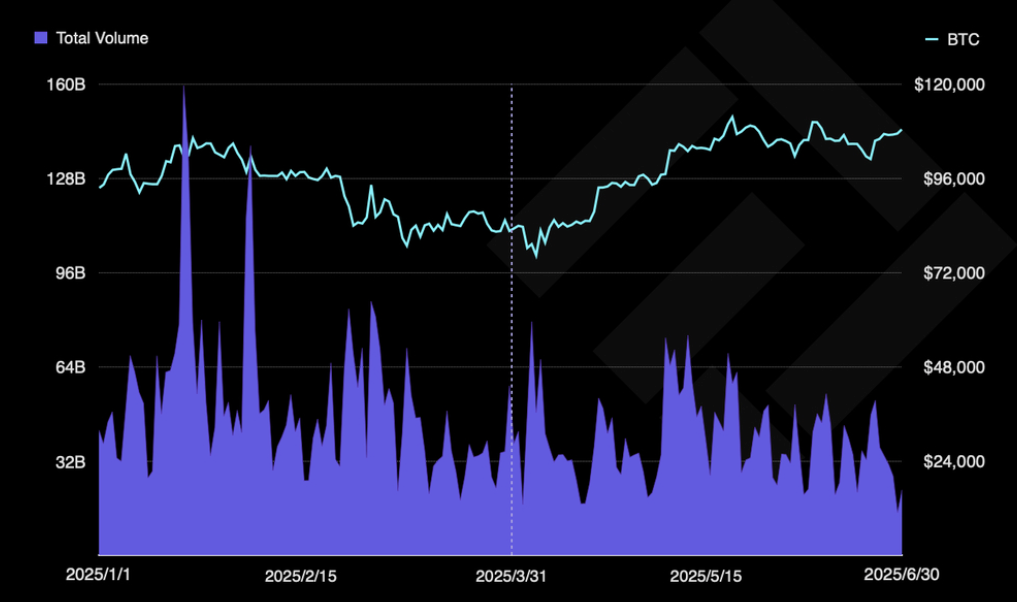

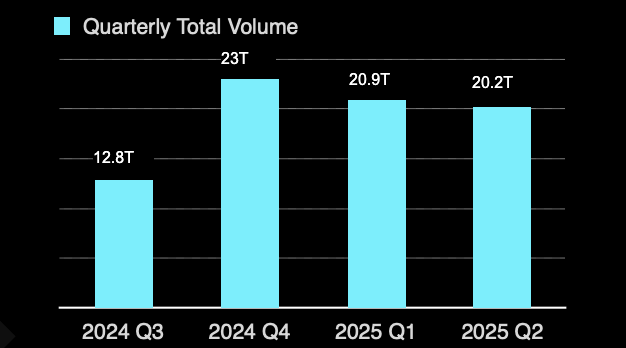

Despite Bitcoin’s impressive 25% surge in Q2 2025, spot trading on centralised exchanges (CEXs) fell sharply by 22%, marking the second consecutive quarter of decline. According to TokenInsight’s latest quarterly exchange report, spot trading volumes dropped from $4.6 trillion in Q1 to $3.6 trillion in Q2, continuing the downtrend that began after Q4 2024’s $5.3 trillion figure.

The decline is primarily attributed to a steep drop in altcoin trading activity and thinning liquidity, which weighed down market participation even as Bitcoin rallied. “Spot market sentiment remained weak due to limited liquidity and fading interest in altcoin trading,” noted TokenInsight.

Derivatives Outshine Spot as Traders Hedge Volatility

Unlike spot trading, the crypto derivatives market showed relative resilience. While derivatives volumes dipped slightly by 3.6% quarter-on-quarter from $20.9 trillion in Q1 to $20.2 trillion in Q2, traders remained active.

Derivatives continue to attract higher volumes as investors prefer short-term trades and risk-hedging strategies amid macroeconomic uncertainty. “Traders maintained their Q1 preference for high-frequency derivatives trading… aiming to hedge risks and leverage volatility,” the report highlighted.

Though the Federal Reserve’s decision to pause rate hikes briefly improved sentiment in April, wider concerns about global economic slowdown and geopolitical tensions kept caution levels high in Q2.

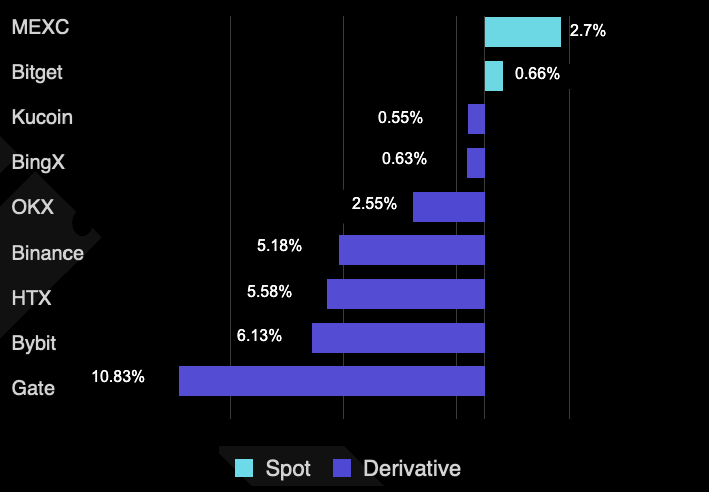

MEXC and Bitget Defy Market Slump

While most major CEXs reported reduced spot trading volumes, a few players bucked the trend. MEXC posted a 2.7% increase in spot trading volumes in Q2, positioning itself as the quarter’s top-performing exchange in the spot segment. Bitget also managed a modest 0.7% gain.

In contrast, the broader market saw a sharp 23% drop in average daily spot trading volume falling from $52 billion in Q1 to $40 billion in Q2. The slump indicates that while a few exchanges are gaining traction, overall market confidence remains low.

TokenInsight forecasts this downward trend will likely persist into Q3, projecting spot volumes to hover between $3 trillion and $3.5 trillion. Weak altcoin liquidity and limited investor engagement are expected to continue suppressing the market.

Bitcoin ETFs Boom as Traditional Inflows Surge

Interestingly, while CEXs saw falling activity, crypto ETFs witnessed a dramatic uptick. Bitcoin-focused exchange-traded funds (ETFs) recorded strong inflows, particularly those issued by BlackRock. The asset management giant saw a staggering 370% quarter-on-quarter growth in ETF inflows, contributing nearly $15 billion to the global crypto ETP total of $17.8 billion in H1 2025.

This institutional confidence helped boost Bitcoin’s market performance in Q2, in stark contrast to the broader altcoin space. According to CoinGecko, Bitcoin’s price gained 25% over the quarter, rebounding from a 12% drop in Q1.

TokenInsight believes growing corporate adoption and increased inflows into Bitcoin funds have significantly contributed to the asset’s recovery. However, the lack of positive momentum in the altcoin sector continues to act as a drag on platform-native tokens such as those tied to exchanges.

Divergent Trends Ahead

As Q3 unfolds, TokenInsight expects spot trading volumes to remain subdued, while derivatives markets may stay relatively stable due to ongoing demand for hedging instruments. Meanwhile, ETFs and institutional products could play a bigger role in supporting Bitcoin and other large-cap crypto assets.

However, exchange tokens and altcoins may continue to struggle, weighed down by liquidity concerns and falling investor interest. “The performance of exchange tokens is expected to remain divergent,” the report concluded, signalling a potentially volatile path ahead for platform-based assets.