Just hours before the U.S. Federal Reserve’s highly anticipated interest rate announcement, President Donald Trump launched a scathing attack on Fed Chair Jerome Powell, reigniting political pressure on the central bank. Speaking from the South Lawn of the White House, Trump labelled Powell “stupid” and accused him of costing the U.S. economy billions by maintaining high borrowing costs.

“The Fed probably won’t cut today,” Trump said, expressing frustration over the current interest rate range of 4.25% to 4.50%. “He’s a political guy who’s not a smart person, but he’s costing the country a fortune.”

Trump argued that U.S. rates should be at least two percentage points lower, citing Europe’s multiple rate cuts as a benchmark. The comments have heightened investor anticipation, though most analysts agree that the Fed is unlikely to announce a cut today.

Market Eyes Fed Signals, Not Just Decision

Despite Trump’s remarks, market consensus remains firm. According to the CME FedWatch tool, there is a 99.9% probability that the Federal Open Market Committee (FOMC) will hold rates steady during today’s meeting. What matters more to investors, however, is the Fed’s forward guidance.

Traders will be watching closely for any dovish signals or indications of rate cuts later in the year. “The Fed’s tone could dictate the short-term movement in both equity and crypto markets,” said one analyst from a major investment firm.

Even without a cut, a more accommodative stance from Powell could lift investor sentiment and risk appetite, a crucial factor for Bitcoin’s next move.

Bitcoin in Holding Pattern

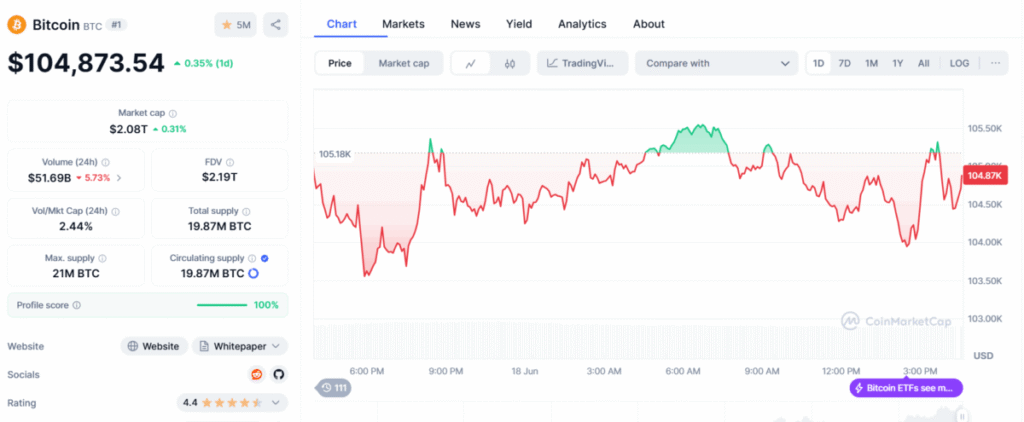

At the time of writing, Bitcoin is trading at $104,873 after a volatile 24 hours. The asset dipped below $104,000 yesterday but briefly recovered before slipping again. Despite Trump’s aggressive comments and macro uncertainty, the crypto market remains relatively calm.

Analysts believe that Bitcoin is currently in a wait-and-see mode. “This is one of those inflection points,” said crypto strategist Daniel O’Connor. “If the Fed signals continued concern about inflation, Bitcoin may slide below the $100,000 mark. But a hint of easing could push it beyond $110,000 quickly.”

Investors have also noted Bitcoin’s resilience amid economic tension. Unlike traditional assets, Bitcoin’s decentralised nature offers a hedge against monetary policy, although it remains highly sensitive to macroeconomic narratives.

Trump’s Personal Grudge Against Powell

The President didn’t hold back in expressing his disdain for Powell, suggesting personal animosity as a factor in the Fed Chair’s decisions. “I don’t even think he’s that political. I think he hates me, but that’s OK,” Trump said. He even joked about taking Powell’s job: “I’d do a much better job than these people.”

While Trump clarified he doesn’t plan to fire Powell, he hinted strongly that a leadership change could be on the horizon. Powell’s term ends in May next year, and Trump’s latest remarks suggest he may appoint a new Fed Chair if re-elected.

This ongoing feud is not just political drama, it adds a layer of unpredictability to monetary policy, which in turn feeds market volatility, especially in risk-on assets like Bitcoin.

Crypto Caught in the Crossfire

As the Federal Reserve prepares to announce its decision, markets are holding steady but tense. Trump’s aggressive rhetoric, while not unusual, adds pressure to an already delicate economic situation. Bitcoin remains poised for a major move depending on Powell’s tone.

Whether the Fed holds or hints at future cuts, today’s decision will likely shape Bitcoin’s trajectory in the short term. For now, the crypto market is caught between political theatrics and central bank caution, a mix that could trigger big moves in either direction.