Bitcoin is back in the spotlight as bullish momentum gains steam, largely fuelled by political drama in the U.S. and rising investor interest in spot Bitcoin ETFs. Over the past three months, U.S.-listed Bitcoin ETFs have attracted over $15 billion in inflows, despite Bitcoin trading sideways since mid-May. According to analysts, this sudden surge isn’t just about market optimism, it’s about politics, power, and pressure on the U.S. Federal Reserve.

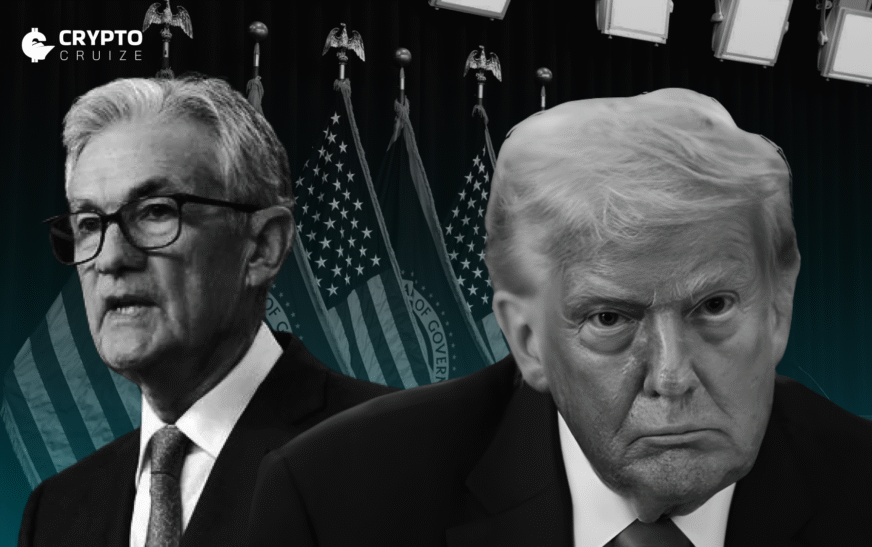

Trump’s Attacks on the Fed Ignite Market Moves

Former U.S. President Donald Trump has taken aim at Federal Reserve Chairman Jerome Powell, demanding interest rate cuts to 1% and even calling for Powell’s resignation. Trump blames Powell’s reluctance to lower rates for costing America billions.

This pressure is not just coming from Trump. Senator Cynthia Lummis and Bill Pulte, the Federal Housing Finance Agency director, have echoed similar sentiments, urging Powell to step down and calling out his “hawkish” stance.

Analysts, including Markus Thielen, founder of 10x Research, compare this political interference to what happened in Turkey between 2019 and 2021. Back then, President Erdogan forced rate cuts, undermined the central bank’s independence, and triggered a crash in the Turkish Lira. Now, the same kind of political tension in the U.S. is influencing market behaviour.

ETF Inflows Trigger Bullish Chase in Derivatives

The ongoing political pressure on the Fed has boosted confidence in Bitcoin as an alternative asset. Since mid-April, spot Bitcoin ETFs in the U.S. have consistently seen strong inflows, even when the price of Bitcoin was consolidating.

This steady demand has created FOMO (Fear of Missing Out) among under-positioned traders. Many who were hesitant to go bullish are now re-entering the market, especially through derivatives.

Thielen notes that these traders are turning to call options, particularly those with strike prices at $130,000, showing they expect Bitcoin to surge well beyond its current levels. A call option is a financial product that gives the buyer the right to purchase Bitcoin at a set price in the future, and heavy demand for high-strike calls reflects strong market optimism.

Strong Seasonality Supports Bitcoin’s July Rally

It’s not just politics that’s helping Bitcoin, historical data shows that July is typically a strong month for the cryptocurrency. According to data from Coinglass, Bitcoin has posted gains in 8 of the last 12 Julys, with an average return of over 7%.

This positive seasonality, combined with ongoing ETF demand and potential macroeconomic catalysts (like Fed policy shifts or inflation data), makes for a supportive environment for Bitcoin in the near term.

Thielen emphasises that this mix of technical indicators and political headlines could fuel further upside, especially if traders continue to pile in.

What’s Next? Watching the Fed and Derivatives

The upcoming Federal Reserve meeting minutes and other macroeconomic data releases will be crucial for Bitcoin’s next move. The Fed seems divided, some officials want to cut rates soon, while others prefer to wait. This indecision is adding to the volatility and making Bitcoin a hedge against policy uncertainty.

Meanwhile, the ETF inflows are showing no signs of stopping. As long as that continues and political pressure on the Fed remains high, Bitcoin may keep climbing, especially if sidelined bulls continue to chase upside through calls and futures.

Bitcoin’s latest rally is being fuelled by a mix of ETF inflows, political pressure on the Fed, bullish trader behaviour, and seasonal strength. As Donald Trump and other political figures turn up the heat on the Federal Reserve, Bitcoin is benefiting from the uncertainty and becoming a favourite among investors again.