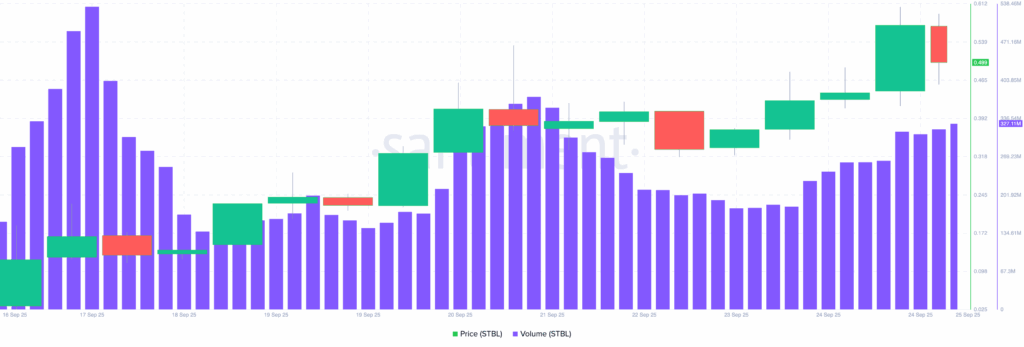

STBL, the governance token of the Real World Assets (RWA)-backed stablecoin project, has seen dramatic price action in recent days. After soaring 1,400% from its Token Generation Event (TGE), the token reached an all-time high of $0.60. However, the rally was followed by a swift correction, with the token retracing nearly 19% to trade at $0.50 at the time of writing.

Despite the pullback, technical indicators and market activity suggest that the decline may be short-lived, with signs pointing towards a potential rebound.

CFTC’s Tokenised Collateral Initiative Spurs Interest

A key driver of STBL’s explosive rally was news from the Commodity Futures Trading Commission (CFTC), which announced a new initiative to explore tokenised collateral in derivatives markets. The move has broad implications for the role of stablecoins and other RWA-backed assets in regulated financial markets.

STBL has positioned itself well within this narrative. Its design involves splitting RWAs into USST, a stable principal token and STBL as the governance layer. This structure aligns with regulatory directions and offers investors a clear value proposition: stability combined with RWA yield capture.

Avtar Sehra, the project’s founder, emphasised the fit between STBL and the evolving regulatory landscape:

“STBL is the perfect endgame for tokenised collateral, marrying regulatory-aligned stability with RWA yield capture, delivering the highest possible capital efficiency for derivatives markets.”

The statement reinforced investor confidence, prompting a surge in trading activity and helping to fuel the price spike.

Liquidity and Volume on the Rise

Trading activity in STBL has picked up significantly. Over the last 48 hours, volume rose from under $190 million to more than $327 million, reflecting a surge in interest among both retail traders and larger investors.

Rising volumes are particularly noteworthy during corrective phases, as they often signal that new demand is absorbing sell-side pressure. If this trend continues, STBL could stabilise quickly and resume its upward trajectory.

The alignment of bullish news, growing liquidity and structural design that appeals to regulatory priorities has put STBL in a strong position within the broader RWA tokenisation space.

Technical Outlook: Signs of Recovery

On the technical front, STBL’s price remains within an ascending channel on the 4-hour chart, a structure typically associated with continued bullish momentum.

Adding to this outlook is the Moving Average Convergence Divergence (MACD) indicator, which shows a bullish divergence. This pattern suggests that momentum is building in favour of buyers and often precedes a continuation of an uptrend.

The Supertrend indicator also remains bullish, with its support line sitting beneath the current price. Analysts suggest this positioning makes a deeper drop below $0.41 unlikely in the near term.

If STBL breaks through the immediate resistance at $0.52, the next target is $0.61, close to its all-time high. In a stronger bullish scenario, price action could extend towards $0.94.

Key Risks and Support Levels

Despite the promising signals, traders must consider the downside risks. If STBL fails to break above the $0.52 resistance, momentum could weaken, exposing the token to further selling pressure. In that case, analysts warn that the price could fall back towards $0.29, a significant support zone.

Still, the combination of favourable regulatory developments, surging volume and bullish technical indicators tilts the probability towards recovery rather than a prolonged downturn.

Outlook: Correction or Launchpad?

The recent 19% pullback in STBL’s price may look sharp, but in the context of a 1,400% rally, corrections are natural. With strong technical structures, growing liquidity and regulatory tailwinds supporting its design, STBL appears well-placed to rebound.

If bulls can defend key support and push past near-term resistance, STBL could quickly retest its all-time high and potentially move into higher price discovery. Traders and investors will be watching closely to see if the token can turn its explosive launch into sustained momentum in the weeks ahead.