The United States has officially minted its final penny, marking the end of a 232-year tradition. The decision underscores a growing concern about inflation and the declining value of fiat currency, a reality that many say strengthens the case for Bitcoin.

The End of the Penny Era

The last US penny, nominally worth $0.01, was minted at the United States Mint in Philadelphia, Pennsylvania, on Wednesday. This event closed a chapter that began in 1793 when the first one-cent coin entered circulation.

The move comes after US President Donald Trump instructed the Treasury Department in February to halt penny production. Initially, officials aimed for a 2026 phase-out, but the Treasury ran out of manufacturing templates earlier than expected, between June and September, according to Axios.

Despite its symbolic value, the penny had become increasingly impractical to produce. Each coin costs approximately 3.7 times its face value to mint, meaning it costs more than three cents to make a single one-cent coin. Although no new pennies will be produced, the existing 250 billion coins already in circulation will remain legal tender.

Inflation and the Decline of Fiat Value

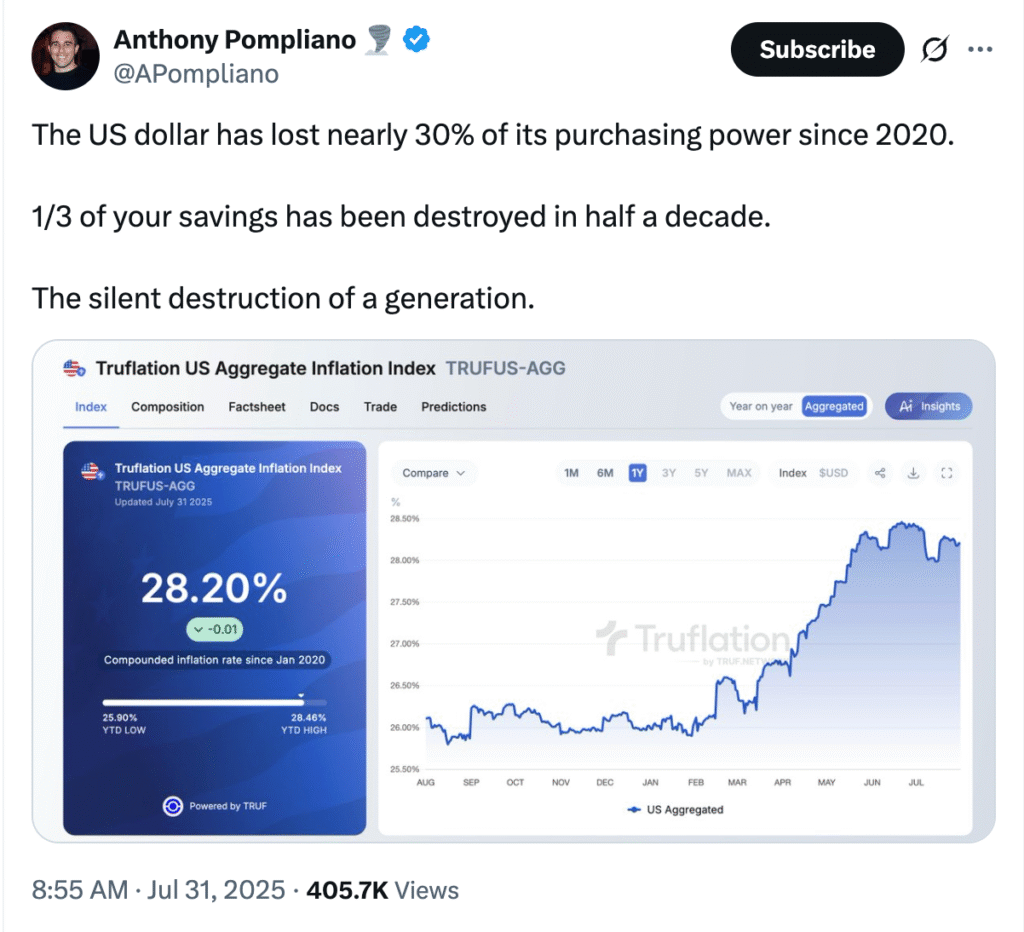

The rising cost of minting the penny is a small yet powerful example of how inflation erodes the value of money. As the cost of materials and labour climbs, producing coins worth less than their manufacturing expense becomes unsustainable.

Alexander Leishman, CEO of Bitcoin financial services firm River, said the penny’s demise reflects a broader economic reality. “Inflation made the penny useless. Meanwhile, it’s making the sat more relevant every year,” he said, referring to the ‘satoshi,’ the smallest unit of Bitcoin.

