Physical attacks aimed at forcing cryptocurrency holders to hand over their assets are becoming more frequent and more dangerous, according to a fresh analysis of so called wrench attacks. While digital security has improved in many areas of crypto, the threat in the real world is growing, especially in parts of Europe and Asia.

The findings highlight a troubling trend where attackers bypass hacking altogether and instead rely on intimidation, assault, or worse, to gain access to digital wallets. As crypto prices rise and ownership spreads, the risks outside the blockchain are drawing renewed attention.

What Are Wrench Attacks and Why They Matter

A wrench attack refers to a crime where an attacker uses physical force or threats to compel a crypto holder to reveal private keys, passwords, or approve transactions. Unlike online hacks, these attacks target people directly, often at their homes or workplaces.

Bitcoin security advocate Jameson Lopp has spent years documenting reported cases of such incidents across the world. His dataset has become one of the most detailed public records tracking how and where these crimes occur. Using this data, investor and analyst Haseeb Qureshi recently examined how the frequency and severity of attacks have changed over time.

The conclusion is clear. Not only are wrench attacks becoming more common, but the level of violence involved is also escalating.

Violence Levels Are Rising Over Time

Qureshi categorized wrench attacks into five levels, ranging from minor physical threats to incidents resulting in serious injury or death. When these categories are viewed across a timeline, the average severity of attacks has increased in recent years.

Earlier cases often involved intimidation or brief assaults. More recent incidents show a higher share of kidnappings, prolonged abuse, and fatal outcomes. This shift suggests criminals are becoming more aggressive, possibly due to larger potential payouts as crypto holdings grow in value.

The data does not suggest that every crypto holder is at risk, but it does point to a growing danger for individuals perceived to hold significant assets, particularly those with a visible online presence or public association with crypto wealth.

Europe and Asia See the Sharpest Increase

Geographically, the rise in violent wrench attacks is not evenly distributed. Western Europe and parts of the Asia Pacific region have experienced the most pronounced growth in incidents, according to the analysis.

North America still records fewer cases by comparison, but it is not immune. The number of reported attacks there has also increased in absolute terms, even if the rate remains lower than in some other regions.

Differences in law enforcement effectiveness, reporting standards, and public awareness may partly explain regional variations. However, the overall trend points to a global issue rather than isolated local problems.

Crypto Prices and Crime Move Together

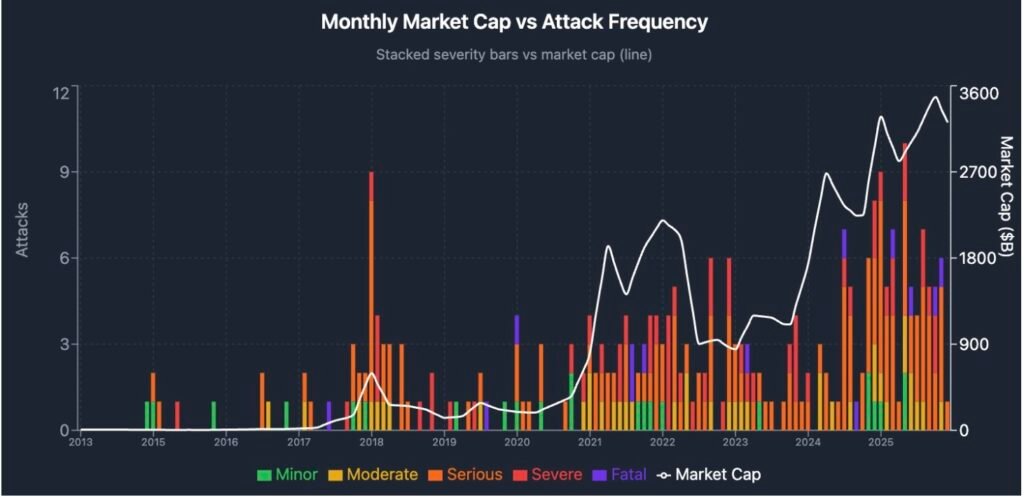

One of the most striking findings from the analysis is the link between wrench attacks and crypto market valuations. When the total crypto market capitalization rises, the number of reported physical attacks tends to rise as well.

A basic regression analysis suggests that around 45 percent of the variation in attack frequency can be explained by market cap alone. In simple terms, higher prices attract more criminals. As holdings become more valuable, the incentive to target individuals directly increases.

That said, the data also challenges the idea that crypto is becoming inherently more dangerous over time. When attacks are adjusted for the rapid growth in crypto users, the risk per user has actually declined. On a per person or per dollar basis, crypto holders faced greater danger in 2015 and 2018 than they do today.

This suggests that while absolute numbers are rising, the ecosystem has grown even faster, diluting individual risk overall.

Personal Security Remains a Key Concern

Despite the more nuanced picture, Qureshi stressed that wrench attacks are not just an abstract data problem. For those who hold large amounts of crypto or are publicly identifiable, personal security should be taken seriously.

Simple steps such as limiting public disclosures, improving home security, using multisignature wallets, and spreading assets across different storage methods can reduce risk. In some cases, professional security advice may be justified.

The growing awareness of physical threats highlights a shift in how crypto security is understood. Protecting digital assets now increasingly means protecting oneself as well.

Phishing Losses Fall Even as Physical Threats Grow

Interestingly, while physical attacks are becoming more severe, some forms of online crypto crime are declining. According to a recent report by Web3 security firm Scam Sniffer, losses from wallet drainer phishing attacks dropped sharply in 2025.

Total losses fell to about 83.85 million dollars, down 83 percent from nearly 494 million dollars the previous year. The number of victims also declined significantly, falling 68 percent year over year to around 106,000.

Scam Sniffer noted that phishing activity still closely follows market cycles. Losses spiked during periods of heavy onchain activity, particularly in the third quarter, which coincided with Ethereum’s strongest rally of the year.

The contrast between falling digital scams and rising physical attacks underscores how crypto crime is evolving rather than disappearing.