XRP is flashing warning signs that closely resemble its 2022 breakdown, with new buyers slipping into losses and selling pressure continuing from large holders. The token has suffered its sharpest weekly decline since October 2025, raising concerns that a deeper pullback may be unfolding.

As of Monday, XRP was trading near $1.60, down more than 20 percent over the past week. The decline has pushed the price below the average buy level of investors who entered the market over the past year, leaving a significant portion of recent holders underwater.

New XRP Buyers Slip Into Losses

XRP is now hovering just above its aggregated realized price near $1.48. This level represents the average cost basis of all tokens currently in circulation. Trading below it suggests that many market participants are holding unrealized losses.

A decisive move below $1.48 would place the average XRP holder underwater, a condition that previously marked the early stages of the 2022 bear market. During that period, similar cost basis losses eventually led to a prolonged selloff that wiped out roughly half of XRP’s value.

Market data indicates that sentiment among newer buyers is weakening as prices fail to reclaim key levels. When investors are already sitting on losses, even modest selling can trigger further downside as confidence erodes.

Whale Selling Continues to Pressure the Market

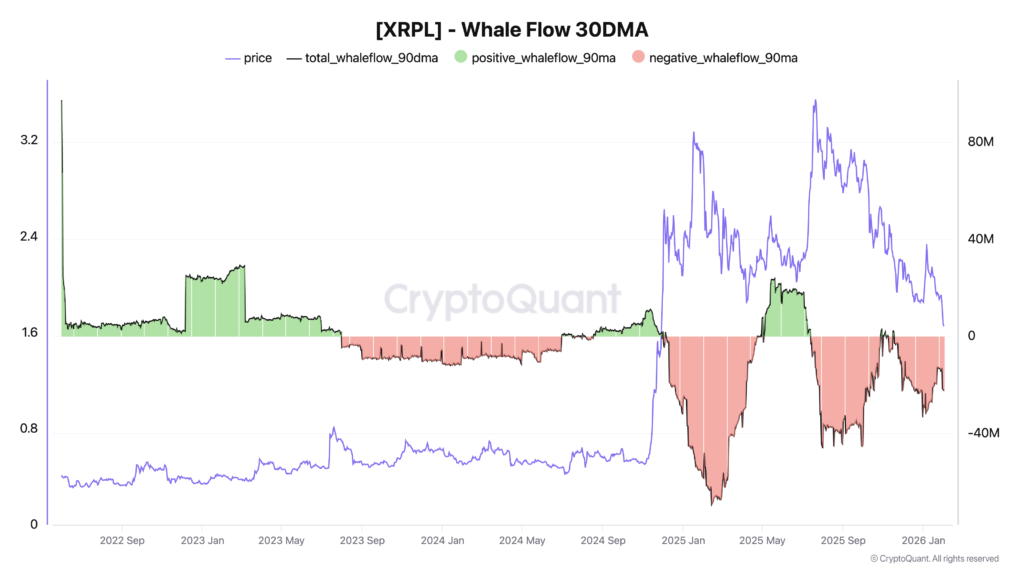

Adding to the bearish setup is persistent distribution from large XRP holders. According to CryptoQuant data, XRP’s 90 day whale flow remains net negative, indicating that major wallets are reducing exposure rather than accumulating.

This behavior increases overhead supply and limits the strength of any short term bounce. When whales sell into weakness, recovery attempts often stall as fresh demand struggles to absorb the additional tokens entering the market.

The combination of underwater retail holders and ongoing whale distribution mirrors conditions seen during earlier market downturns, making sustained upside more difficult in the near term.

Stablecoin Outflows Weaken Buying Power

Broader liquidity conditions are also working against XRP. Stablecoin inflows to exchanges turned sharply negative toward the end of 2025, with 30 day net outflows reaching approximately $9.6 billion.

While outflows moderated in January, net flows remained negative at around $4 billion, according to CryptoQuant analyst Darkfost. This decline suggests that traders are holding fewer stablecoins on exchanges, reducing immediate buying power across the crypto market.

With less capital readily available to deploy, XRP faces an uphill battle in reclaiming its realized price. Historically, strong recoveries have required rising stablecoin balances on exchanges, a condition that has yet to materialize.

Key Support Levels That Could Decide XRP’s Next Move

From a technical standpoint, XRP is currently holding above its 100 two week exponential moving average, located near $1.43. This level sits just below the aggregated realized price and has acted as a key support zone in previous cycles.

The $1.43 to $1.48 range is now a critical area for bulls to defend. As long as price remains within this band, hopes of stabilization remain intact.

XRP’s two week relative strength index is hovering near 38, a level that has historically preceded relief rallies. If this pattern holds, XRP could spend several weeks consolidating before attempting a stronger recovery later in the first half of 2026.

Breakdown Scenario Raises 50 Percent Crash Risk

The bullish outlook would weaken significantly if XRP breaks below its 100 two week EMA. A decisive loss of this support would likely invalidate the recovery scenario and expose the price to deeper losses.

In such a case, XRP could slide toward its 200 two week EMA near the $1 mark as early as March. This would mirror the type of structural breakdown seen in 2022, when similar support failures triggered a prolonged selloff.

A move to $1 would represent a decline of roughly 36 percent from current levels, while further weakness could open the door to a broader capitulation phase if selling pressure accelerates.

For now, XRP remains at a crossroads, with market structure suggesting elevated risk unless key support levels hold and liquidity conditions improve.