The supply of XRP held on cryptocurrency exchanges has dropped to its lowest level in almost eight years, raising fresh speculation about whether the token could be preparing for a major price move in 2026. Market data suggests that a significant portion of XRP has been withdrawn from exchanges in recent months, reducing the amount readily available for sale and potentially easing selling pressure.

At the same time, XRP’s price has managed to remain above a long standing demand zone that has acted as a reliable floor throughout 2025. With exchange balances tightening and price holding firm above a key support level, analysts are increasingly debating whether the foundations are being laid for a supply driven recovery in the next market cycle.

XRP Supply on Exchanges Drops to Levels Last Seen in 2018

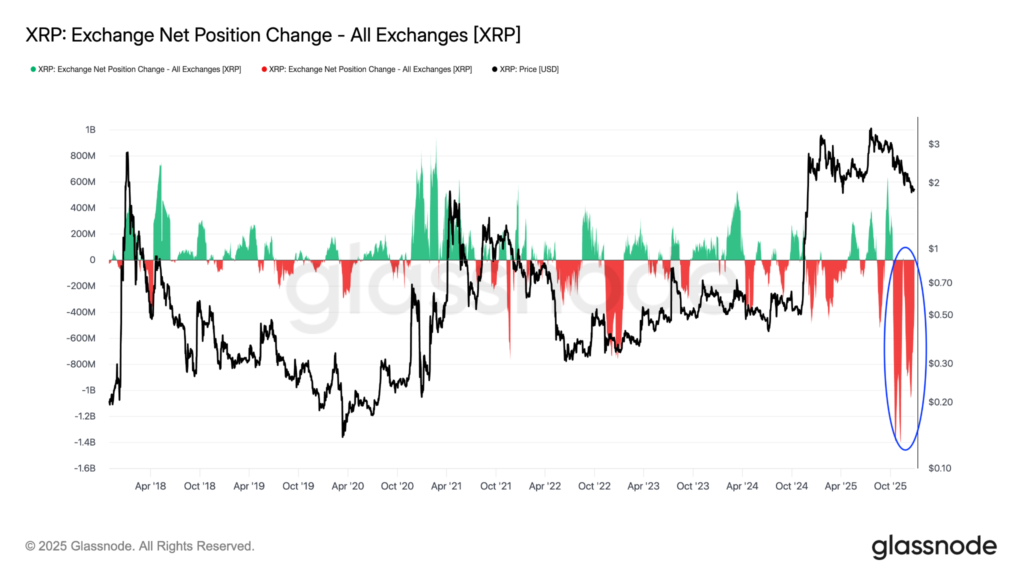

On chain data from Glassnode shows a sharp and sustained decline in the amount of XRP held on centralised exchanges over the past two months. Since early October, the exchange balance has fallen by approximately 2.16 billion tokens, dropping from around 3.76 billion XRP on 8 October to close to 1.6 billion by mid December.

These figures place current exchange balances at levels last observed in August 2018, a period that followed XRP’s previous major market cycle. Such a dramatic contraction in exchange supply over a relatively short timeframe is widely interpreted as a sign that holders are choosing to store their tokens off exchanges rather than keeping them readily available for trading.

A falling exchange balance typically indicates reduced intent to sell. When investors move assets into private wallets, cold storage or long term custodial products, it limits the immediate supply that can be sold on the open market. This shift often reflects growing confidence among holders or expectations of higher prices in the future.

Market participants have highlighted that the recent decline is not gradual but rather marked by several large outflow events. According to Glassnode, XRP experienced its largest ever daily exchange net outflow on 19 October, when more than 1.4 billion tokens left exchanges in a single day. Such activity is usually associated with large holders or institutions repositioning their assets for longer term holding.

Large Holders Accumulate as Liquidity Tightens

The scale of the recent exchange outflows has drawn attention from analysts who track whale behaviour. Large holders often move tokens off exchanges when they expect reduced downside risk or anticipate future upside. The timing of the outflows has strengthened the view that accumulation is taking place behind the scenes.

