Stablecoins are moving from the edges of crypto trading into everyday money use, according to a new global survey commissioned by BVNK. The findings show a growing share of crypto users receiving salaries and making routine purchases with fiat-pegged digital tokens, driven by lower fees, faster transfers and wider merchant acceptance, particularly in emerging markets.

Income and payments lead adoption

The survey, conducted by YouGov, polled 4,658 adults across 15 countries in September and October 2025. All respondents either currently hold cryptocurrency or plan to acquire it. Among them, 39 percent said they receive income in stablecoins, while 27 percent use them for everyday payments.

Those receiving wages in stablecoins reported that the assets make up about 35 percent of their annual income on average. For cross-border transfers, users cited fee savings of roughly 40 percent compared with traditional remittance services, underlining why freelancers, remote workers and globally distributed teams are adopting digital payouts.

On average, stablecoin users hold about 200 dollars worth of tokens in their wallets globally. In high-income economies, average balances rise to around 1,000 dollars, reflecting greater disposable income and higher transaction sizes.

Emerging markets drive growth

Adoption is strongest in middle- and lower-income economies, where 60 percent of respondents said they hold stablecoins, compared with 45 percent in high-income countries. Africa recorded the highest ownership rate at 79 percent, along with the sharpest increase in holdings over the past year.

Spending behavior also reflects this momentum. More than half of all crypto holders said they have made a purchase specifically because a merchant accepted stablecoins. In emerging markets, that figure rises to 60 percent. Looking ahead, 42 percent of respondents said they want to use stablecoins for major or lifestyle purchases, compared with 28 percent who already do so.

Where users keep and spend stablecoins

When asked how they prefer to manage stablecoins, respondents leaned toward platforms that blend crypto with familiar financial tools. Exchange platforms topped the list at 46 percent, followed by payment apps with crypto features such as PayPal or Venmo at 40 percent. Mobile crypto wallet apps followed closely at 39 percent. Only 13 percent said they prefer hardware wallets, suggesting convenience still outweighs cold storage for day-to-day use.

The survey also found openness to deeper integration with traditional finance. About 77 percent of respondents said they would open a stablecoin wallet with their primary bank or fintech provider if offered. Meanwhile, 71 percent expressed interest in using a linked debit card to spend stablecoins directly, a sign that users want seamless bridges between digital assets and retail payments.

Multiple tokens, not one issuer

According to a BVNK spokesperson, the study was designed to examine usage patterns among existing and prospective crypto users rather than measure adoption across the general population. The results show that users rarely rely on a single stablecoin issuer. Instead, they tend to hold a mix of dollar- and euro-pegged tokens, spreading balances across multiple options based on availability, trust and use case.

BVNK, founded in 2021 and headquartered in London, focuses on stablecoin-based payments infrastructure for enterprises. In June, the company partnered with San Francisco-based Highnote to support stablecoin funding for card programs, highlighting growing institutional interest in tokenized money rails.

Payroll and regulation bring momentum

Stablecoins are also entering more formal wage and payroll systems as regulation advances. In the United States, the passage of the GENIUS Act and in Europe, the rollout of the Markets in Crypto-Assets Regulation, have provided clearer legal frameworks for issuers and payment providers.

On Feb. 11, global payroll platform Deel announced it will begin offering stablecoin salary payouts through a partnership with MoonPay. The service is set to launch next month for workers in the United Kingdom and European Union, with plans to expand to the United States. Employees will be able to receive part or all of their wages in stablecoins to non-custodial wallets, while Deel continues to manage payroll operations and compliance.

Enterprise activity is accelerating elsewhere too. Paystand recently acquired Bitwage, a firm focused on cross-border stablecoin payouts. The deal expands digital asset settlement and foreign exchange options across Paystand’s B2B payments network, which the company says has processed more than 20 billion dollars in payment volume.

Market size and outlook

Stablecoins are typically pegged one-to-one with fiat currencies such as the US dollar or euro, offering price stability that makes them more practical for payments than volatile cryptocurrencies. This feature, combined with regulatory clarity and expanding enterprise use, is pushing stablecoins closer to mainstream finance.

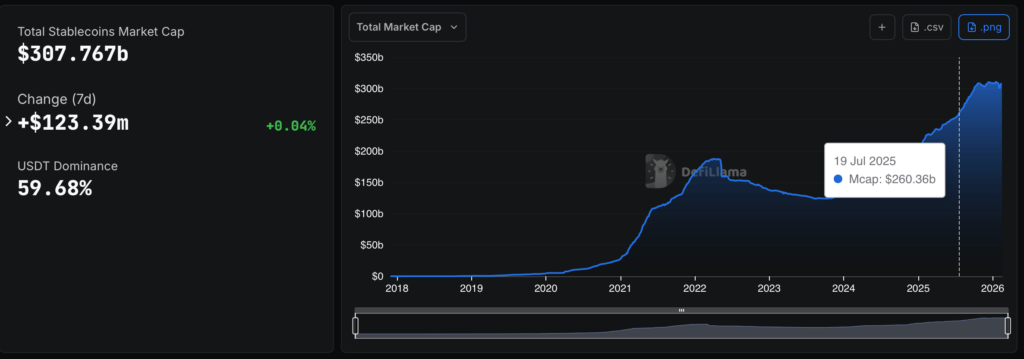

Data from DefiLlama shows the stablecoin market at 307.8 billion dollars, up from 260.4 billion dollars in mid-July, around the time the GENIUS Act was signed into law. As payroll providers, merchants and financial institutions continue to experiment with digital payouts, stablecoins appear increasingly positioned as a bridge between crypto infrastructure and everyday money use.