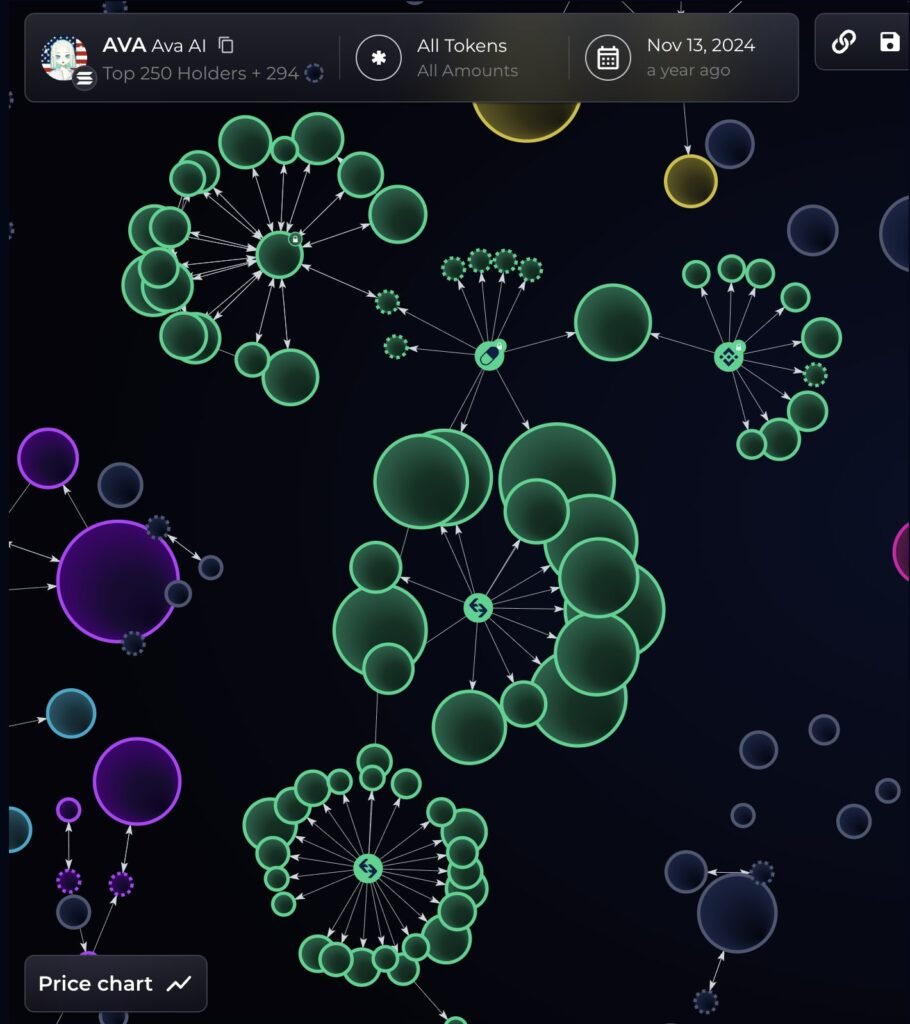

Blockchain analytics firm Bubblemaps has alleged that a group of wallets linked to the deployer of the Solana based AI token Ava accumulated a large share of the supply at launch. According to the firm, 23 connected wallets snapped up close to 40 percent of the AVA token supply as soon as trading began, raising concerns about insider coordination during the project’s debut.

Bubblemaps said the wallets formed a sybil style cluster that behaved in a strikingly similar manner. They were funded within a short time window, received comparable amounts of Solana and showed no prior on chain activity before participating in the AVA launch. The firm shared its findings in a post on X, stating that the patterns strongly point to deliberate coordination.

Funding trails point to common sources

The analytics firm noted that the wallets were funded through centralised exchanges including Bitget and Binance. Each wallet received Solana in similar quantities before quickly purchasing AVA tokens at launch. Bubblemaps said these similarities in funding size, timing and source were unlikely to be coincidental.

In addition to the core group of 23 wallets, Bubblemaps identified other early buyers that appeared to be linked through comparable funding behaviour. The firm said these connections reinforced the theory that multiple clusters were acting together during the token’s initial distribution.

Sniping raises concerns for retail investors

In crypto markets, sniping refers to the use of automated trading bots that buy new tokens the moment they become available. The goal is to secure large amounts at the lowest possible price before wider market participation.

