Bitcoin has once again shocked the financial world, smashing past its previous peak to hit a new all-time high (ATH) of $109,845. After consolidating just below the $110K mark, this surge is not just another price spike, it signifies a deeper shift in market dynamics, investor sentiment, and the global adoption of digital assets.

Below, we break down what’s driving Bitcoin’s remarkable rally, the signals from institutional players and market indicators, and what traders might expect in the weeks ahead.

Bitcoin Breaks Records, Enters Price Discovery Phase

Bitcoin’s latest breakout above its previous high of $109,588 comes after 121 days of fluctuating between consolidation and recovery. This move has officially pushed BTC into a fresh price discovery phase. The sharp V-shaped recovery signals renewed confidence, supported by a significant surge in trading volume.

With this rally, Bitcoin has not only set a new price ATH but also crossed a staggering $2 trillion in market capitalisation. Its realized cap, a metric tracking the value of all coins at the price they last moved, has also hit new highs, confirming that this rally is not merely speculative but backed by significant market activity.

Notably, BTC has successfully broken above the final resistance just below its ATH. Such a breakout often signals sustained bullish momentum, especially when it aligns with broader macroeconomic and institutional trends.

Institutional Momentum: Whales and ETFs Drive Confidence

While retail traders remain cautiously optimistic, institutional confidence is booming. A standout example is the recent move by James Wynn, a prominent Bitcoin whale holding 40X BTC, who increased his long position to a staggering $1 billion. Such high-conviction moves from industry giants usually reflect strong internal sentiment and are rarely made on mere speculation.

Additionally, the market has seen record inflows into Bitcoin ETFs. This surge in institutional participation is a clear vote of confidence, not just in Bitcoin’s long-term value but also in its short- to mid-term price trajectory. ETFs offer traditional investors easy exposure to BTC, fuelling adoption while reducing perceived risk.

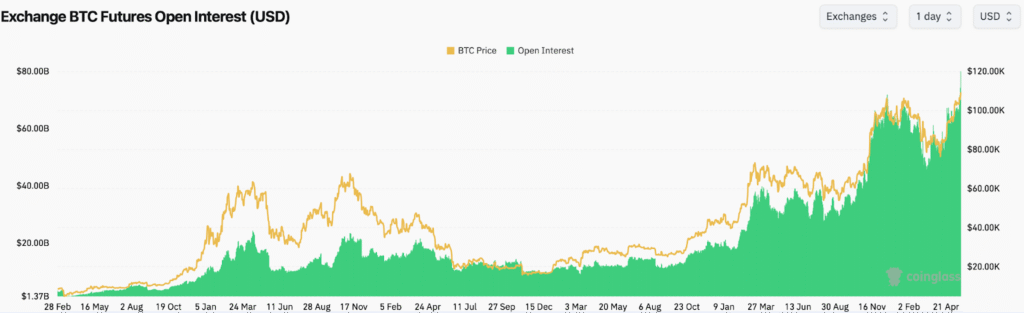

Open interest (OI) in Bitcoin futures on Binance has also surged by $13 billion, marking a new ATH. This is a strong indicator of increasing liquidity and volatility, both essential for healthy market movement and large-scale price action.

Technical Indicators Point Towards Extended Bull Run

From a technical standpoint, Bitcoin’s rally is not just a result of external momentum, it is also supported by bullish indicators. The 50-day and 200-day moving averages (MAs) are now converging towards a “Golden Cross,” a historically reliable signal of a strong upward trend.

Initially, directional indicators (+DI and -DI) were showing signs of a bearish crossover. However, the latest price movement has reversed this pattern, creating a bullish divergence. This flip strengthens the case for an extended bullish phase, suggesting Bitcoin could continue climbing deeper into uncharted territory.

Moreover, the completion of the first correction phase following the initial uptrend now paves the way for a potentially longer and more stable rally.

What’s Next for BTC Price? Eyes on $119K

With key technical and institutional factors aligning, Bitcoin’s upward trajectory appears far from over. Analysts and chart watchers are eyeing the next major resistance around $119,000. This target seems feasible, especially if momentum continues from both retail and institutional segments.

However, as always in crypto, volatility remains a constant. While the trend is currently bullish, traders should remain cautious of sudden corrections or profit-taking dips that often follow ATH breakouts. Still, the broader market structure and sentiment support the notion that Bitcoin has entered a sustainable discovery phase rather than a short-term pump.

Bitcoin’s breakout to nearly $110K is more than just a number, it’s a reflection of growing global trust in decentralised finance, rising institutional appetite, and maturing market mechanics. With strong technical support, bullish whale activity, and historic ETF inflows, Bitcoin may be entering its most robust phase yet.