The global cryptocurrency market has taken a sharp hit, dropping by 4.5% in the last 24 hours, after former US President Donald Trump issued fresh tariff letters to 14 countries. This decision not only shook digital asset markets but also dragged down crypto-related stocks and the wider US stock market.

With further tariffs expected in the coming weeks and Federal Reserve rate cuts looking less likely, the atmosphere across financial markets is turning increasingly tense.

Trump’s Tariff Blitz Hits 14 Countries

On July 7, Trump sent out tariff letters to 14 countries, including South Korea, Japan, Malaysia, Indonesia, Thailand, and others. These letters outlined new import tariffs ranging between 25% and 40%, aimed at reducing America’s trade deficits.

According to The Kobeissi Letter, more than 100 countries may soon receive similar notices, as many failed to respond to previous US tariff requests with trade agreements.

Trump’s letters warned these countries that any retaliation would result in even higher tariffs. His stance was firm blaming trade deficits on “unfair” practices, despite critics saying otherwise.

Economist Peter Schiff was quick to respond, stating that Trump’s view on trade is flawed:

“Our trade deficits with Japan and South Korea aren’t because of tariffs, it’s because they produce goods Americans want more than the goods we make. These 25% tariffs won’t fix that.”

Crypto Market Suffers Sharp Losses

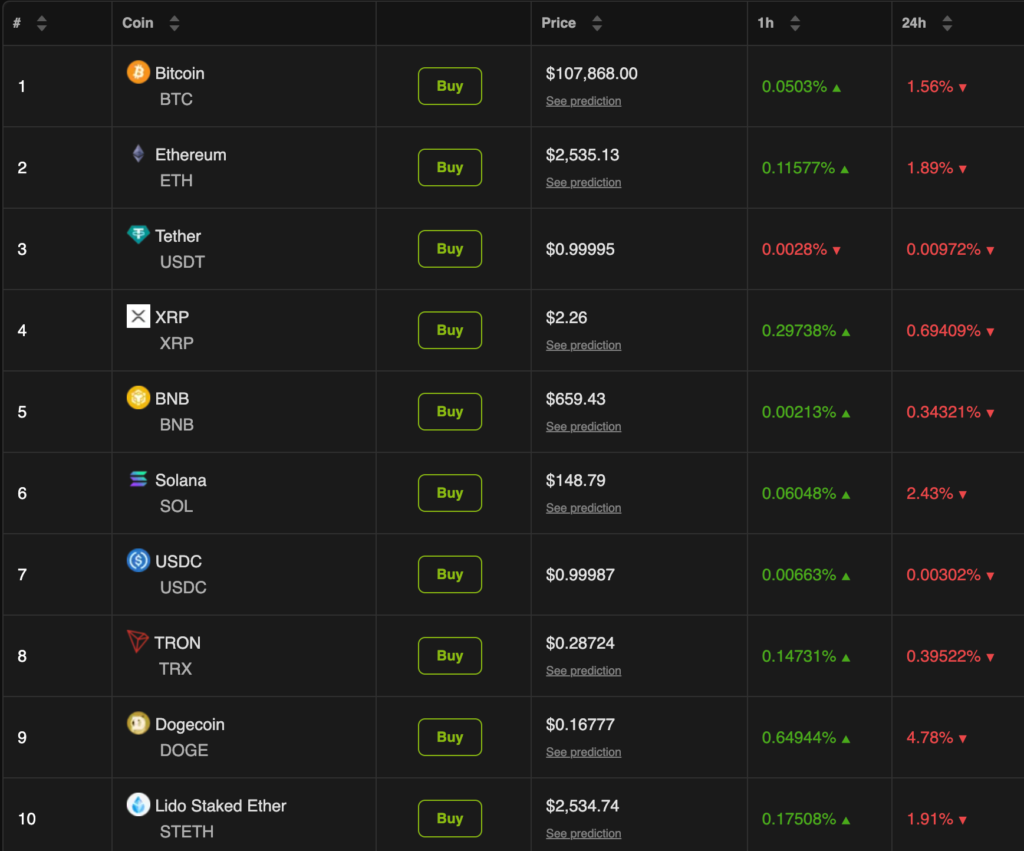

The impact on the crypto market was immediate and widespread. Data from BeInCrypto shows the total market cap dropped by 4.5% in just one day. All top ten cryptocurrencies fell into the red.

