Bulls Struggle to Maintain Momentum

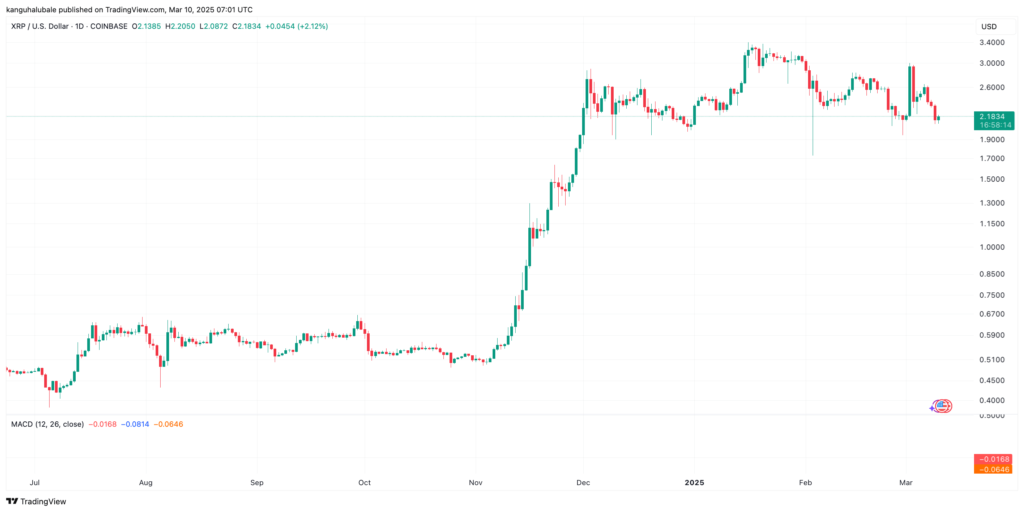

XRP’s price has staged a modest recovery after hitting a low of $1.94 on February 28. However, it continues to trade below a key resistance zone, raising concerns about further declines. The altcoin is currently valued at $2.19, and analysts warn that if bulls fail to hold above the psychological support level of $2.00, a steeper correction could follow.

Key Support Levels Under Threat

The recent drop in XRP’s price is part of an ongoing market correction that began on March 3. This downward move has seen the Relative Strength Index (RSI) decline sharply, reflecting increased selling pressure. At present, the RSI is at 42, indicating that market conditions still favour the downside.

If XRP fails to hold above $2.00, it could extend its decline to the recent range low of $1.76, formed on February 3. Further losses may see the price test the support level at $1.61, where the 200-day Simple Moving Average (SMA) currently sits.

Conversely, for XRP to regain bullish momentum, it must reclaim the resistance zone between $2.53 and $2.62, which aligns with the 100-day and 50-day SMAs. A decisive close above the 50-day SMA could pave the way for a recovery to $3.00 or even the seven-year high of $3.40.

Liquidation Clusters Signal Potential Support

Market data indicates a significant concentration of bids around the $2.00 level, suggesting that traders are keen to defend this psychological support. However, the prevailing bearish sentiment and broader market conditions remain a challenge for XRP bulls.

The 66% rally that saw XRP surge between February 3 and March 2 was halted by heavy selling pressure at $3.00. The inability to break through this resistance level has left XRP vulnerable to further downside movement.

Bearish Signals from Technical Indicators

Despite attempts to regain momentum, XRP remains in a precarious position. The formation of a bull flag pattern in the weekly timeframe offers some hope for bullish traders, but technical indicators suggest further downside risks.

Currently, the price rests on the support at $2.16, the upper boundary of the flag. However, a bearish crossover on the Moving Average Convergence Divergence (MACD) indicator suggests that a deeper correction could be imminent. If XRP closes below the $2.16 support level, it risks dropping further into the flag’s range, leading to a prolonged period of consolidation.

As previously reported, should the critical $2.00 level break, XRP could decline toward its 50-weekly Exponential Moving Average (EMA) at $1.46. The fading enthusiasm surrounding the US government’s strategic reserve of digital assets may also weigh on XRP’s future price prospects.

Market Outlook

While XRP continues to battle key support levels, the coming days will be crucial in determining its next move. If bulls manage to defend the $2.00 support and reclaim key resistance zones, the altcoin could stage a recovery. However, failure to hold above critical price levels may result in a deeper correction, testing support at $1.61 or lower.

As traders monitor XRP’s next move, market sentiment and macroeconomic factors will play a significant role in shaping its trajectory.