Tokenisation, the process of issuing real-world assets on blockchain, could reshape Latin America’s underperforming capital markets by removing systemic inefficiencies, cutting costs, and expanding access to global investors, according to Bitfinex Securities.

A new report from the company argues that tokenisation adoption may solve long-standing challenges, accelerating investment and capital flow while unlocking new opportunities for both issuers and investors in the region.

Liquidity Latency: The Region’s Core Challenge

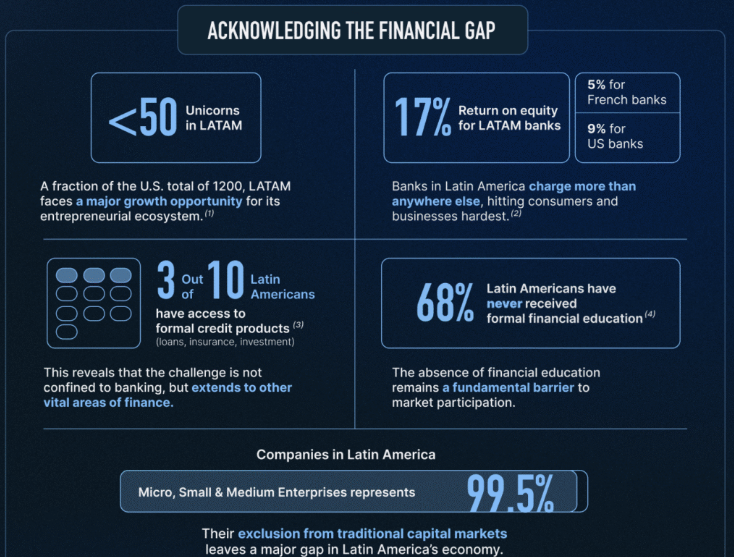

Latin America’s capital markets have long suffered from what Bitfinex terms “liquidity latency” a structural slowdown in the flow of capital and investment. The phenomenon is driven by a mix of high transaction fees, complex regulatory frameworks, technological barriers and high start-up costs for issuers.

These inefficiencies have hampered investment into the region, leaving businesses and individuals struggling to access capital through legacy systems. As a result, markets often fail to attract global liquidity, restricting growth potential in both established and emerging sectors.

Tokenisation as the Solution

Bitfinex Securities believes tokenisation offers a breakthrough. By minting financial and tangible assets onto an immutable blockchain ledger, tokenisation increases accessibility and efficiency while creating broader trading opportunities.

According to the report, tokenised financial products can reduce capital raising issuance costs by up to 4% and cut listing times by as much as 90 days. This not only lowers barriers for companies seeking funding but also broadens the investor base by allowing a more direct connection between issuers and buyers.

“Tokenisation represents the first genuine opportunity in generations to rethink finance,” said Jesse Knutson, Head of Operations at Bitfinex Securities. “It lowers costs, accelerates access, and creates a more direct connection between issuers and investors.”

Expanding Access for Developing Economies

Paolo Ardoino, CEO of Tether and CTO of Bitfinex Securities, emphasised tokenisation’s potential in emerging economies.

“For decades, businesses and individuals, particularly in emerging economies and industries, have struggled to access capital through legacy markets and organisations,” he noted. “Tokenisation actively removes these barriers.”

By enabling issuers to raise funds on-chain and giving investors regulated access to higher-yielding, asset-backed products, tokenisation could open new streams of capital in markets traditionally sidelined by global finance.

Bitfinex was notably the first exchange to secure a digital asset service provider licence under El Salvador’s Digital Assets Issuance Law. This regulatory approval allowed the platform to issue and facilitate secondary trading of tokenised assets including tokenised US Treasury bills, designed to help savers hedge against inflation and volatility by accessing the world’s reserve currency.

A Multi-Trillion-Dollar Opportunity

The potential of tokenised assets is being increasingly recognised by global consulting firms. McKinsey estimates the tokenised securities market alone could reach $1.8 trillion by 2030 under its base case scenario, with a bull case prediction of up to $3 trillion.

Such growth would represent one of the most significant transformations in modern finance, reshaping how issuers raise funds and how investors allocate capital globally. For Latin America, where access to reliable financial infrastructure remains uneven, tokenisation could be a catalyst for inclusive growth.

Crypto Adoption in Latin America on the Rise

The optimism around tokenisation comes as Latin America experiences a surge in cryptocurrency adoption. Stablecoins in particular are increasingly used as a store of value, offering protection against local currency volatility.

In 2024, stablecoins such as USDC and USDt accounted for 39% of total purchases on Bitso, one of the region’s largest cryptocurrency exchanges, according to its latest Latin America Crypto Landscape report. This shift underscores the growing appetite for digital assets as both an investment vehicle and a tool for financial stability.

While tokenisation remains in its early stages, its application across Latin America could help solve structural inefficiencies that have historically restrained the region’s markets. With regulatory support, blockchain infrastructure, and growing investor demand, tokenised assets may provide the liquidity boost needed to unlock long-term capital market growth.

For now, Bitfinex Securities’ message is clear: tokenisation is not just a technological upgrade, it could be the foundation for a new era of accessible, transparent, and inclusive finance in Latin America.