Tether, the world’s largest stablecoin issuer, has overtaken Germany in US Treasury holdings, solidifying its position as a major force in the global financial landscape. The company’s strategic diversification into traditional assets such as US Treasury bills and gold has helped it absorb the recent volatility in the cryptocurrency market.

Tether Holds Over $120 Billion in US Treasurys

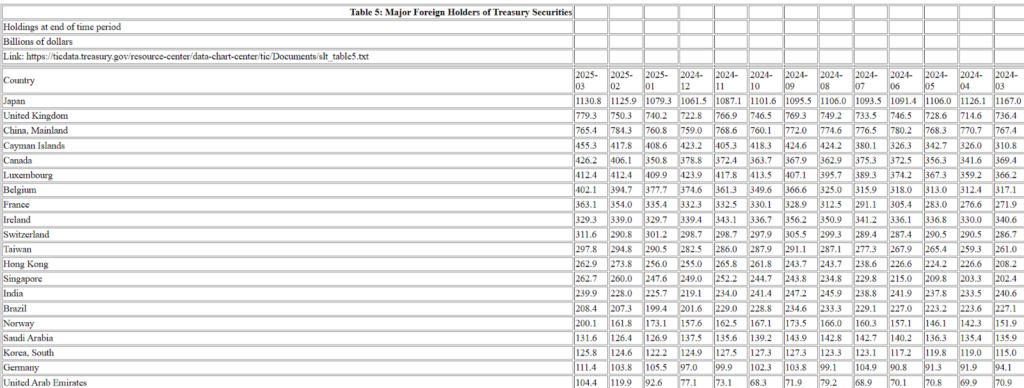

According to Tether’s latest attestation report for the first quarter of 2025, the firm now holds over $120 billion in US Treasury bills. This figure surpasses Germany’s $111.4 billion worth of Treasurys, as recorded by the US Department of the Treasury. This milestone places Tether as the 19th largest holder of US Treasurys globally, higher than many sovereign nations.

During 2024, Tether emerged as the seventh-largest buyer of US Treasurys among all countries, ahead of Canada, Taiwan, Mexico, Norway, and Hong Kong. This reflects not only the growing importance of stablecoins in global finance but also the increasing institutional adoption of crypto-backed assets.

In its report, Tether highlighted the significance of this development, stating: “This mileston e not only reinforces the company’s conservative reserve management strategy but also highlights Tether’s growing role in distributing dollar-denominated liquidity at scale.”

Diversified Reserves Cushion Crypto Market Turbulence

Tether’s investments in US Treasury bills and gold proved pivotal in managing risk during the first quarter of 2025, a period marked by downturns in the broader crypto market. The firm reported over $1 billion in operating profit from its traditional investments, largely driven by gains from its Treasury portfolio.

Moreover, its gold reserves played a crucial role in offsetting losses from crypto market volatility. The combination of these traditional assets helped stabilise the company’s balance sheet, providing confidence in the value of its US dollar-pegged stablecoin, USDt.

Stablecoin Regulation Gathers Momentum

Tether’s financial strategy aligns with broader regulatory developments in the US, where momentum is building for clearer rules around stablecoins. The industry is currently tracking progress on two key legislative proposals aimed at establishing regulatory clarity and operational standards for stablecoin issuers.

The Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act has made progress, having passed the House Financial Services Committee with a 32–17 vote on 2 April. The bill now awaits scheduling for full debate and a floor vote in the House of Representatives.

If passed, the STABLE Act would introduce more rigorous oversight of reserve assets, transparency standards, and reporting requirements for issuers like Tether.

GENIUS Act Stalls Amid Political Tensions

In contrast, the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act hit a roadblock on 8 May after it failed to gain sufficient support from key Democratic lawmakers. Critics raised concerns about potential financial conflicts of interest tied to former US President Donald Trump, citing his family’s involvement in digital assets.

Despite the setback, support for the GENIUS Act remains strong among industry leaders. On 14 May, over 60 prominent cryptocurrency founders gathered in Washington, DC, to advocate for the bill, which seeks to establish clear collateralisation standards for stablecoins and ensure full compliance with Anti-Money Laundering (AML) laws.

Looking Ahead

As regulatory clarity improves, Tether is poised to attract even more institutional and retail users to its USDt stablecoin. The company has indicated that a portion of new investments will continue to bolster its Treasury reserves, reinforcing trust in its reserve-backed model.

Tether’s recent financial milestones and its proactive approach to traditional asset investment signal a maturing phase for the stablecoin market, where risk management and regulatory alignment are becoming central to long-term growth and stability.