- Bitcoin (BTC) dropped 1.56%, falling just below the $108,000 level.

- Ethereum (ETH) slid 1.89%, trading at $2,535.

- Dogecoin (DOGE) took the hardest hit, falling 4.78%.

The market sentiment turned bearish as investors reacted to the uncertainty caused by the tariffs. Historically, major trade disruptions have led to crypto volatility, and this event proved no different.

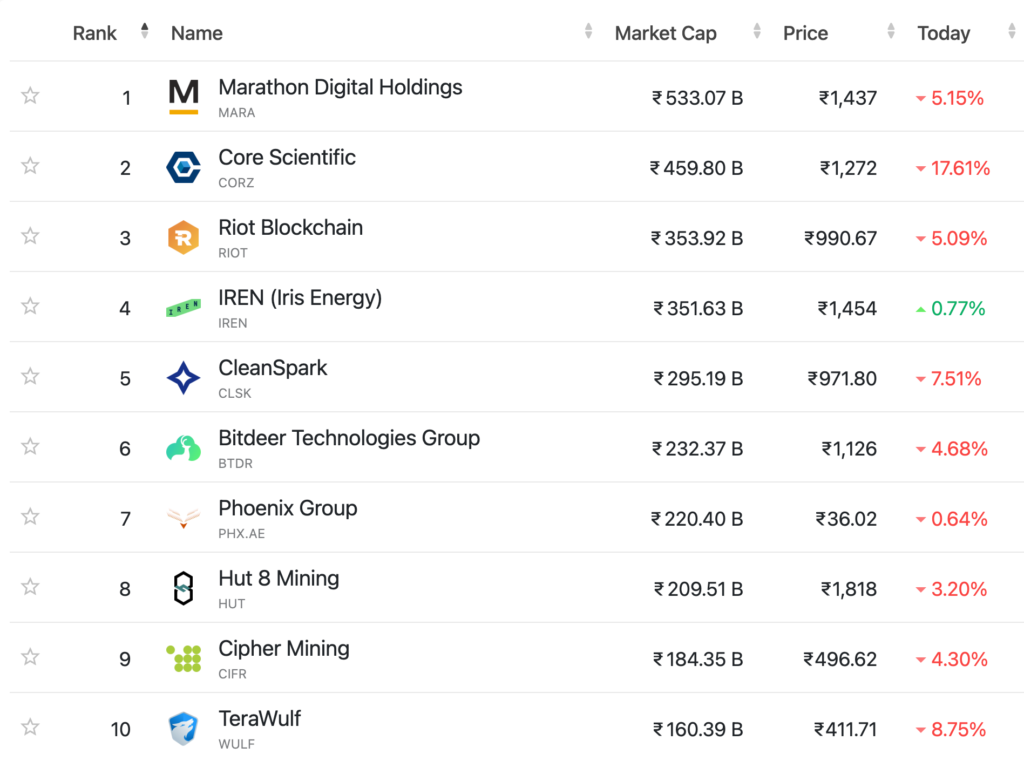

Even crypto-adjacent public stocks weren’t spared.

- MicroStrategy (MSTR) fell by 2%.

- Robinhood dipped 1%.

- Bitcoin mining firms saw even bigger losses, as operational costs and energy pricing concerns came into play amid broader global trade tensions.

US Stock Market Tumbles Too

The crypto crash was mirrored in the traditional financial markets. According to CNN:

- The Dow Jones Industrial Average fell by 422.17 points.

- The S&P 500 dropped by 49.37 points.

