Telegram has officially shut down Haowang Guarantee, a notorious Chinese-language crypto black market that facilitated over $27 billion in illicit activity. The move comes after increasing scrutiny from blockchain investigators and journalists, bringing one of the world’s largest online crime syndicates to an abrupt end.

Haowang, formerly operating under the name Huione Guarantee, was openly conducting illegal operations via Telegram. The platform served as a hub for money laundering, scam-related services, and crypto fraud, operating under the guise of a digital escrow service. Vendors used the channel to exchange stolen data, digital identities, and illicit funds—all using cryptocurrency.

Telegram acted swiftly after an investigation by blockchain analytics firm Elliptic was reported by WIRED, which traced the market’s explosive growth in scam-related activities over the past year. On May 12, Telegram banned thousands of accounts connected to Haowang, and by May 14, the marketplace had shut down completely.

The $27 Billion Trail: Elliptic’s Findings

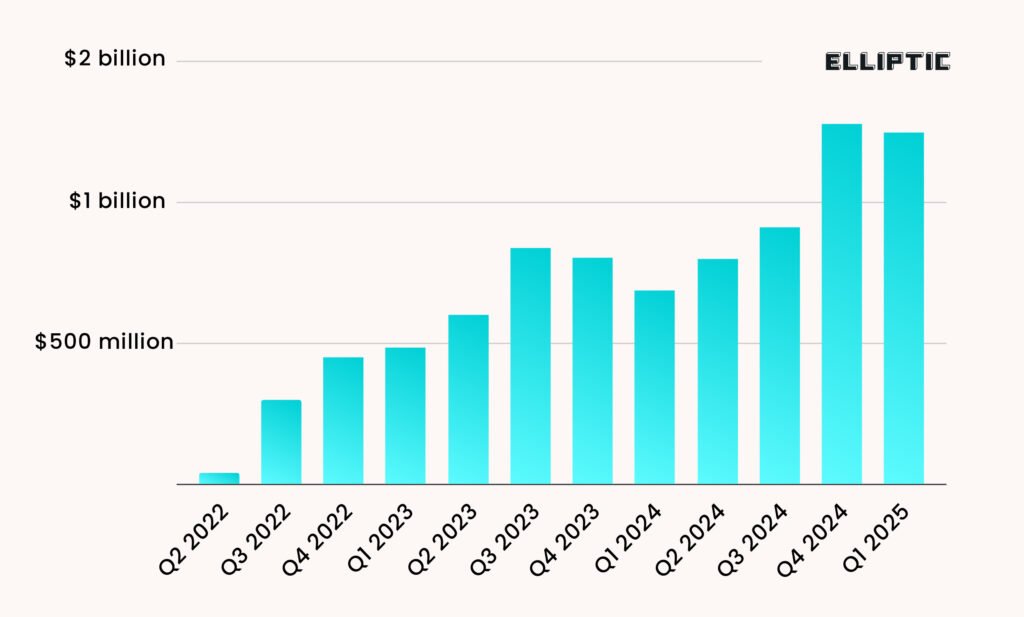

Elliptic, a respected name in blockchain forensics, had been tracking Haowang’s activity since July 2024. Their research showed the marketplace had processed over $24 billion in illicit transactions by early 2025, a figure that grew to $27 billion by May.

Vendors operating on Haowang offered services ranging from laundering crypto to more serious crimes like fraud and digital extortion. The model mimicked traditional darknet markets, but with a key difference—this one was hiding in plain sight on one of the world’s most popular messaging apps.

Elliptic’s investigation didn’t stop with Haowang. They also identified Xinbi Guarantee, a similar Telegram-based operation. Xinbi has reportedly processed over $8.4 billion since 2022, dealing in deeply disturbing services including harassment-for-hire and sex trafficking.

The scale and openness of these operations shocked many. Telegram, often praised for its encryption and privacy features, found itself under immense pressure to address its role in harbouring such networks.

Telegram’s Response: A Swift and Decisive Crackdown

Following inquiries from WIRED regarding Elliptic’s findings, Telegram responded with a sweeping crackdown. Thousands of user accounts linked to Haowang were banned overnight. In response, Haowang issued a brief and error-ridden statement, announcing the end of its operations:

“Telegrame were blocked all of our NFT, Channels and group on May 13th 2025, Haowang Grarantee will cease operation from now.”

While the closure marks a significant victory, it also reveals the limits of enforcement. Xinbi Guarantee is already attempting to re-establish itself via new Telegram channels. Similarly, Tudou Guarantee—another black market thought to be linked to Haowang’s operators—has seen a spike in new users, hinting at a potential migration of criminal activities.

A Deeper Problem: Ties to Power and Influence

One of the most alarming revelations is the link between Haowang’s parent company, Huione Group, and high-ranking officials within Cambodia’s ruling elite. These connections have raised serious concerns about the extent to which such illicit operations may be protected or even enabled by political power.

“This is a huge win,” said Elliptic co-founder Tom Robinson. “The largest darknet marketplace ever has been shut down. It’s a game-changer for online criminal networks and a major victory for victims of online fraud.”

Still, Robinson warned that the crackdown must continue. As long as platforms like Telegram remain accessible and unregulated, there’s always the risk of a resurgence.

A Test for Telegram

Telegram’s ability to tackle such widespread misuse will likely define its role in the future of secure communication. While the platform was never designed for illegal use, its privacy features have made it a magnet for bad actors.

The fall of Haowang Guarantee sends a powerful message—but it’s only the beginning. If Telegram wishes to maintain its legitimacy, ongoing vigilance and cooperation with investigators will be essential.

As the digital world evolves, so too does the nature of crime. And in that fight, platforms must choose a side—fast.