ProShares gears up for XRP Futures ETF launch as legal battles persist; Bitcoin eyes $90K on trade optimism and shifting ETF flows.

As XRP continues its legal tug-of-war with the SEC, the spotlight shifts to the upcoming launch of three XRP Futures ETFs by ProShares. These ETFs—UltraShort, Ultra, and Short—are set to go live on April 30, 2025. Unlike spot ETFs, they won’t hold XRP directly but will rely on futures contracts, swaps, and money market instruments like U.S. Treasuries to gain exposure.

These ETFs could still influence XRP prices in the short term by attracting institutional investors, signalling growing regulatory acceptance, and offering a low-risk entry point for retail investors.

XRP Legal Battle Continues to Cast a Shadow

XRP’s long-standing legal battle with the SEC remains a central factor in price volatility. Investors are closely watching whether the SEC will withdraw its appeal on the Programmatic Sales ruling. A settlement could unlock a potential rally toward XRP’s all-time high of $3.5505.

The market is also anticipating the arrival of Paul Atkins as the new SEC Chair, who is expected to bring a more crypto-friendly stance. His leadership could accelerate progress toward spot ETF approval, with issuers like Grayscale and 21Shares already in line.

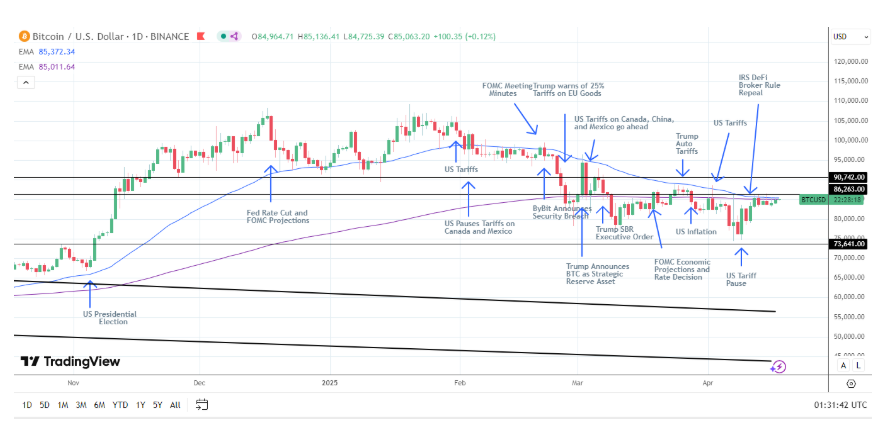

Bitcoin Climbs Amid Tariff Easing Hopes

While XRP slipped 0.86% to $2.0652 on April 17, Bitcoin surged 1.11% to close at $84,963. The rise follows hopes of a U.S.-China trade deal, fuelled by Trump’s comments about a potential breakthrough. Historically, Bitcoin prices have dipped during tariff escalations and bounced back with trade optimism.

However, BTC remains below the $85,000 threshold for the fifth consecutive session, reflecting cautious investor sentiment amid ongoing macroeconomic uncertainty.

ETF Inflows Signal Mixed Sentiment

Despite a $171.1 million outflow from US BTC-spot ETFs on April 16, inflows returned on April 17. Excluding BlackRock’s iShares Bitcoin Trust (IBIT), total ETF inflows stood at $25.9 million. IBIT continues its streak, suggesting growing institutional interest in Bitcoin even as other ETFs lag.

CryptoQuant’s Julio Moreno remarked, “BlackRock is buying Bitcoin… but basically every other ETF is selling.” A broader shift in ETF demand will be critical for sustaining Bitcoin’s upward momentum.

Outlook: Cautious Optimism in Volatile Waters

XRP could benefit from a combination of legal clarity and ETF momentum, while Bitcoin’s direction hinges on macroeconomic shifts.

- Bearish triggers: Fed hawkishness, trade war flare-ups, and ETF outflows.

- Bullish signals: Settlement in SEC-Ripple case, dovish Fed policy, and renewed ETF inflows.

As the crypto space braces for regulatory shifts and global economic turbulence, the coming weeks could define the trajectory for both XRP and BTC.