Crypto market analysts suggest Bitcoin could be primed for a major rally, potentially pushing past $100,000, as a key risk indicator flashes bullish signals for the first time in years.

Risk-Off Signal Drops to Lowest Since 2019

On May 5, Bitcoin’s ‘Risk-Off’ signal, a metric that assesses correction risk using on-chain and exchange data, fell to 23.7, its lowest reading since March 27, 2019. At that time, Bitcoin was trading at just $4,000. Today, Bitcoin hovers around $94,500. This signal, now in the ‘blue zone’, historically indicates low risk and a high probability of upward momentum.

Back in 2019, the same signal preceded a 1,550% rally that drove Bitcoin above $68,000 by 2021. Analysts suggest the current reading could once again foreshadow a similar surge. The indicator, developed by CryptoQuant, combines six market metrics, including exchange inflows, funding rates, market capitalisation, and volatility, offering a broad view of market sentiment.

Institutional Adoption and Market Maturity Support Rally

Unlike 2019, Bitcoin’s price environment in 2025 reflects greater institutional participation and market maturity. The introduction of spot Bitcoin ETFs in the US in early 2024 played a major role, unlocking access for institutional capital. As a result, ETFs and public companies now hold around 9% of the total Bitcoin supply.

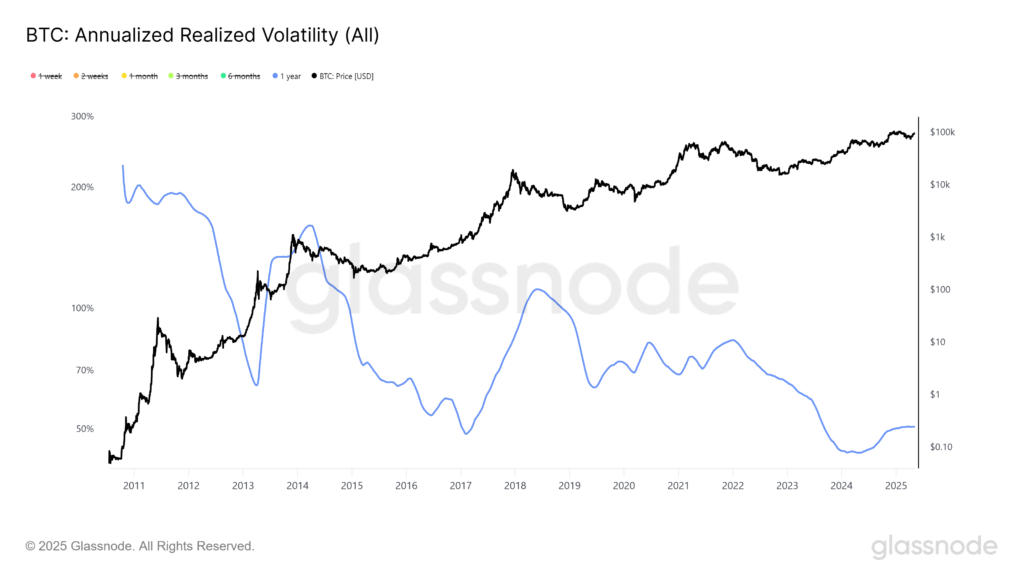

Additionally, Bitcoin’s volatility has decreased significantly. According to Fidelity Digital Assets, its 1-year annualised realised volatility has dropped by more than 80% since 2019. This lower volatility, now three to four times below major equity indexes, points to a maturing asset class capable of absorbing large inflows without dramatic price swings.

Macro Indicators Flash Bullish Signals

Further strengthening the bullish outlook, the Macro Chain Index (MCI), a composite of on-chain and macroeconomic indicators, has issued its first buy signal since 2022. At that time, Bitcoin was valued at $15,500 and soon began its ascent. Historically, an MCI RSI crossover has preceded significant rallies, including the 500% surge in 2019.

Rising futures open interest and favourable funding rates are also adding weight to bullish predictions. Some market analysts now forecast Bitcoin breaking past $100,000 in the coming weeks, driven by macro support and strong capital inflows.

Cautious Optimism Despite Network Activity Dip

Not all metrics are trending upwards. Analyst ‘Darkfost’ highlighted that Bitcoin’s network activity has dropped significantly since December 2024, with lower transaction volumes and fewer daily active addresses. A decline in unspent transaction outputs (UTXOs) further suggests reduced demand for block space, common during bear market phases.

However, this drop in activity is not necessarily a bearish signal. Experts argue that subdued network usage, in the context of overwhelmingly bullish macro indicators, could represent a temporary lull or a potential accumulation phase for long-term investors.

With major signals aligning and institutional backing stronger than ever, the current market landscape may offer one of the most promising entry points for Bitcoin investors in recent years.