A user of Venus Protocol has fallen victim to a phishing scam, resulting in losses worth $13.5 million in cryptocurrency. The decentralised finance (DeFi) platform temporarily paused operations to carry out security checks, but confirmed the incident was not linked to a flaw in its smart contracts.

Phishing Attack Drains Millions

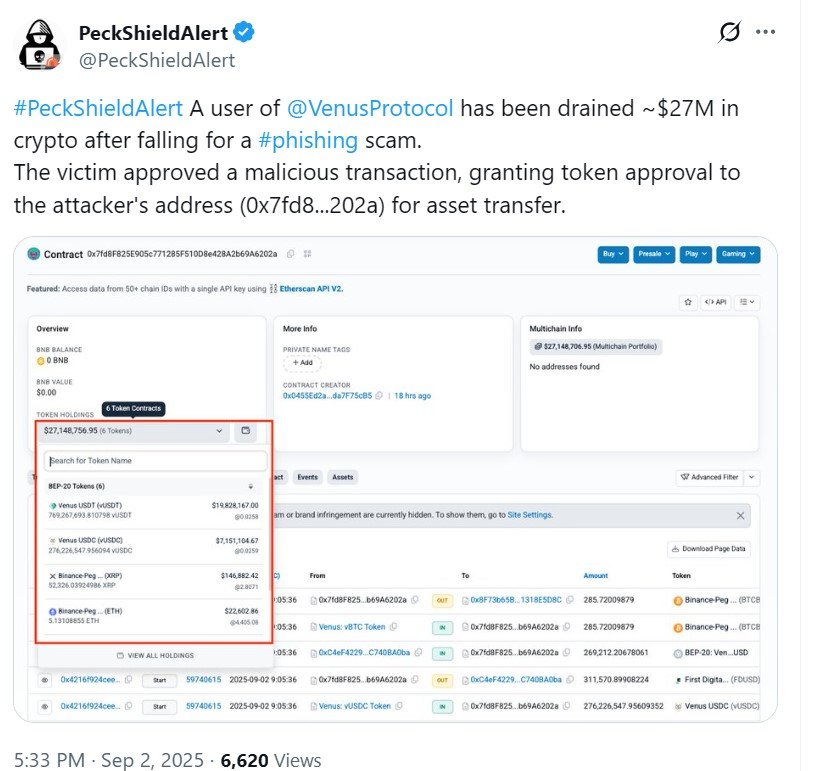

Blockchain security firm PeckShield first reported that the victim lost crypto assets valued at $27 million. However, the figure was later corrected to $13.5 million, as the initial assessment did not account for the user’s debt position.

The scam was carried out through a phishing attack, a tactic where cybercriminals trick victims into granting access or revealing sensitive information by posing as legitimate entities. In this case, the victim approved a malicious transaction that enabled the attacker to drain stablecoins and wrapped assets from their balance.

Venus Protocol Responds

Following the incident, Venus Protocol addressed community concerns through social media, assuring users that the loss was not caused by weaknesses in its code. When asked whether it was due to user error, the platform suggested this was the most likely explanation.

“To be cautious, we have paused the protocol while conducting comprehensive security reviews,” Venus Protocol stated. “We will keep the community informed as the investigation continues.”

Rise in Crypto Exploits

The Venus Protocol incident is part of a surge in crypto-related attacks at the start of September. On the same day, World Liberty Financial (WLFI) tokenholders were targeted by a phishing wallet exploit, according to security firm SlowMist.

In another case, decentralised exchange Bunni halted all smart contract operations after identifying a vulnerability in its Ethereum-based contracts. Security company BlockSec Phalcon estimated Bunni’s losses at $2.3 million.

Security Threats Across the Sector

The spate of incidents follows a damaging August, when 16 separate attacks cost the crypto sector over $163 million in losses. Kronos Research chief executive Hank Huang noted that criminal activity often intensifies during periods of rising crypto prices, as attackers seek to exploit increased trading activity and market optimism.

The Venus Protocol attack highlights the persistent risks in the DeFi sector, where even experienced traders can be deceived by sophisticated phishing tactics. While security audits and reviews provide reassurance, platforms continue to urge users to exercise extreme caution when approving transactions or interacting with third-party wallets.