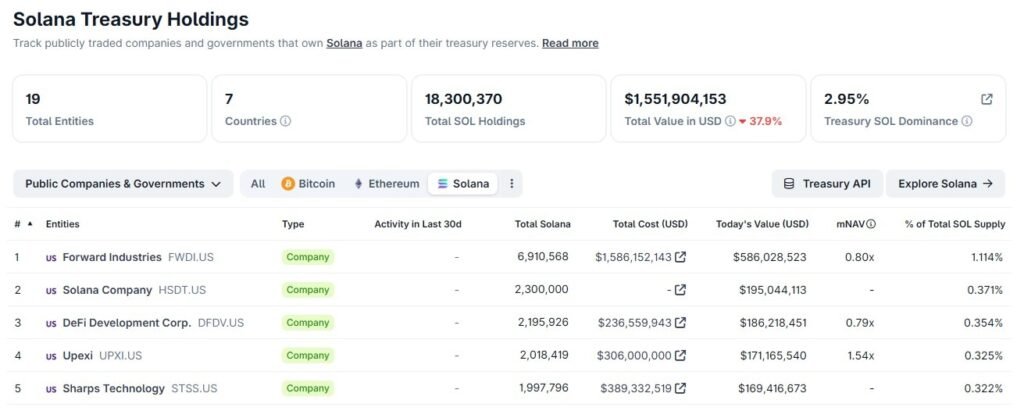

Publicly listed companies that added Solana to their corporate treasuries during the 2025 crypto rally are now sitting on more than $1.5 billion in unrealized losses, according to acquisition disclosures and current market prices tracked by CoinGecko. While none of the firms have sold their holdings, equity markets have already adjusted sharply, putting pressure on balance sheets and future fundraising plans.

Heavy Solana bets weigh on public balance sheets

A small group of US listed companies control the bulk of publicly disclosed Solana treasury holdings. Together, they hold more than 12 million SOL tokens, roughly 2 percent of Solana’s total supply. With SOL trading near $84, far below 2025 highs, these positions are now deeply underwater on paper.

CoinGecko data shows that Forward Industries, Sharps Technology, DeFi Development Corp and Upexi account for more than $1.4 billion of the disclosed unrealized losses. The real figure may be higher, as Solana Company has not fully detailed the costs of its acquisitions.

Although the losses remain unrealized, stock market investors have already priced in the downside. Most of these companies now trade well below the market value of their crypto holdings, signaling concerns over liquidity, governance and the sustainability of crypto-heavy treasury strategies.

Accumulation surge ended months ago

Blockchain transaction data compiled by CoinGecko shows that most Solana accumulation by corporate treasuries took place between July and October 2025. During that period, several firms made large, concentrated purchases as SOL prices climbed and enthusiasm around alternative crypto treasuries peaked.

Since October, accumulation has effectively stopped. None of the top five Solana treasury holders have disclosed meaningful new purchases, and there is no onchain evidence of selling either. The pause suggests that firms are waiting for clearer market conditions, or are constrained by falling share prices and limited access to fresh capital.

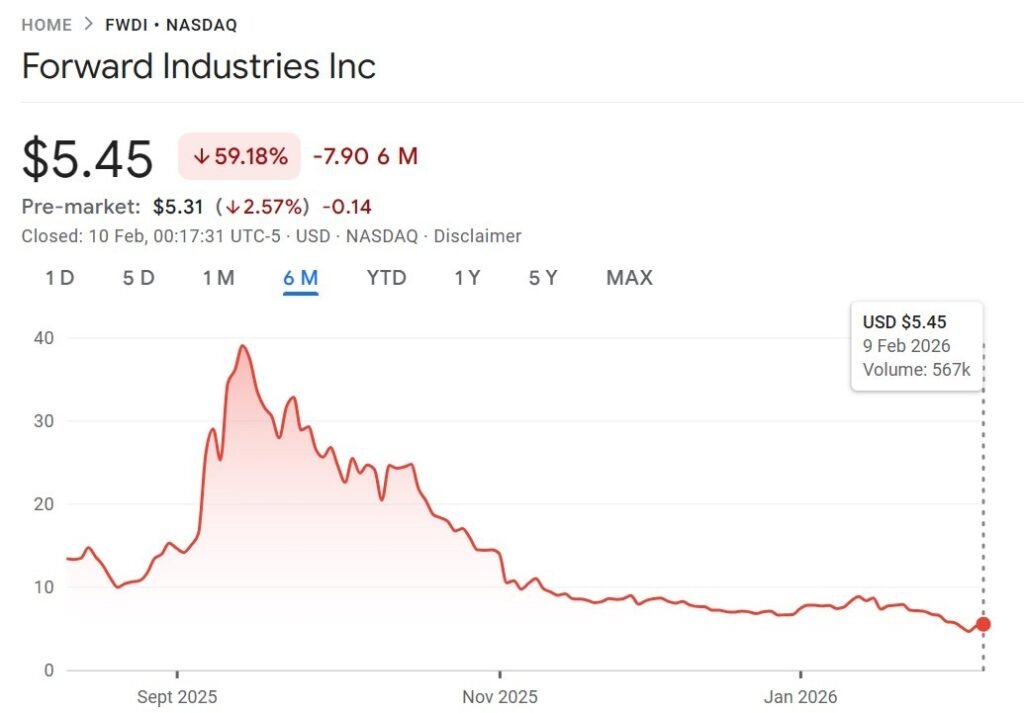

Forward Industries, the largest holder, accumulated more than 6.9 million SOL at an average price close to $230. At current prices, the position is down by more than $1 billion on paper. Sharps Technology made a single large purchase worth $389 million near the market peak, and its holdings are now valued at roughly $169 million, a decline of more than 56 percent.

Different strategies, similar market reaction

DeFi Development Corp followed a slower accumulation strategy and reports smaller unrealized losses relative to its peers. Even so, its shares continue to trade below the estimated value of its SOL holdings, reflecting broader skepticism toward crypto treasury models.

Solana Company built a 2.3 million SOL position across multiple tranches but has not disclosed full acquisition costs. CoinGecko’s transaction history shows that the company has not added to its holdings since October, aligning with the broader halt in accumulation across the sector.

Upexi, another notable holder, is sitting on about $130 million in unrealized losses. While smaller in absolute terms, the market response has been harsher, with its share price collapsing more steeply than those of other Solana treasury firms.

Equity markets price in a treasury winter

Stock performance over the past six months highlights the growing disconnect between token prices and equity valuations. Google Finance data shows that Forward Industries, DeFi Development Corp, Sharps Technology and Solana Company have seen their share prices fall between 59 percent and 73 percent during that period.

In contrast, SOL itself has outperformed most of these equities, despite its sharp decline from 2025 highs. Investors appear to be discounting not just token price risk, but also dilution concerns, financing constraints and the volatility of holding a single crypto asset on corporate balance sheets.

Upexi’s shares have dropped by more than 80 percent over the same six-month period, underlining how quickly sentiment can turn against companies perceived as overexposed to crypto market cycles.

Liquidity pressure grows despite no forced selling

For now, none of the Solana treasury companies have been forced to liquidate their holdings. However, falling share prices and compressed net asset value multiples have limited their ability to raise new capital without significant dilution.

The gap between unrealized losses and real-world liquidity pressure is becoming more visible. While paper losses do not immediately threaten solvency, they reduce financial flexibility and make it harder for companies to defend or expand their treasury strategies.

As SOL trades far below the levels at which most corporate buyers entered, the Solana treasury experiment is entering a quieter phase. Whether accumulation resumes will likely depend on a sustained recovery in token prices and renewed confidence from equity investors.