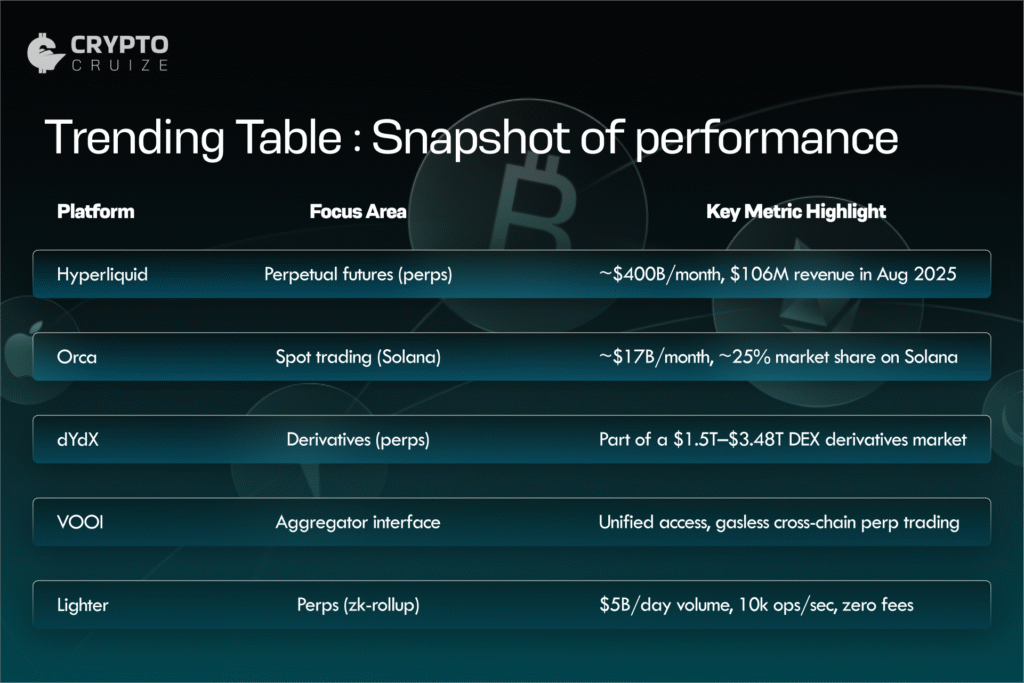

As decentralized finance (DeFi) flourishes, a handful of decentralized exchanges (DEXs) are distinguishing themselves through innovation, liquidity, and advanced execution capabilities. Below, we profile five standout platforms- Hyperliquid, Orca, dYdX, VOOI, and Lighter– that have emerged as leaders in trading activity, user experience, and technical innovation throughout 2025.

Hyperliquid: The Perpetual Powerhouse

Unmatched volume and revenue

Hyperliquid has shattered records in July and August 2025:

- In July, it executed nearly $320 billion in perpetual trades, a 47% increase from June’s $216 billion and a 28% rise over May’s previous high.

- In August, trading volume surged further to $400 billion, fueling a record $106 million in monthly revenue, a 23% increase from July’s $86.6 million.

With over 75% market share in perps DEXs, Hyperliquid’s dominance underscores its appeal among professional traders seeking speed, liquidity, and transparency.

Orca: Solana’s Spot Trading Champion

User growth and robust liquidity

Built on Solana, Orca continues to lead in spot trading. As of mid-2025:

- It recorded $17.05 billion in 30-day volume, with $4.60 billion over the past week, making it one of Solana’s most active DEXs.

- Orca’s intuitive UI and efficient swaps have strengthened its position amid Solana’s competitive landscape. It reclaimed significant market share, reaching nearly 20–25% of Solana DEX volume at times.

As Solana cemented its position as a DeFi powerhouse, recording $64.1 billion in DEX volume in June 2025, eclipsing Ethereum, Orca held firm as one of the primary venues for high-frequency trading.

dYdX: Veteran Derivatives Platform Reinvented

Steady growth, professional tools

dYdX remains a stalwart in derivatives trading:

- In 2024, decentralized derivatives on DEXs exceeded $1.5 trillion, with dYdX contributing over one-third of that volume. Projections suggest this figure could reach $3.48 trillion in 2025.

- The “Unlimited” upgrade in late 2024 introduced MegaVault, which now holds $79 million in USDC TVL, powering 175+ markets.

With a full migration to a Cosmos-based network, dYdX delivers decentralized order book and matching functionality, maintaining its stature as the go-to DEX for advanced perpetual traders.

VOOI: The Perpetuals Aggregator Unifying DEX Access

Seamless multi-platform execution

Though not a DEX in itself, VOOI fills a critical niche as a non-custodial aggregator providing access to multiple perpetual DEXs, such as Hyperliquid, Orderly, and more, from a single interface.

It offers gasless trading, chain abstraction, and unified balance management, streamlining a traditionally fragmented landscape. This consolidation and AI-powered route optimization make VOOI a novel and powerful entry in 2025’s DEX ecosystem.

Lighter: The Emerging Speed-First Challenger

Rapid ascent, technical innovation

Lighter has quickly risen to become the second-largest perpetual DEX by daily volume, registering $5 billion in daily trading volume, just behind Hyperliquid.

Built on a zk-rollup architecture, Lighter offers zero trading fees for retail users and boasts impressive throughput: 10,000 orders per second with ~5ms finality, rivaling even Hyperliquid in responsiveness. Currently in invite-only beta, it’s attracting 1,000+ new wallets daily.

Lighter’s focus on ultra-low latency and fee incentives positions it as a formidable upstart with the potential to reshape trading expectations.

Conclusion

The decentralized exchange sector in 2025 is no longer defined by a single model; it is a multi-front race shaped by innovation, liquidity, and user needs. Hyperliquid dominates perpetuals with unmatched scale, Orca anchors Solana’s spot trading growth, and dYdX proves its resilience by evolving into a fully decentralized derivatives giant. Meanwhile, VOOI is pioneering a new cross-chain aggregation model, and Lighter is rewriting expectations for speed and user acquisition in the perp market.

Together, these five platforms highlight the next chapter of DeFi: a trading environment where efficiency, accessibility, and decentralization converge, offering traders more choice than ever. The competition among them is not just reshaping market share, it’s setting the standards for how the next generation of crypto markets will operate.