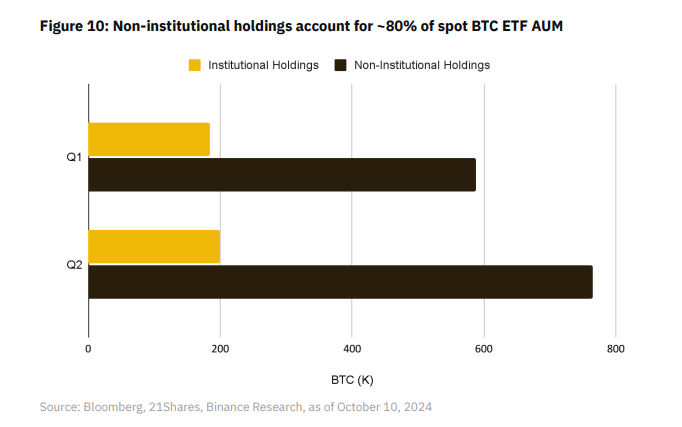

In a recent report, Binance revealed that retail investors have dominated demand for spot Bitcoin exchange-traded funds (ETFs), accounting for approximately 80% of total assets under management (AUM). Since launching in January 2024, spot Bitcoin ETFs have attracted substantial inflows, driven primarily by individual investors rather than institutions.

Retail Demand Outpaces Institutions

According to Binance’s October 25 research report, spot Bitcoin ETFs have accumulated $63.3 billion in assets as of October 10, with retail investors responsible for the majority of this total. Retail demand has primarily come from investors shifting funds from digital wallets and exchanges into ETFs, seeking the regulatory protections these funds offer over more complex or higher-fee options, like the Grayscale Bitcoin Trust.

“Spot ETFs are appealing for new investors while attracting existing holders who prefer the regulated structure of ETFs over direct on-chain holdings,” Binance analysts noted.

Institutional Interest Grows But Remains Cautious

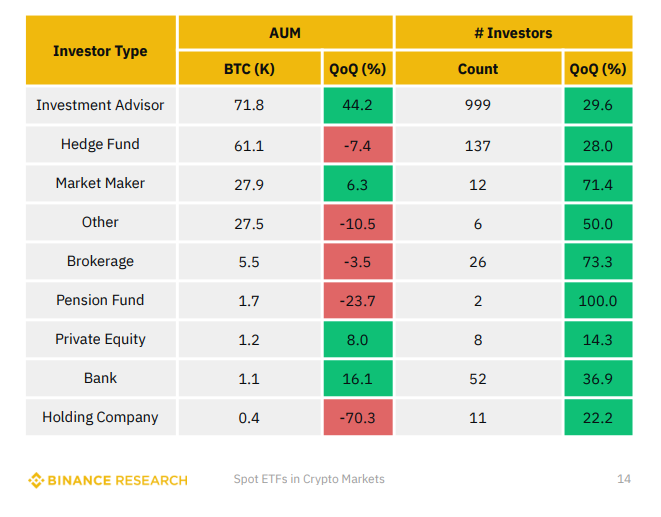

Although retail investors lead the charge, Binance’s report highlighted a growing interest from institutional investors, particularly investment advisers and hedge funds. However, many large institutions have shown restraint in their Bitcoin ETF investments due to volatile market conditions and uncertainties in global liquidity. Traditional financial (TradFi) firms like Vanguard, the world’s second-largest ETF issuer, have maintained a resistant stance. Vanguard’s CEO, Salim Ramji, reiterated the firm’s anti-crypto position in August, confirming it has no plans to launch any crypto ETFs.

High ETF Inflows Spark Warnings of Price Dip

Spot Bitcoin ETFs have seen a strong influx of capital in recent weeks, generating $2.88 billion in inflows between October 11 and October 23, with just one outflow day. This inflow surge has led some analysts to caution that an overheated ETF market could prompt a near-term Bitcoin price dip.

While institutions are anticipated to drive larger trade volumes over time, Binance analysts observed little change in institutional demand so far, attributing it to the ongoing market volatility and liquidity concerns.