AVA was launched through Pump.fun, a memecoin launch platform that promotes fair and community driven token distribution. However, the concentration of tokens across a small number of wallets suggests that a single entity or closely aligned group may have gained effective control over a significant portion of the supply.

Such concentration is often viewed as a red flag by investors, as it can enable practices such as liquidity withdrawal or coordinated sell offs. These actions can trigger sharp price collapses that leave late buyers holding near worthless assets.

Time Travel tool reveals early distribution

Bubblemaps said the activity was uncovered using its Time Travel feature, a forensic analytics tool launched in May. The tool allows users to reconstruct how tokens were distributed in the early stages of a project’s life, helping to identify insider accumulation that may not be obvious from current wallet data alone.

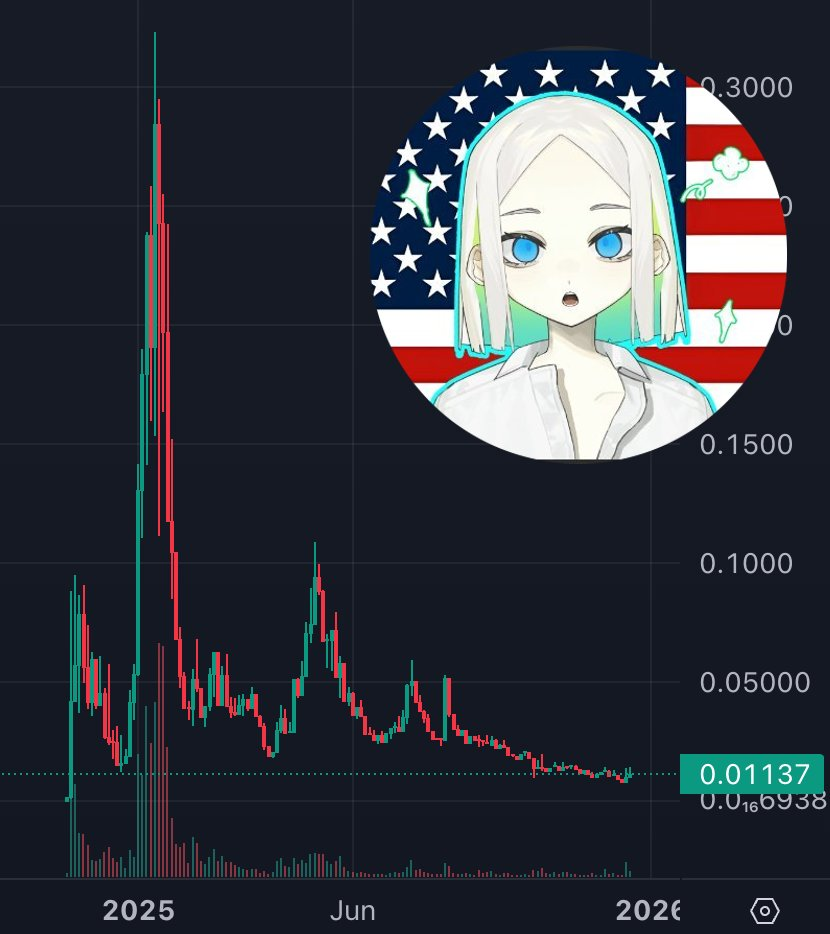

The findings came more than a year after AVA was launched on 13 November 2024. At its peak, the token achieved a fully diluted valuation of around 300 million dollars by January 2025, gaining attention as a high profile autonomous AI agent token on Solana.

AVA price plunges after early hype

Since that peak, AVA’s market performance has deteriorated sharply. Data from CoinGecko shows the token is down more than 79 percent since launch and over 96 percent from its all time high of 0.33 dollars reached on 15 January 2025.

Ava, also known as the HOLO AI intern, was marketed as the first AI agent built on the Holoworld AI platform. Holoworld positions itself as a decentralised AI launchpad that allows users to create, interact with and fund agent based AI applications. The platform claims to have more than one million users and hundreds of thousands of AI creations.

At the time of writing, Holoworld has not publicly responded to the allegations. The publisher has approached the platform for comment regarding the wallet activity identified by Bubblemaps during the AVA token launch.