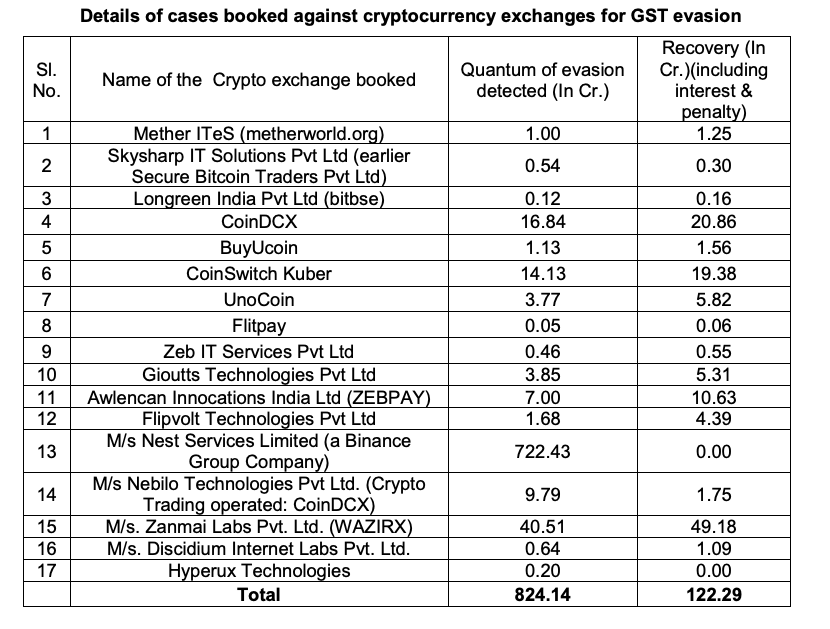

India’s Minister of State for Finance, Pankaj Chaudhary, revealed significant tax evasion by cryptocurrency exchanges, including Binance and WazirX. Authorities have identified 824 crore rupees ($97 million) in unpaid Goods and Services Tax (GST) across 17 crypto firms, sparking multiple investigations.

Recovered Taxes and Penalties

The Indian government has already recovered 122.3 crore rupees ($14 million) in unpaid taxes, penalties, and interest. WazirX, accused of evading 40.5 crore rupees ($4.8 million) in GST, has paid 49.18 crore rupees ($5.8 million), including penalties and interest. Similarly, CoinDCX and CoinSwitch Kuber settled their liabilities of 16.84 crore rupees ($1.9 million) and 14.13 crore rupees ($1.7 million), respectively.

Binance Yet to Pay $85 Million

Binance faces a significant GST liability of 722 crore rupees ($85 million). However, it has yet to settle its dues, leaving it out of the total recovery amount. Binance stated it is cooperating with authorities and addressing inquiries.

Crypto Regulation and AML Compliance

The crackdown comes as India strengthens its regulatory framework for virtual digital assets. Currently, 47 crypto service providers are registered as reporting entities under the Financial Intelligence Unit, aligning with the country’s anti-money laundering laws.

As the crypto industry grows in India, authorities are intensifying scrutiny to ensure compliance and recover lost revenue.