Bitcoin traders face renewed challenges as the leading cryptocurrency fails to sustain momentum above the $100,000 mark, slipping 3% amidst mixed economic signals and altcoin dominance.

BTC Dips Despite US Jobs Data

Bitcoin’s price fell nearly 3%, trading at $97,000, according to data from TradingView. This decline followed the release of the US weekly jobless claims, which stood at 217,000, slightly above the forecast of 210,000. While this hinted at a marginally weaker labour market, the impact on stocks was minimal, with major indices stabilising after previous gains.

Global markets had rallied earlier following a lower-than-expected Consumer Price Index (CPI) report, easing inflation concerns. QCP Capital highlighted Bitcoin’s brief rise to $100,800 before it stabilised below the $100,000 milestone. In equities, the S&P 500 and Nasdaq posted gains of 1.83% and 2.27%, respectively.

Institutional Demand Remains Robust

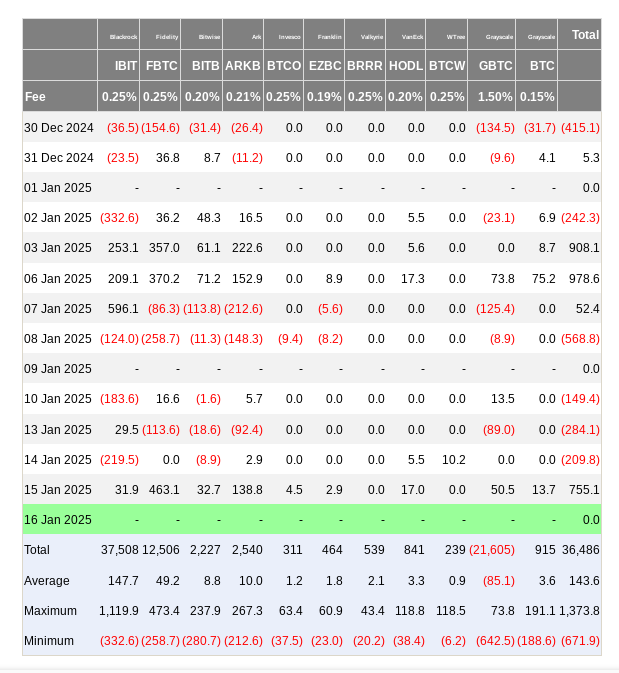

QCP Capital noted “staggering” institutional demand for Bitcoin, with US spot Bitcoin ETFs seeing inflows of $755 million on January 15. This recovery in inflows underscores strong institutional interest and suggests a positive outlook for the cryptocurrency sector.

Despite these inflows, Bitcoin’s dominance in the crypto market fell from 58.6% to 57.4%. Analysts predict that for a true “altcoin season” to emerge, Bitcoin dominance must break below the 57.3% support level while prices hover near the $100,000 threshold.

XRP Hits All-Time High as Altcoins Surge

Altcoins stole the limelight as XRP reached a new all-time high of $3.36 on Bitstamp, fuelled by reports of the incoming US administration considering a broader crypto reserve with preferential treatment for US-founded altcoins.

Solana also posted standout daily gains of 8%, trading at $214.68 and nearing price discovery territory. This shift reflects increased optimism for altcoins, with profits rotating from Bitcoin into Ethereum and other alternatives.

Caution Over Federal Reserve Outlook

Despite the positive momentum in crypto and equities, caution persists over the Federal Reserve’s monetary policy. The CME Group’s FedWatch Tool indicates only a 2.7% chance of an interest rate cut in the next Fed meeting, suggesting limited relief for risk assets.

The broader economic divide between Wall Street and Main Street remains stark. According to The Kobeissi Letter, “Many consumers believe we are in a recession, while the stock market is less than 5% away from an all-time high.”

As Bitcoin struggles to regain its footing above $100,000, traders are increasingly eyeing altcoins for potential growth opportunities, setting the stage for dynamic shifts in the crypto market.