SharpLink Gaming has further strengthened its position in the cryptocurrency market after adding $252 million worth of Ether to its reserves last week. The move takes its Ether treasury to almost 800,000 ETH, worth about $3.7 billion, while the company also approved a $1.5 billion share repurchase programme.

Major ETH Purchase and Growing Reserves

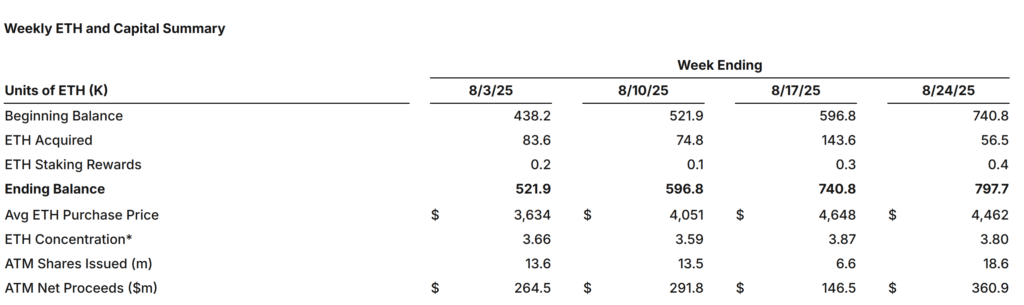

The Minneapolis-based firm confirmed it acquired 56,533 ETH at an average price of $4,462 per token during the past week. This purchase lifts its total holdings to 797,704 ETH, valued at approximately $3.7 billion. Alongside the Ether purchase, SharpLink raised $360.9 million through its at-the-market equity programme, leaving it with a $200 million cash balance for potential further acquisitions.

Since disclosing Ether as its core reserve asset in June, the company has rapidly scaled its holdings. In just four weeks, its reserves have grown from 438,000 ETH to nearly 800,000 ETH, placing SharpLink among the world’s largest corporate holders of Ethereum.

New Metric to Measure ETH Concentration

In its update, SharpLink introduced a new metric called “ETH Concentration”, which calculates Ether holdings per 1,000 assumed diluted shares outstanding. This figure has now surpassed 4.0, more than double its level in June.

The company reported staking rewards of 1,799 ETH since the launch of its treasury strategy in June, highlighting the additional yield being generated from its holdings.

Commitment to Long-Term Strategy

Co-Chief Executive Officer Joseph Chalom said the latest purchase reflected SharpLink’s continued commitment to its Ether-focused strategy. “Our regimented execution of SharpLink’s ETH treasury strategy continues to demonstrate the strength of our vision,” he said. “We are focused on building long-term value for our shareholders while supporting the broader Ethereum ecosystem.”

Stock Buyback Plan Announced

Alongside its crypto investment strategy, SharpLink’s board has approved a $1.5 billion stock buyback plan. The programme is designed to enhance shareholder value at a time when the company’s share price remains under pressure.

SharpLink’s stock closed at $0.96 on Monday, down 6.8% for the day, before recovering slightly in after-hours trading. The buyback initiative is expected to provide support to the stock while the firm continues deploying capital into its crypto reserves.

Wider Market Context: BitMine and ETH Outlook

The corporate push into Ether reserves comes as other firms continue to expand their exposure. BitMine Immersion Technologies, an Ether-focused treasury company, announced it had purchased 4,871 ETH worth $21.3 million, raising its total holdings to 1.72 million ETH valued at around $7.5 billion.

Meanwhile, Fundstrat’s co-founder Tom Lee suggested Ether could soon find its bottom. Citing technical strategist Mark Newton, he pointed to a strong risk-reward outlook near $4,300, with the potential for a rebound towards $5,400.