibly laying the groundwork for a sustained bull run. With whale flows turning positive, technical indicators flashing green, and buying pressure on the rise, XRP is once again at a pivotal moment.

If history is any guide, the cryptocurrency may be on the verge of another explosive rally, echoing its performance from last year. While resistance levels and market sentiment will play a role in shaping the short-term price action, current data suggest that bullish momentum is gaining traction.

Investors and traders are now watching closely to see whether this familiar pattern will lead XRP to new highs in the coming months.