S&P Global Ratings has, for the first time, assigned a formal credit rating to a decentralised finance (DeFi) platform. Sky Protocol, formerly known as Maker Protocol, has been given a “B-” issuer credit rating, marking a significant moment in the integration of blockchain-based financial services into traditional credit analysis.

The decision forms part of S&P’s ongoing review of stablecoin issuers, launched in 2023, which assesses their ability to maintain a stable value relative to major fiat currencies such as the US dollar. This review covers the creditworthiness of Sky Protocol’s liabilities, including its USDS and DAI stablecoins, as well as its sUSDS and sDAI savings tokens.

For the USDS stablecoin, S&P assigned a stability score of 4 on its 1–5 scale, where 1 means “very strong” and 5 means “weak” indicating a “constrained” ability to hold its dollar peg.

What is Sky Protocol?

Sky Protocol is a decentralised lending platform that enables users to take out cryptocurrency-backed loans. Its main stablecoin, USDS, is the fourth-largest in the market, with a capitalisation of around $5.36 billion at the time of assessment, according to CoinMarketCap.

The protocol evolved from the original Maker Protocol, which pioneered decentralised stablecoin lending with the DAI token. The rebrand to Sky Protocol reflects an expanded ecosystem, including new governance and risk management structures.

Despite its position in the market, Sky Protocol’s central role in DeFi lending comes with significant financial and operational risks, the very factors S&P analysed before arriving at its “B-” rating.

Key Risks Highlighted by S&P

S&P’s analysis pointed to several areas of concern:

- Governance Centralisation:

While DeFi is intended to be decentralised, Sky Protocol’s governance is heavily concentrated. Sky co-founder Rune Christensen holds nearly 9% of governance tokens, and voter turnout for major decisions is low. This means that a small group of participants effectively control the protocol’s direction. - Capitalisation Weakness:

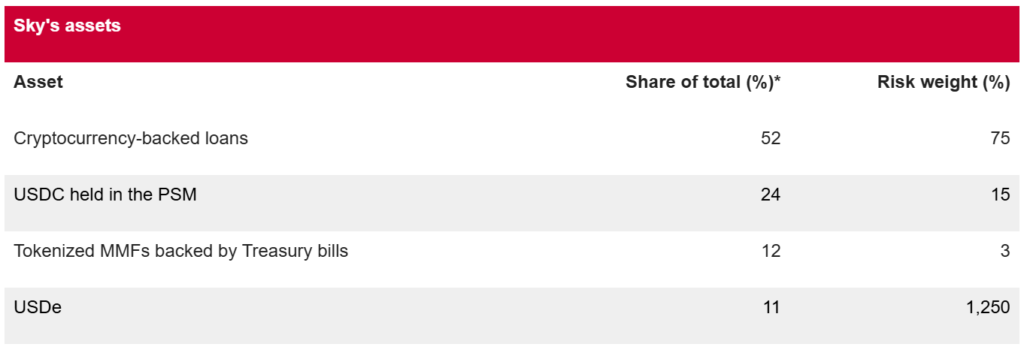

As of July 27, Sky Protocol’s risk-adjusted capital ratio stood at only 0.4%. This is a very thin buffer to cover potential credit losses, making the system more vulnerable during times of financial stress.

- Regulatory Uncertainty:

DeFi platforms operate in a rapidly evolving legal environment. S&P lowered Sky’s anchor rating to “bb” four notches below the US bank anchor of “bbb+” to account for the uncertainty and potential changes in regulation that could impact operations. - Liquidity Pressures:

A key vulnerability lies in the possibility of depositor withdrawals exceeding the liquidity available in the protocol’s peg stability module. In such a scenario, the USDS stablecoin could temporarily lose its peg, harming confidence. - Reliance on Founder and Team:

S&P noted the risks tied to the protocol’s dependence on its founder and a relatively centralised development structure, which contrasts with the ideal of community-driven DeFi governance.

While these risks are significant, S&P also acknowledged strengths such as minimal credit losses since 2020 and steady earnings, which helped support the “B-” grade rather than a lower score.

The Broader Stablecoin Landscape

The Sky Protocol rating fits into a wider industry trend, traditional financial institutions are beginning to evaluate crypto projects using their established credit rating systems. S&P launched its stablecoin stability assessment programme in December 2023, and since then has rated several major issuers:

- Circle’s USDC: Rated 2 (strong)

- Tether (USDT): Rated 4 (constrained)

- Sky Protocol’s USDS: Rated 4 (constrained)

According to S&P’s Andrew O’Neil, USDC’s higher rating comes from its transparency and simpler asset base. In contrast, USDS’s more complex asset structure and weaker capital position weighed on its score, while Tether’s transparency issues remain its main weakness.

DeFi and Traditional Finance Converge

S&P’s move reflects a growing overlap between the crypto sector and traditional finance. As more capital flows into blockchain-based products, investors, regulators and rating agencies are seeking formal assessments of creditworthiness and risk.

Sky Protocol’s own governance body, the Sky Ecosystem Asset-Liability Committee noted that the process with S&P gave them the opportunity to examine both traditional counterparty risks and DeFi-specific threats. These included smart contract vulnerabilities, oracle manipulation, bridge security issues and governance risks.

Importantly, they highlighted that some traditional risk models used in centralised finance (TradFi) do not always apply in on-chain systems, but that novel risks unique to blockchain must be addressed with equal seriousness.

The rating also follows other examples of blockchain-based financial products receiving mainstream credit ratings. In June, Figure Technology Solutions, a platform for blockchain-based financial products secured an “AAA” rating from S&P for a $355 million mortgage securitisation.

Outlook for Sky Protocol

A “B-” rating means that, in S&P’s view, Sky Protocol is currently able to meet its financial obligations, but would be vulnerable in adverse economic, business or financial conditions. For the protocol, the rating offers both a challenge and an opportunity:

- Challenge: The centralisation, low capital reserves and unclear regulatory environment will need to be addressed to improve its rating.

- Opportunity: Being formally rated by S&P provides credibility and visibility, especially for institutional investors considering DeFi exposure.

As DeFi projects like Sky Protocol begin to receive more formal oversight and analysis, the gap between decentralised systems and traditional finance will continue to close, potentially making the sector more resilient, but also more accountable.