XRP’s long-term holders remain steadfast despite a sharp correction and heavy selloffs in South Korean markets. On-chain data and technical indicators point to mixed signals: growing whale accumulation and ETF anticipation on one side, and intense regional selling pressure on the other. With the price consolidating, the coming weeks could prove pivotal for XRP’s trajectory.

Denial Phase: Investors Hold On Despite Corrections

According to Glassnode’s Net Unrealized Profit/Loss (NUPL) chart, XRP long-term holders have entered the “denial” phase of the market cycle. This phase follows euphoric highs and is characterised by investors’ reluctance to accept a downtrend. Since mid-December, XRP’s NUPL has stayed between 0.55 and 0.65, a range historically associated with denial.

Despite XRP’s price falling from above $3 to around $2, these holders have shown little interest in selling. The sentiment suggests that many still believe in a rebound, even as broader market indicators hint at waning momentum.

ETF Anticipation Fuels Optimism

One key driver behind this unwavering confidence is the hope surrounding a potential spot XRP exchange-traded fund (ETF). Leading asset managers like Bitwise, WisdomTree, and Grayscale have filed applications for spot XRP ETFs.

Grayscale’s filing is of particular interest, with a U.S. Securities and Exchange Commission (SEC) decision expected by May 22, 2025. The approval of such ETFs could open the door to significant institutional inflows, reinforcing bullish narratives among retail and long-term investors alike.

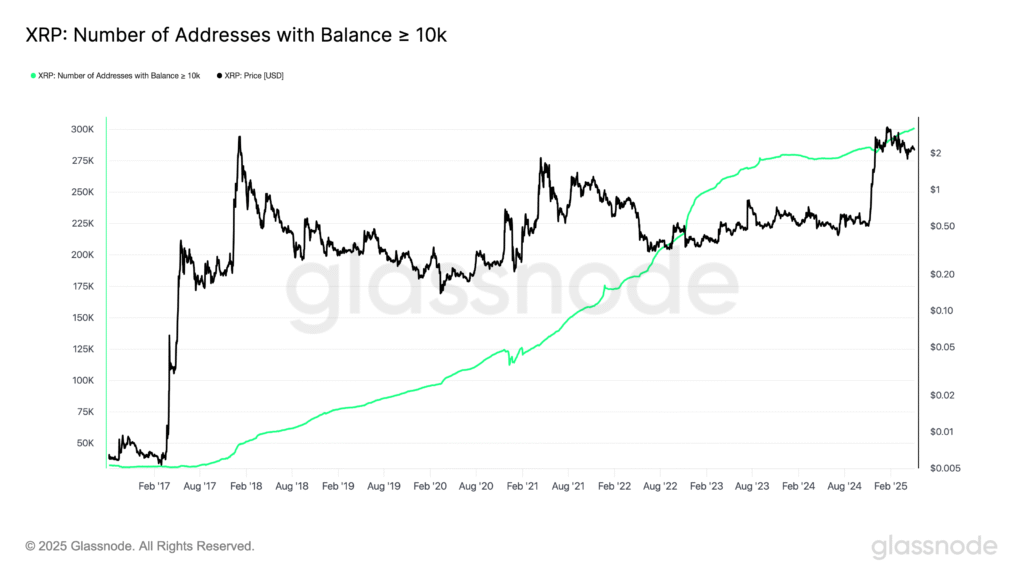

Whales Accumulate as Price Dips

Large XRP holders—often referred to as “whales”—are increasing their holdings despite the market correction. Glassnode data reveals that the number of addresses holding at least 10,000 XRP has hit an all-time high, surpassing 290,000.

This accumulation during a downturn signals strategic positioning for a future rally. Historically, rising whale participation during pullbacks has often preceded significant price movements upward, lending credibility to bullish forecasts.

Korean Selloffs Challenge Global Sentiment

However, not all markets share the same optimism. The XRP/KRW trading pair on South Korea’s Upbit exchange has seen over 220 million XRP net sold since April 11—an amount exceeding $500 million in value.

This dramatic selloff, revealed through Cumulative Volume Delta (CVD) analysis, suggests Korean traders may be turning bearish. The divergence in sentiment between Western and Korean markets raises red flags, potentially undermining global bullishness.

Technical Setup: Falling Wedge Pattern in Focus

From a technical standpoint, XRP is trading within a falling wedge pattern—a bullish formation typically signalling a reversal. A breakout above resistance around $2.20 could push XRP toward $3.00–$3.40, with a projected peak of $3.68.

However, failure to break above the wedge could see XRP falling to $1.80–$1.70, invalidating the bullish thesis. The pattern’s resolution will likely determine whether holders stay in denial—or begin transitioning into fear or capitulation.