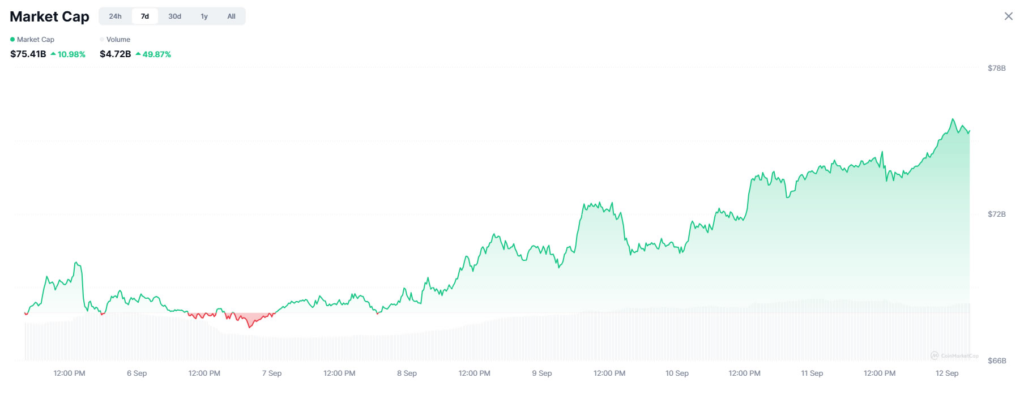

Real-world asset (RWA) tokens are enjoying renewed momentum as institutional adoption accelerates. The total market capitalisation of RWA-linked cryptocurrencies surged 11% this week, while the onchain value of tokenised assets reached a record $29 billion.

Market Cap Pushes to New Heights

According to CoinMarketCap data, the RWA sector’s market cap climbed from roughly $67 billion to nearly $76 billion within seven days, marking an all-time high on Friday. The sharp gains were led by projects focused on asset tokenisation, including oracle provider Chainlink, high-speed blockchain Avalanche and DeFi platform Ondo Finance, which alone rallied 9% in a single day.

This surge highlights how the narrative around RWAs has become one of the strongest growth drivers in crypto markets, buoyed by both investor appetite and institutional involvement.

Onchain Tokenisation Crosses $29B

Figures from RWA.xyz show that tokenised assets onchain crossed $29 billion for the first time this week. That figure has nearly doubled since January, underscoring how rapidly financial institutions are embracing blockchain as an infrastructure for real-world financial products.

Private credit leads the charge, accounting for more than half of the tokenised value. US Treasurys make up roughly a quarter, while the remainder is spread across commodities, alternative funds, equities and bonds.

When stablecoins are added to the picture, the total tokenised value skyrockets to $307 billion with Ethereum and its layer-2 networks hosting more than three-quarters of that activity.

Institutional Momentum Builds

Industry watchers argue that tokenisation is no longer a speculative trend but a structural shift in finance. Crypto investor Ryan Sean Adams noted on X that tokenisation is “now being pushed by the US government in an effort to modernise US markets.”

The entry of major institutions has played a key role in this momentum. Traditional financial players and fintech firms are increasingly incentivised to offer tokenised products, as they lower settlement times, increase transparency and unlock new liquidity opportunities.

BlackRock Eyes Tokenised ETFs

The movement has also caught the attention of Wall Street’s largest asset manager. BlackRock is reportedly exploring tokenising its exchange-traded funds (ETFs), building on its earlier success with the USD Institutional Digital Liquidity Fund (BUIDL).

Launched in 2024 on Ethereum, BUIDL is a tokenised money-market fund that has grown to around $2.2 billion in assets under management. BlackRock CEO Larry Fink has long argued that tokenisation will “democratise finance,” predicting that eventually every financial asset could be tokenised.

If BlackRock moves forward with ETF tokenisation, it would further validate blockchain’s role in global markets while providing a model for how traditional finance can embrace the technology at scale.

The Road Ahead

The RWA sector’s explosive growth in 2024 and 2025 shows how quickly tokenisation is bridging the gap between traditional and decentralised finance. With total onchain value already approaching $30 billion and momentum from heavyweight institutions, the stage is set for RWAs to become one of the dominant themes in the next phase of crypto adoption.

For now, the numbers tell the story: record highs in market cap, surging institutional inflows and growing recognition from global asset managers. Tokenisation may soon shift from an emerging trend to a cornerstone of modern finance.