US Representative Ritchie Torres is preparing legislation that would place new restrictions on insider trading in political prediction markets, following controversy around a lucrative wager tied to the reported capture of Venezuelan President Nicolás Maduro. The proposed bill comes amid growing scrutiny of how prediction platforms operate when traders may have access to sensitive government or military information.

Lawmakers Turn Attention to Prediction Market Ethics

According to Punchbowl News founder Jake Sherman, Torres plans to introduce the Public Integrity in Financial Prediction Markets Act of 2026. The legislation would bar federal elected officials, political appointees, and executive branch employees from trading on prediction market contracts connected to government policy decisions or political outcomes if they possess nonpublic information gained through their official roles.

The restriction would apply broadly to buying, selling, or exchanging contracts on platforms operating in interstate commerce. The intent is to ensure that public officials cannot personally profit from information that is not available to the general public, even when those trades occur outside traditional stock or commodity markets.

Torres’ proposal reflects existing insider trading rules that already govern equities and other financial instruments, but it would be one of the first efforts to explicitly extend similar standards to political and policy focused prediction markets.

A Sudden Bet Raises Red Flags

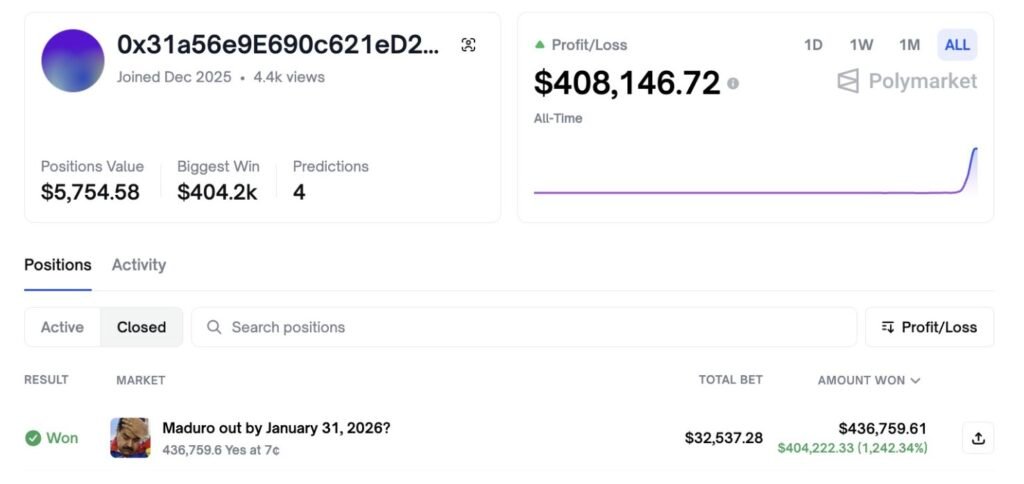

The push for legislation follows unusual trading activity on Polymarket, a popular crypto based prediction platform. A newly created account reportedly placed around $32,000 on a contract predicting that President Maduro would be removed from power by Jan. 31, 2026.

Within hours, reports surfaced claiming that US forces had captured the Venezuelan leader. The market rapidly settled, turning the initial stake into a payout exceeding $400,000. The speed and scale of the profit drew attention, particularly because the account showed little prior trading history and the Maduro wager represented most of its gains.

The timing led observers to question whether the trader may have had access to advance political or military intelligence. While no official confirmation has been made regarding the trader’s identity or information sources, the episode intensified calls for clearer rules governing who can participate in such markets.

Why Prediction Markets Face New Scrutiny

Prediction markets allow users to speculate on real world events ranging from elections to policy decisions and geopolitical developments. Supporters argue they provide valuable insight into public sentiment and probabilities, while critics warn they can blur the line between forecasting and exploitation.

Unlike traditional financial markets, prediction platforms often operate in regulatory gray areas. As these markets grow in size and influence, lawmakers are increasingly concerned that insiders could use privileged information to place highly profitable bets without facing consequences.

Torres’ proposed bill aims to close that gap by applying familiar ethical standards to a newer class of financial instruments, particularly when public trust and national security issues are involved.

Industry Response Highlights Existing Rules

Following Sherman’s post about the planned legislation, Kalshi, another US based prediction market platform, responded publicly by noting that its rules already prohibit insiders or decision makers from trading on material nonpublic information.

Platforms argue that internal policies and compliance measures are designed to prevent abuse, though critics say enforcement can be difficult, especially when user identities are obscured or trades are executed through crypto wallets.

The Maduro related trade has renewed debate over whether self regulation is sufficient or if statutory limits are necessary to protect market integrity.

Polymarket Addresses Separate Security Concerns

The controversy around the Maduro bet unfolded alongside unrelated but troubling reports of account breaches on Polymarket. Several users reported that their balances were drained after experiencing repeated unauthorized login attempts. In some cases, positions were closed and funds reduced to nearly zero, despite users claiming there was no compromise of their devices or other online accounts.

Polymarket later said it had identified a security issue linked to a vulnerability introduced by a third party authentication provider. The company stated that the flaw affected only a small number of users, has been fully fixed, and poses no ongoing risk. It added that impacted users would be contacted directly.

While the security incident was separate from the insider trading concerns, it added pressure on prediction platforms at a moment when regulators and lawmakers are already paying closer attention.

What Comes Next

If introduced, the Public Integrity in Financial Prediction Markets Act of 2026 would mark a significant step toward formal oversight of political betting markets in the United States. The proposal signals that lawmakers are no longer viewing prediction platforms as niche experiments, but as influential financial tools that warrant the same ethical guardrails as traditional markets.

As prediction markets continue to expand, the balance between innovation, transparency, and public trust is likely to remain at the center of the debate.