The Blockchain Gaming Alliance’s (BGA) latest State of the Industry Report highlights a clear shift in the priorities of Web3 game developers, with stablecoins breaking into the top three growth drivers for the first time. The findings point to a maturing sector that is moving away from speculation and turning towards sustainable business models, improved game quality and payment infrastructure rooted in Web3.

Stablecoins Become Core to Web3 Game Economies

According to the 2025 report, the three leading catalysts for growth are high-quality game launches at 29.5 percent, revenue-focused models at 27.5 percent and stablecoin adoption in payment systems at 27.3 percent. Stablecoins, which have long formed the backbone of decentralised finance, are increasingly viewed as essential for powering in-game transactions. Developers believe they can offer frictionless payment experiences similar to traditional fiat systems, which could help streamline game economies and reduce onboarding barriers.

BGA co-president Sebastien Borget said the findings reflect a more disciplined and global industry that is now centred on building commercially viable games for real players rather than catering to speculative hype cycles.

Five-Year Evolution Shows Industry Maturity

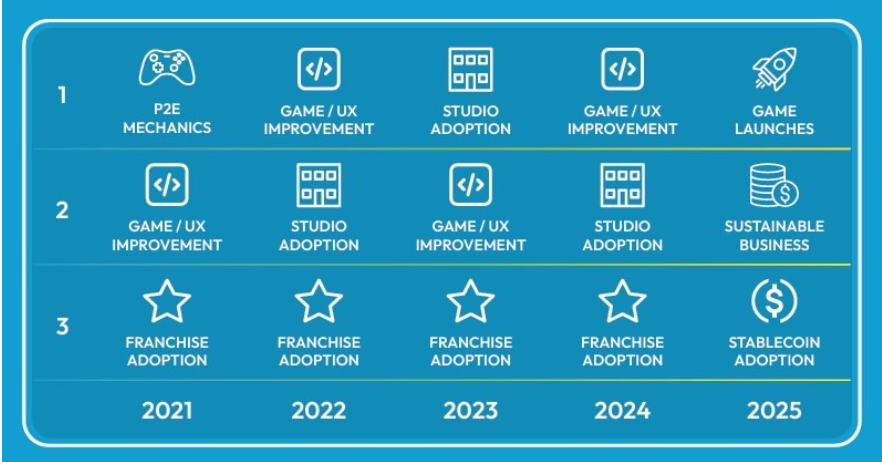

The report also traces how perceptions have changed over the last five years. Between 2021 and 2023, builders placed significant emphasis on external triggers such as play-to-earn surges and the expectation that well-known Web2 publishers would validate the space. By 2024, the focus shifted towards solving issues around user experience and accessibility. This year, developers link growth more directly to game quality, polished user journeys and monetisation models that can sustain long-term engagement.

Stablecoins have entered this discussion as developers increasingly see them as reliable infrastructure for in-game spending rather than speculative instruments. Their consistency makes them suitable for supporting everyday transactions in virtual worlds.

Declining Dependence on Traditional Gaming Giants

The survey also records a notable decline in how much weight the sector places on established gaming companies. Only 17.2 percent of respondents consider Web2 publishers a key growth driver compared with 35.8 percent last year. Instead, developers are turning their attention to interoperability at 26.1 percent, artificial intelligence integration at 25.9 percent and player-led creator economies at 25.5 percent.

This shift suggests that Web3 game builders are increasingly confident in their own ecosystems. Rather than waiting for traditional publishers to validate the space, they are investing in systems that prioritise community creativity, cross-platform assets and smart automation.

Policy Momentum Strengthens Stablecoin Adoption

Stablecoin infrastructure is also gaining support from ongoing regulatory developments. The United States is advancing its GENIUS Act, which aims to create a structured framework for stablecoin issuance. Europe is implementing its Markets in Crypto-Assets regulation, which introduces clear rules for digital asset providers. These frameworks could boost trust in stablecoin rails, paving the way for wider adoption in Web3 gaming systems.

Developers surveyed believe that a stable and clearly regulated payment layer will help reduce friction for users and strengthen in-game economies, especially as global audiences continue adopting blockchain-based entertainment.

A Sector Focused on Fundamentals

Overall, the BGA report indicates that Web3 gaming is moving towards a more grounded approach driven by real utility, improved player experience and sustainable business foundations. With stablecoins becoming central to payment flows and with gamemakers prioritising quality over hype, the industry appears to be entering a phase of more balanced and commercially oriented growth.