Bitcoin’s Deflationary Alternative

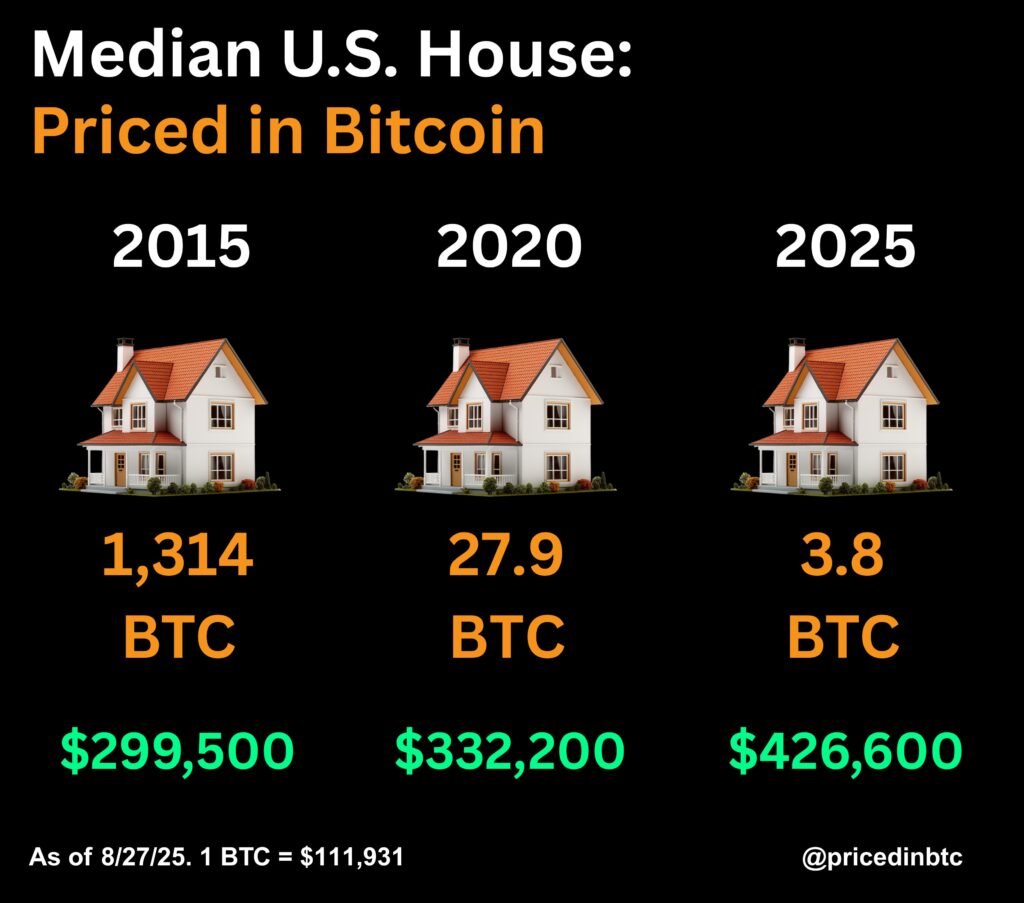

Bitcoin was designed as a hedge against inflation and a challenge to traditional fiat systems. With its fixed supply of 21 million coins, Bitcoin’s value is dictated by demand rather than government policy.

Economist and Bitcoin advocate Saifedean Ammous argues that technological advancement is inherently deflationary, as innovation makes production more efficient and goods cheaper over time. Fiat currencies, however, fail to capture this benefit because governments continually increase money supply, reducing overall purchasing power.

According to Ammous, the apparent rise in prices is not due to goods becoming more expensive but because fiat currencies like the dollar lose value relative to tangible goods, services and assets. Under a Bitcoin-based economy, he argues, prices would naturally fall over time as technology improves.

A Century of Decline for the Dollar

The weakening purchasing power of the US dollar supports these arguments. Data from The Gold Bureau shows that the dollar has lost over 92% of its value since the establishment of the Federal Reserve in 1913.

In 2025, Bitcoin reached record highs of more than $126,000, while the dollar faced one of its worst years since 1973, according to analysts at The Kobeissi Letter. The same report estimated that the dollar has lost roughly 40% of its purchasing power since 2000 and more than 10% just this year.

The Debate Over Usability

Despite Bitcoin’s appeal as a hard-money alternative, critics argue that its practicality remains limited. Nobel Prize-winning economist Paul Krugman has consistently questioned Bitcoin’s role as a mainstream currency.

“The whole point about the dollar is it’s really easy to use, and Bitcoin is not easy to use,” Krugman said in a conversation with podcast host Hasan Minhaj.

Krugman’s critique highlights a major challenge for Bitcoin adoption: while it may protect savings from inflation, it is still less convenient for everyday transactions.

A Symbolic End and a New Beginning

The final minting of the US penny serves as a symbolic reminder of the declining strength of fiat currencies. As inflation continues to devalue traditional money, digital alternatives such as Bitcoin are gaining credibility among investors and savers.

Whether Bitcoin becomes a true replacement for national currencies remains to be seen, but the end of the penny underscores one undeniable truth, the money of the past may no longer fit the economy of the future.