SharpLink Gaming, a Nasdaq-listed sports betting platform, has announced a landmark acquisition of Ether (ETH) worth $463 million, positioning itself as the largest publicly traded holder of the cryptocurrency. This bold move mirrors MicroStrategy’s Bitcoin-centric approach but shifts the focus squarely onto Ethereum, making SharpLink the first public company to adopt ETH as its primary treasury reserve asset.

$463 Million Investment in Ether

On Friday, SharpLink revealed that it had purchased 176,271 ETH, funded through a mix of private placement and at-the-market equity sales, including $79 million raised since 30 May. The company’s average acquisition price was $2,626 per Ether, slightly above the current market rate of $2,554.

According to the announcement, more than 95% of the acquired ETH has already been deployed into staking and liquid staking platforms. This not only allows SharpLink to earn yield but also contributes to the Ethereum network’s security and decentralisation.

Rob Phythian, CEO of SharpLink Gaming, hailed the purchase as a “landmark moment” in corporate digital asset adoption, adding that the firm is committed to treating ETH as its core treasury reserve.

“MicroStrategy of Ether”

SharpLink’s strategy has drawn comparisons to MicroStrategy, the enterprise software firm renowned for its aggressive Bitcoin buying strategy. However, in SharpLink’s case, the company has made Ethereum the centrepiece of its treasury model.

“SharpLink’s bold ETH strategy represents a pivotal milestone and innovative approach to the institutional adoption of Ethereum,” said Joseph Lubin, SharpLink chairman and Ethereum co-founder. “By allocating significant capital to ETH and deploying it in network activities such as staking, SharpLink is both contributing to Ethereum’s long-term security and trust properties while earning additional ETH.”

This strategy makes SharpLink the first Nasdaq-listed company to fully align its financial reserves with Ethereum and aims to give shareholders a “meaningful economic exposure to ETH.”

Other Major ETH Holders

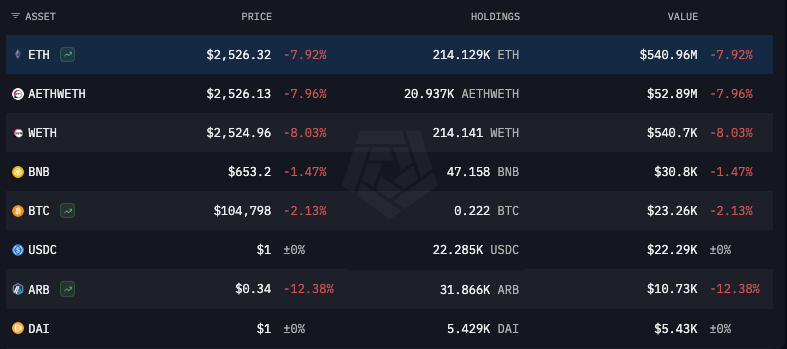

Despite SharpLink’s new title as the largest public holder of Ether, it is still outpaced by some non-public and institutional holders. The Ethereum Foundation currently holds 214,129 ETH, valued at approximately $594 million, according to Arkham data.

Meanwhile, BlackRock’s iShares Ethereum Trust ETF controls roughly 1.7 million ETH, worth around $4.5 billion, although this is held on behalf of clients rather than as a direct corporate reserve.

Market Reaction and Controversy

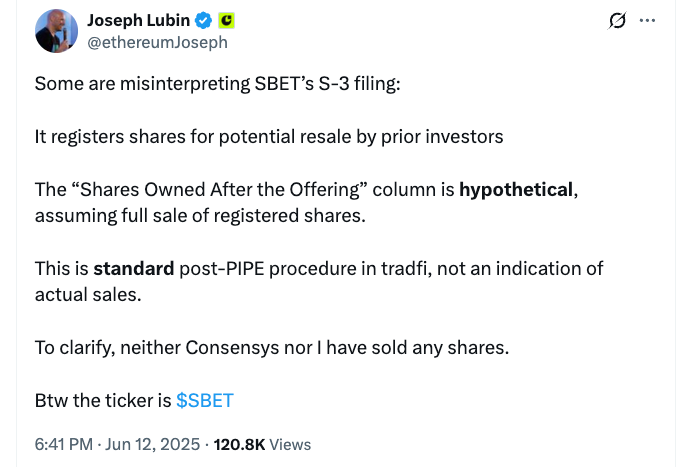

SharpLink’s ETH move initially triggered a surge in its share price, which rose over 400% following the 27 May treasury announcement. However, this rally was short-lived. After an SEC Form S-3 filing surfaced, indicating the potential resale of 58.7 million shares from PIPE (Private Investment in Public Equity) participants, shares plummeted from $32.53 to below $8 in after-hours trading before partially rebounding.

The sharp drop was reportedly due to confusion surrounding the SEC filing. Investors mistakenly assumed a mass insider sell-off was imminent. Lubin later clarified that the filing was a standard regulatory measure and not an indication of insider trading or unloading of company shares.

Institutional Adoption Accelerates

SharpLink’s move signals a growing trend among corporations integrating cryptocurrencies into their treasury strategies. While Bitcoin has traditionally been the reserve asset of choice, Ethereum’s increasing utility through staking, smart contracts, and decentralised finance (DeFi) has made it an attractive alternative.

By taking this step, SharpLink not only joins a small but growing list of public companies investing in digital assets but also pioneers a unique ETH-first strategy that could inspire other firms to follow suit.