Despite recent policy wins in key regions, crypto firms worldwide still struggle to access traditional banking services. The issue of “debanking”—the practice of denying financial services to crypto companies—remains a pressing barrier to industry growth, especially in the US, Australia, and Canada.

United States: Policy Shifts, Lingering Resistance

The US crypto sector has long criticised “Operation Chokepoint 2.0”, a set of regulations under President Biden that allegedly restricted banking access for digital asset firms. Under President Trump’s renewed administration, key reversals have taken place, such as the repeal of Staff Accounting Bulletin 121, which had previously deterred banks from offering crypto custody by labelling such assets as liabilities.

Rodney Hood, the new head of the Office of the Comptroller of the Currency (OCC), has since greenlit banks to provide services such as custody and stablecoin reserves. However, some experts warn that these victories are only partial. Caitlin Long, CEO of Custodia Bank, argues that the Federal Reserve’s leadership—still dominated by Democrats—continues to obstruct progress.

She notes that crypto-friendly banks remain under intense scrutiny, with aggressive regulatory audits still underway, limiting the true impact of regulatory changes until at least 2026.

Australia: New Legal Framework on the Horizon

In Australia, debanking is driven more by risk aversion than regulatory directives. Crypto companies often face account closures without explanation, forcing some to shift operations offshore.

The ruling Labor Party is now stepping in with proposed laws to provide a clear legal framework for the crypto industry. This move has been welcomed by platforms like MHC Digital Group, whose executive Edward Carroll believes such clarity will give banks the confidence to reengage with compliant crypto businesses.

The bipartisan interest in developing regulation signals a maturing industry, though full adoption and trust from financial institutions remain a work in progress.

Canada: A Stalemate in Sight

Canada’s crypto landscape remains grim, with few signs of improvement. Many companies continue to face abrupt account closures and rejections, with little recourse or explanation.

Morva Rohani, head of the Canadian Web3 Council, blames vague compliance guidelines and disproportionate risk assessments by banks. Unlike Australia and the US, Canada has made no legislative progress.

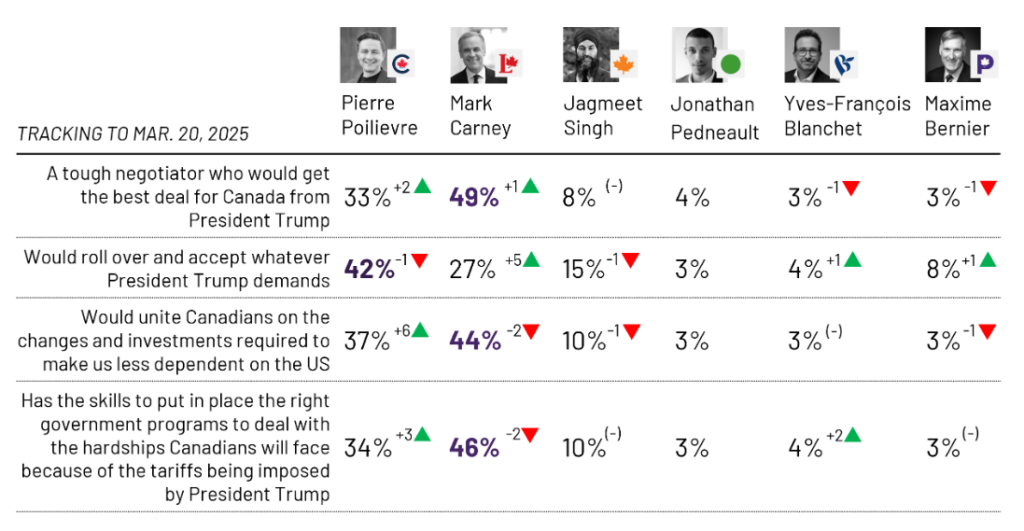

With crypto-sceptic Liberal Party leader Mark Carney rising in the polls ahead of the April 28 elections, meaningful reform appears unlikely in the near future. Carney favours central bank digital currencies (CBDCs) over private crypto innovation, further dampening hopes for change.

Industry Workarounds and Divided Opinions

In response to these ongoing challenges, many crypto companies have adopted stablecoins and partnered with regional banks or specialised trust firms. While this allows operations to continue, experts argue it leads to higher costs and fragmented infrastructure—a poor foundation for sustainable growth.

Critics like Molly White, author of Web3 Is Going Just Great, argue that the industry may be exaggerating the debanking issue to avoid regulatory scrutiny and push a deregulatory agenda. She notes inconsistencies in the industry’s stance, particularly in the US, where some crypto leaders both criticise debanking and celebrate the dismantling of protections meant to address it.