Market analyst Levi Rietveld commented on social media that XRP supply on exchanges has tightened significantly, with roughly 1.5 billion tokens remaining available. He described the situation as bullish, suggesting that the reduction in liquid supply could support higher prices if demand increases.

Another market observer known as Skipper suggested that institutional activity may be playing a growing role in the trend. According to this view, exchange traded products or institutional grade investment vehicles could be absorbing XRP and removing it from active circulation. If correct, this would mark a shift in how XRP is being held and traded, moving it closer to the structure seen in more established digital assets.

As liquidity tightens, price discovery can change. With fewer tokens available for immediate sale, even modest increases in demand can have an outsized effect on price. This dynamic is often referred to as a supply shock, where constrained supply meets rising interest from buyers. While such conditions do not guarantee a rally, they can create an environment in which price moves become more pronounced.

XRP Price Holds Above Critical Demand Zone

While on chain data points to tightening supply, technical analysts are also closely watching XRP’s price behaviour. Throughout 2025, XRP has repeatedly found support within a broad demand zone ranging from roughly 1.60 to 1.84 dollars. Each time price has dipped into this area, buyers have stepped in to defend it.

More recently, XRP has been trading near 1.87 dollars, holding above what many analysts consider the most important support level within that zone. According to Glassnode’s UTXO Realised Price Distribution data, the price level around 1.78 dollars represents the point where the largest concentration of current XRP supply was acquired. Approximately 1.87 billion tokens were bought at this level, making it a significant area of interest for market participants.

When price remains above a level where many investors entered the market, it tends to reinforce confidence among holders. Losing such a level can quickly shift sentiment, as it places a large portion of the market into unrealised losses. Analysts have therefore stressed that maintaining support above 1.78 dollars is critical for any bullish outlook heading into 2026.

There is relatively little structural support below this area based on historical volume and on chain data. A decisive breakdown could weaken the case for a recovery and raise the risk of extended consolidation or further declines. For now, however, buyers appear committed to defending the zone.

Chart Patterns Point to Potential Upside if Support Holds

Beyond on chain metrics, chart based analysis is also fuelling optimism among some traders. On higher time frames, XRP appears to be forming a potential triple bottom structure near the long term demand zone. This pattern is often interpreted as a sign that selling pressure is being exhausted and that buyers are gradually gaining control.

Analyst VipRoseTr noted that XRP has shown signs of breaking out from a descending channel on the weekly chart. According to this analysis, a sustained rebound from the current support zone could open the door to a move towards the 3.79 dollar region over time. Such a move would represent a significant recovery from current levels, though it would still fall short of XRP’s historical highs.

Technical signals alone are not enough to guarantee such an outcome. Market structure can change quickly, particularly in the cryptocurrency sector where sentiment remains highly sensitive to broader conditions. Nevertheless, the combination of strong on chain support and improving chart patterns has kept bullish scenarios firmly in play.

Outlook for 2026 Depends on Broader Catalysts

Despite the positive signals emerging from supply metrics and technical analysis, note that XRP’s path into 2026 is unlikely to be straightforward. Several analysts caution that price may remain range bound for an extended period unless new catalysts emerge to drive sustained demand.

Macro conditions, regulatory developments and broader market sentiment will all play a role in determining whether XRP can transition from consolidation into a full recovery phase. While tightening exchange supply reduces immediate selling pressure, it does not automatically create demand. For a lasting rally to materialise, new participants or increased usage would be required.

Some observers believe that institutional adoption could provide that missing ingredient over time. If XRP continues to be integrated into regulated financial products or cross border payment infrastructure, demand dynamics could shift meaningfully. Others argue that the wider crypto market cycle will remain the dominant influence, with XRP following broader trends rather than leading them.

For now, the focus remains on whether XRP can continue to hold above its key demand zone while exchange balances remain depressed. If these conditions persist into the next market cycle, the groundwork for a supply driven price expansion could already be in place.