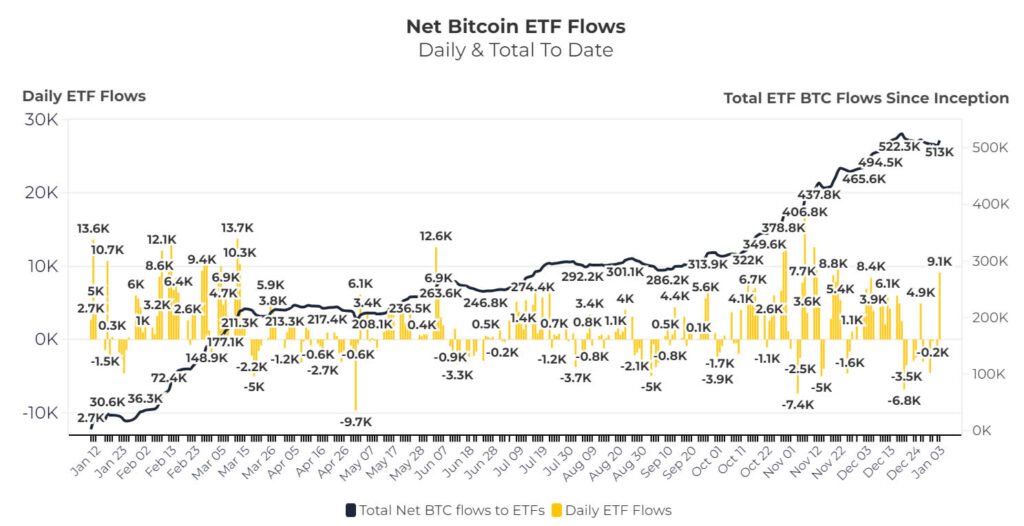

After a sluggish end to 2024, spot Bitcoin ETFs have kicked off 2025 with a significant rebound in investor interest.

Bitcoin ETFs Reverse Outflows with Strong Inflows

United States-based spot Bitcoin exchange-traded funds (ETFs) have started the new year on a high note, attracting nearly $1.9 billion in net inflows on January 3 and January 6. This marks a sharp turnaround after a period of weak demand in the latter half of December.

According to data from Farside Investors, the inflows on January 6 alone amounted to $978.6 million, with Fidelity’s Wise Origin Bitcoin Fund leading the pack at $370.2 million. BlackRock’s iShares Bitcoin ETF and the ARK 21Shares Bitcoin ETF followed with $209 million and $153 million, respectively.

Other notable contributors included the Bitwise Bitcoin ETF and Grayscale’s two spot Bitcoin ETFs—GBTC and BTC—which collectively garnered over $70 million. Meanwhile, VanEck and Franklin Bitcoin ETFs attracted $17.3 million and $8.9 million, respectively.

However, not all ETFs saw investor interest. Products issued by Invesco, Valkyrie, and WisdomTree recorded zero inflows on January 6.

Recovering from December’s Outflows

The strong performance in early January has nearly offset the $1.9 billion in net outflows experienced between December 19 and January 2. Since their launch almost a year ago, spot Bitcoin ETFs have now accumulated $36.9 billion in net inflows.

BlackRock’s iShares Bitcoin ETF continues to dominate the market, leading with $37.4 billion in net inflows, followed by Fidelity’s Wise Origin Bitcoin Fund at $12.4 billion. In contrast, Grayscale’s converted GBTC has struggled, bleeding $21.4 billion in outflows.

Retail Investors Drive Demand, Institutions to Follow?

A report from Binance in October revealed that nearly 80% of the demand for spot Bitcoin ETFs has come from retail investors rather than institutions. However, industry experts anticipate that institutional interest will grow in 2025 as more clearinghouses for spot Bitcoin ETF trading become operational.

Bitwise’s Chief Investment Officer, Matt Hougan, sees this institutional involvement as a key driver behind the firm’s bullish $200,000 Bitcoin price prediction for 2025. Similarly, VanEck forecasts Bitcoin to reach $180,000.

December Bitcoin Mining Figures Released

In parallel with the ETF surge, leading Bitcoin mining companies have disclosed their production figures for December. MARA Holdings, the largest Bitcoin mining firm by market capitalisation, reported mining 9,457 BTC last month.

Other notable figures include Riot, which mined 516 BTC—a 4% increase from November—and Cleanspark, which produced 668 coins. Core Scientific generated 291 Bitcoin from its fleet, while Bitfarms reported mining 211 BTC.

Smaller players also contributed, with Terawulf mining 158 Bitcoin and cloud mining provider BitFuFu producing 111 coins.

Looking Ahead

The renewed interest in Bitcoin ETFs and strong mining activity highlight the continued growth and resilience of the cryptocurrency market. With predictions of higher institutional participation and ambitious price targets, 2025 could prove to be a pivotal year for Bitcoin and its related financial products.