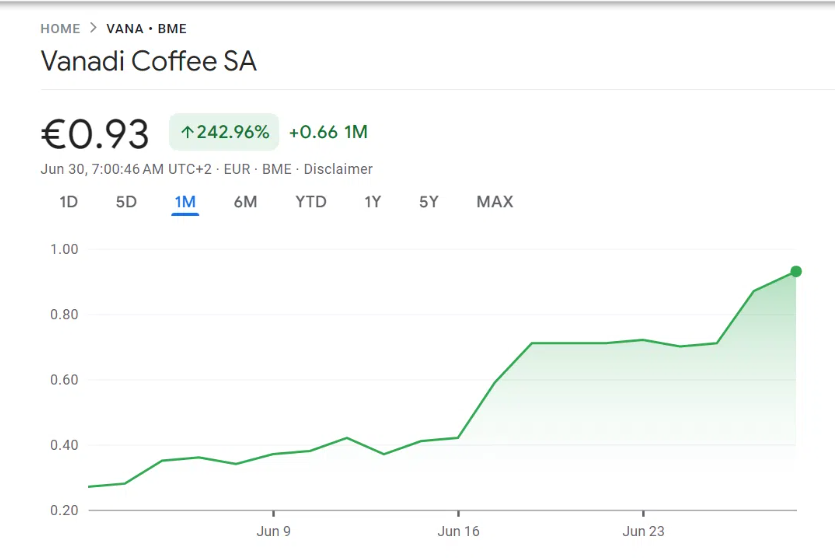

Vanadi Coffee, a small Spanish coffee chain, has stunned investors and markets alike with a dramatic 242% surge in its stock price. This rise follows the company’s announcement of a sweeping Bitcoin treasury strategy worth up to €1.1 billion, a move approved unanimously by shareholders on 29 June 2025.

Despite posting €3.3 million in losses in 2024, the Alicante-based firm now plans to become Spain’s largest corporate holder of Bitcoin. The company has already taken its first step, purchasing 54 BTC valued at roughly €5.8 million. Assets are currently held under custody by the Spanish crypto exchange Bit2Me.

The Vanadi Coffee stock surge reflects growing market enthusiasm for companies integrating Bitcoin into their core business models, even when these companies come from non-tech, traditional sectors.

Bitcoin Treasury Strategy Sparks Investor Frenzy

The announcement has triggered a wave of investor interest, reminiscent of early corporate Bitcoin adoption seen with companies like MicroStrategy and Japan’s Metaplanet. Vanadi’s board was authorised not only to pursue investments of up to €1 billion in Bitcoin but also to increase company capital by 50% and issue convertible debt.

Such aggressive financial manoeuvres aim to transform Vanadi’s brand and balance sheet. The company stated, “Similar to companies such as Strategy or Metaplanet, Vanadi Coffee redefines its business model and will use Bitcoin as its main reserve asset.”

This strategy marks a significant shift from a struggling six-outlet coffee chain to a potential crypto-heavyweight, at least in terms of digital asset holdings.

Criticism Amid Enthusiasm: Is It Sustainable?

Not everyone is sold on the idea. Andrew Bailey, senior fellow at the Bitcoin Policy Institute, criticised the move as likely unsustainable, calling most new Bitcoin treasury companies “gimmicks” designed to chase hype rather than long-term value.

“A badly run business doesn’t become a good one just because it is acquiring sound money,” Bailey warned, echoing concerns over Vanadi’s relatively small operational footprint and rising losses.

Critics also question whether the company’s Bitcoin-driven transformation is a genuine turnaround strategy or a speculative attempt to inflate valuation during a bull market. The volatile nature of crypto prices, paired with Vanadi’s already precarious financial health, adds to the risk.

Corporate Crypto Adoption Gains Ground in Europe

Still, Vanadi Coffee’s bold Bitcoin treasury plan highlights a broader trend of growing corporate adoption of digital assets, particularly in Europe. The move aligns with increasing investor appetite for crypto exposure through traditional equities, allowing traders to benefit from Bitcoin’s price action without directly holding the asset.

Vanadi’s strategy also underscores how businesses are reacting to macroeconomic pressures, such as inflation and rising operational costs, by exploring alternative reserve assets. For Vanadi, Bitcoin is not just a speculative bet, it’s a strategic pivot to reinvent its corporate identity.

Though it’s too early to judge the long-term impact, the market’s initial reaction shows that bold moves into crypto still resonate strongly with investors. Whether this gamble pays off for Vanadi remains to be seen, but it has undoubtedly made the company a hot topic in both the finance and crypto worlds.

Vanadi Coffee’s 242% stock rally is a clear signal that the market is still willing to reward bold, crypto-centric pivots even from small, struggling companies. But as the dust settles, investors will be watching closely to see whether this ambitious Bitcoin treasury plan leads to sustained growth or serves as a cautionary tale about speculative financial overreach.