Strategy, the world’s largest corporate holder of Bitcoin, has kicked off 2026 with a fresh crypto purchase even as it reported a massive unrealized loss tied to last year’s market downturn. The company disclosed in a regulatory filing on Monday that it added more Bitcoin to its balance sheet during the opening days of the year while absorbing a steep fourth quarter paper loss as prices weakened late in 2025.

First Bitcoin Purchase of 2026

Strategy said it acquired 1,283 Bitcoin for approximately $116 million, marking its first purchase of the new year. The acquisition lifts the firm’s total Bitcoin holdings to 673,783 BTC, currently valued at about $62.6 billion based on prevailing market prices.

According to the filing with the US Securities and Exchange Commission, the company’s average cost basis across its Bitcoin holdings now stands at $75,026 per coin. The latest batch of Bitcoin was bought at an average price of roughly $90,000 per BTC.

The purchase was funded through proceeds raised from selling shares of MSTR stock under Strategy’s at the market offering program, a method the company has frequently used to finance its Bitcoin accumulation strategy.

Cash Reserves Strengthened Alongside BTC Holdings

In addition to expanding its Bitcoin position, Strategy also increased its US dollar reserves. Executive chairman and co-founder Michael Saylor said in a post on X that the company’s cash balance rose by $62 million, bringing total dollar reserves to $2.25 billion.

Saylor noted that the cash reserve plays a key role in supporting dividend payments, preferred stock obligations, and interest payments on the company’s outstanding debt. Maintaining a sizable cash buffer has become increasingly important as Strategy continues to rely heavily on capital markets to fund its Bitcoin purchases.

The latest Bitcoin buy follows a significant cash boost reported in late December. On Dec. 22, Strategy disclosed that it had added $747.8 million in net proceeds to its reserves from the sale of common stock.

Smaller Buy Compared With 2025 Mega Purchases

While the $116 million purchase is larger than the $108 million buy disclosed the previous week, it pales in comparison to some of Strategy’s largest Bitcoin acquisitions made in 2025.

Data from SaylorTracker.com shows that the company’s two biggest purchases last year came on March 31, when it acquired 22,049 BTC for $1.92 billion, and on July 29, when it bought another 21,021 BTC for $2.46 billion.

These large-scale purchases cemented Strategy’s position as the dominant corporate holder of Bitcoin, far ahead of any other publicly listed company. The firm has repeatedly stated that it views Bitcoin as a long-term store of value and a core treasury asset rather than a short-term trade.

$17.4 Billion Unrealized Loss in Q4

Despite continuing to add Bitcoin, Strategy acknowledged the financial impact of last year’s price correction. The company reported an unrealized loss of $17.4 billion on its Bitcoin holdings during the fourth quarter of 2025.

Bitcoin prices fell more than 23 percent during the quarter, leading to the paper loss. While unrealized, the figure has renewed concerns among critics who question the sustainability of Strategy’s Bitcoin-heavy business model, especially during extended market downturns.

The filing also revealed a $5 billion deferred tax benefit associated with the loss. This represents a potential future reduction in Strategy’s income tax liabilities, though it does not provide immediate cash relief.

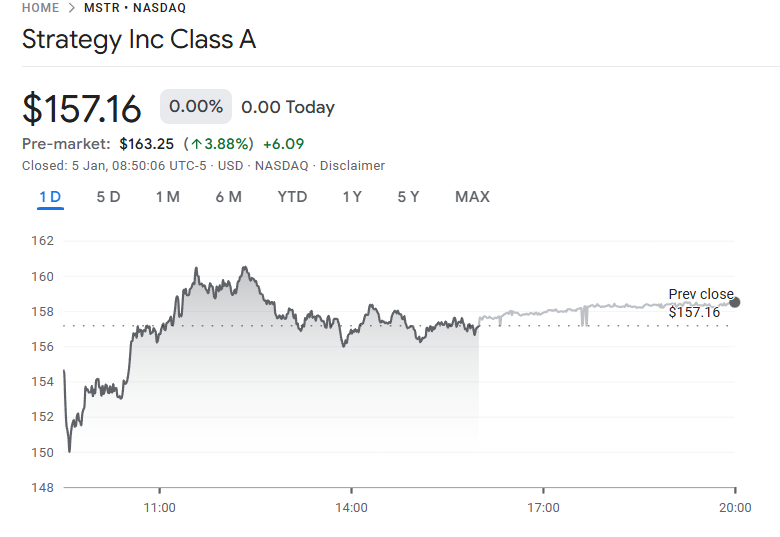

Stock Performance and Broader Market Influence

Strategy’s stock reacted positively in early trading following the disclosure. Shares rose 3.88 percent in pre-market trading on Monday to move above $157. However, the stock remains down more than 58 percent over the past year, reflecting both Bitcoin’s volatility and investor unease over the company’s aggressive crypto exposure.

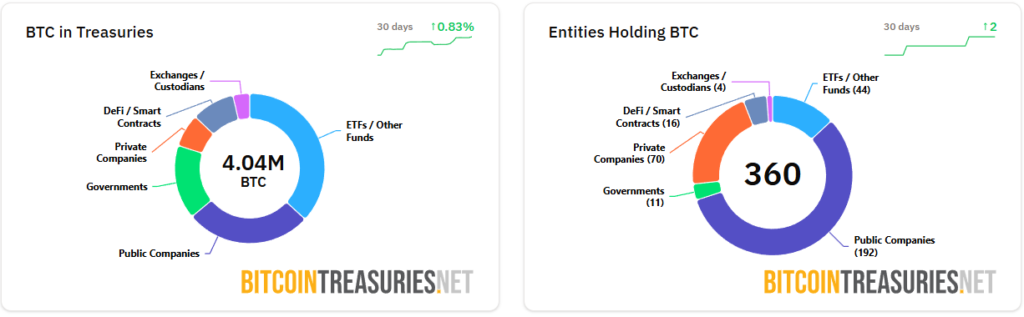

Even so, Strategy’s approach has influenced a growing number of firms worldwide. Its Bitcoin-first treasury strategy has inspired companies such as Japan-based investment firm Metaplanet, which has emerged as the fourth-largest public holder of Bitcoin. Metaplanet currently holds 35,102 BTC, valued at roughly $3.25 billion.

According to data from Bitcointreasuries, public companies now collectively hold around 1.09 million Bitcoin, representing about 5.21 percent of the total supply. Strategy alone accounts for a significant share of that figure, underscoring its outsized role in shaping corporate adoption of Bitcoin.

As 2026 begins, Strategy appears committed to staying the course. Despite paper losses and market skepticism, the company continues to double down on Bitcoin, reinforcing its belief that long-term conviction will outweigh short-term volatility.