Wall Street’s attention is shifting from early-stage digital assets to established cryptocurrency firms preparing to go public, with billions in capital at stake. Analysts suggest this trend could reshape the next phase of the crypto market cycle and redefine what an “altcoin season” looks like.

Billions in Crypto IPOs on the Horizon

Research by Matrixport revealed that more than $200 billion worth of crypto firms are preparing initial public offerings. These listings could raise between $30 billion and $45 billion in fresh capital, making them one of the largest waves of public market entries in the sector’s history.

The focus is now on scalable companies already positioned for public markets. Among the firms leading this wave is Kraken, the US-based crypto exchange, which reportedly secured $500 million in funding at a $15 billion valuation. Crypto custodian BitGo also filed for a US IPO on 19 September, reporting $90.3 billion in assets under custody and over a million users.

Bitcoin Selling Pressure Continues

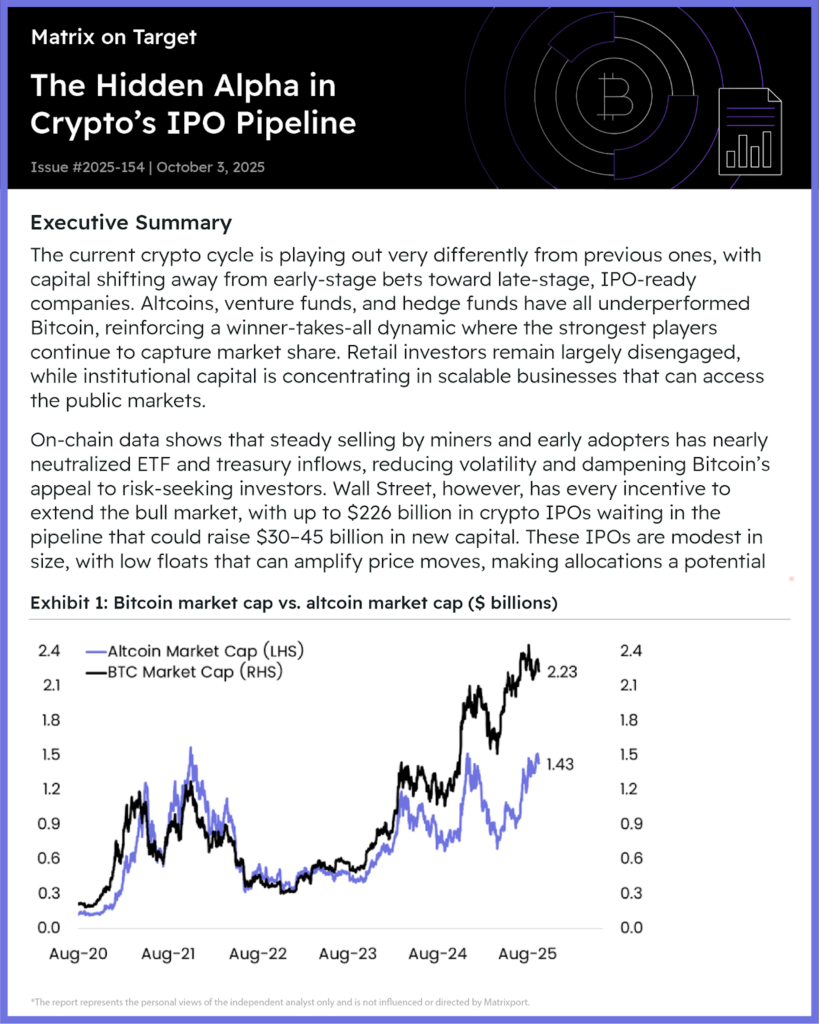

While IPO plans gain momentum, Bitcoin faces continued selling from miners and early adopters. According to Matrixport, this selling pressure has offset inflows from exchange-traded funds and corporate treasuries, leading to reduced volatility and dampened appeal for high-risk investors.

However, the firm noted that Wall Street has every incentive to sustain the bull market, with up to $226 billion in crypto IPOs potentially lined up. This influx of capital could act as a counterbalance to selling pressures in Bitcoin.

ETF Approvals Could Trigger Selective Altseason

The report also suggests that the traditional altcoin boom may not repeat in its usual form. Instead, analysts expect only select tokens with strong institutional support or exchange-traded fund approvals to perform significantly.

Industry voices highlight that Ethereum has quietly begun to outperform as Bitcoin dominance trends lower. Nic Puckrin, co-founder of The Coin Bureau, said these indicators have historically signalled a rotation into altcoins, although he emphasised the movement remains selective.

Ki Young Ju, CEO of blockchain analytics platform CryptoQuant, described the shift as the beginning of a “paper-backed altseason,” pointing to the growing influence of ETFs.

Key ETF Deadlines in October

Regulatory decisions due this month could become decisive moments for altcoins. Multiple Solana ETF filings from firms including Grayscale, VanEck, 21Shares and Bitwise face deadlines on 10 October. XRP ETF proposals from Grayscale, WisdomTree, Bitwise and CoinShares are expected between 19 and 24 October.

Meanwhile, Litecoin’s ETF deadline on 2 October passed without response from the US Securities and Exchange Commission, possibly due to the ongoing government shutdown. Dogecoin and Cardano ETFs from Grayscale are also awaiting final decisions before the end of the month.

A Different Kind of Market Cycle

Unlike the explosive 2021 bull run, analysts believe the current cycle is shaping up differently. Institutional involvement, IPO pipelines and ETF approvals appear to be driving momentum rather than speculative retail trading alone.

This shift could mark the beginning of a more selective but potentially more sustainable altcoin season, with Wall Street playing a leading role.