- The NASDAQ sank 188.59 points.

Meanwhile, the 10-year US Treasury yield jumped back up to 4.40%, signalling investor concern over rising government debt and inflationary pressure.

“It’s like clockwork, Trump sends tariff letters, and yields spike,” wrote The Kobeissi Letter.

“Deficit spending is now in full control of long-term rates.”

This mirrors earlier events in April when the US-China trade conflict dragged Bitcoin below $80,000, triggering mass sell-offs and liquidations.

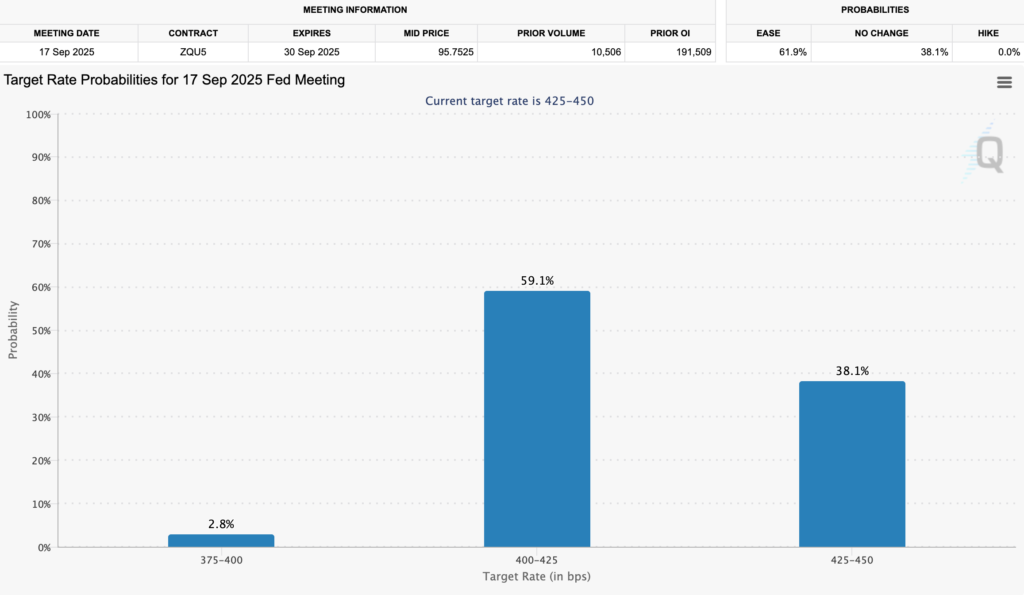

Fed Rate Cut Expectations Plummet

The Federal Reserve’s interest rate path is now under renewed scrutiny. Previously, markets were hopeful for a rate cut in July, but those hopes have nearly vanished.

BeInCrypto reported that the chances of a July cut are now below 5%. Expectations for a September rate cut have also dropped from 90% just two weeks ago to 61.9% now, according to the CME FedWatch Tool.

Rising tariffs could push prices up, and with inflation still a concern, the Fed may be reluctant to loosen policy.

For crypto markets, this is especially bad news. Rate cuts usually lead to cheaper borrowing and higher asset prices. But without cuts, liquidity remains tight, making it harder for risk assets like Bitcoin and Ethereum to rally.

More Volatility Ahead

With Trump’s tariffs set to take effect on August 1, market participants are bracing for more turbulence. If more countries receive tariff letters, the economic ripple effects could be severe.

Investors are now juggling multiple uncertainties:

- Rising global trade tensions

- High inflation and interest rate risks

- Falling crypto and stock prices

- Diminishing hope of central bank support

All eyes will now be on how countries respond to Trump’s tariff threats and whether the Federal Reserve will shift its stance amid mounting pressure.

Trump’s latest trade move has once again shown how global politics can shake even the most decentralised markets. As tariffs loom, and the crypto market bleeds alongside stocks, uncertainty remains the only constant. The coming weeks could decide whether this is just a correction or the start of a longer downturn.