XRP’s Recent Surge May Be Losing Momentum

XRP has seen an impressive rally of over 385% since late 2024, rising to a peak of around $3.40 in January 2025. However, recent on-chain and technical indicators suggest that this rally may be nearing exhaustion. Analysts warn of a potential 25% correction, pointing to a combination of a top-heavy market structure, declining network activity, and bearish chart patterns.

Realised Cap Signals Market Fragility

Data from Glassnode highlights a concerning trend: over 70% of XRP’s realised market capitalisation has been accumulated between late 2024 and early 2025. Realised cap reflects the value of tokens based on the last time they moved on the blockchain, offering a more behaviour-focused metric than traditional market cap.

Notably, the 3-to-6-month coin age group has seen a sharp rise in realised cap since November 2024, particularly after XRP’s peak in January. This suggests that a large proportion of investors bought in at or near the top. Historically, such “top-heavy” conditions, where many holders are short-term participants, make assets more vulnerable to steep sell-offs, as these investors are often quick to exit during downturns.

Similar patterns were observed in previous XRP cycles. In 2017, a comparable spike in short-term holder realised cap occurred just before XRP’s all-time high of $3.55, which was followed by a 95% drawdown. A repeat scenario unfolded in 2021, with an 80% drop following a similar rise in realised cap by newer investors.

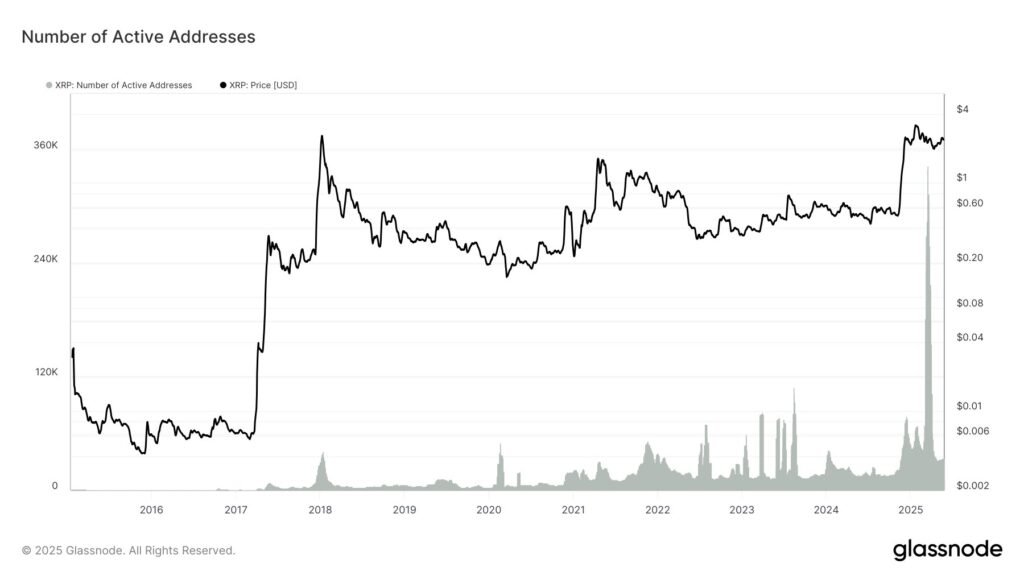

Network Activity Sees Sharp Decline

Another bearish signal comes from XRP’s network activity. After reaching record levels in March 2025, the number of active addresses has fallen by more than 90%, reverting to pre-rally figures.

While high prices often attract more users and increased transactional demand, the opposite trend is now evident. This divergence between rising prices and falling on-chain activity mirrors the patterns seen in previous market tops. Although a decrease in active addresses isn’t a definitive sell signal, it indicates reduced user engagement, suggesting that fewer people are using XRP for transactions and more are holding onto their tokens passively.

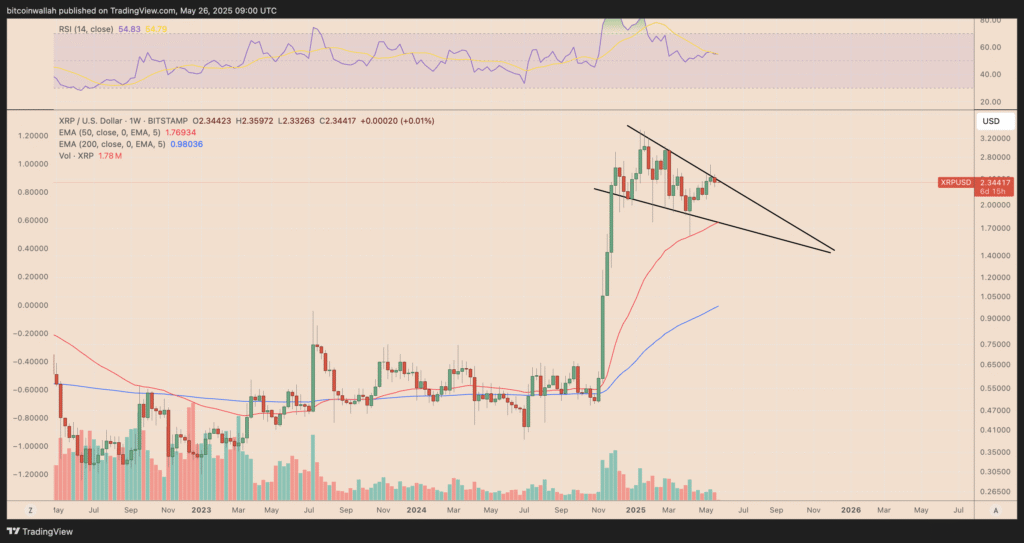

Chart Patterns Point to Falling Wedge Breakdown

Technical analysis further supports the case for a possible decline. XRP is currently trading within a falling wedge pattern on its weekly chart, a formation typically seen during periods of consolidation or reversal. After failing to break above the wedge’s upper trendline in recent sessions, XRP is showing signs of entering a short-term correction phase.

If this pattern continues to unfold, XRP could fall toward the wedge’s lower boundary, which coincides with the 50-week exponential moving average (EMA), currently around $1.76. This would represent a decline of approximately 25% from its current price of $2.30.

Caution Advised for New Investors

While the broader crypto market has seen renewed optimism in recent months, XRP’s combination of onchain weakness, historical parallels, and technical resistance suggests that the recent rally may be unsustainable in the near term. Investors who joined the rally late, particularly between December 2024 and March 2025, may be especially vulnerable if a correction unfolds.

As with all market cycles, it’s important to consider a range of indicators before making trading decisions. For XRP, the current signs indicate caution, particularly for those banking on continued short-term upside.

Summary

The XRP market is showing multiple warning signs that the recent bullish momentum may be reversing. With over 70% of its realised cap clustered near recent highs, a dramatic decline in active addresses, and bearish technical formations in play, a 25% price drop to the $1.76 support zone appears increasingly likely. Investors should remain cautious as the market navigates these uncertain waters.