Ripple’s Chief Technology Officer, David Schwartz, has sparked fresh discussions in the crypto world with a bold new idea: refund unused transaction fees on the XRP Ledger (XRPL). This seemingly simple concept could lead to major changes in how the network handles transaction costs, rewards users, and maintains fairness, especially as XRPL continues to grow with new features like Hooks.

The Problem: Paying More Than You Use

In the XRPL ecosystem, developers have been exploring powerful features like Hooks, small pieces of code that can be triggered during a transaction to perform automated tasks. When a Hook is used, the system pre-calculates a fixed execution fee, based on the worst-case scenario of how much compute it might require.

This upfront fee is added on top of the base transaction fee and doesn’t change, even if the Hook ends up doing very little work. In other words, you pay for compute that you don’t always use.

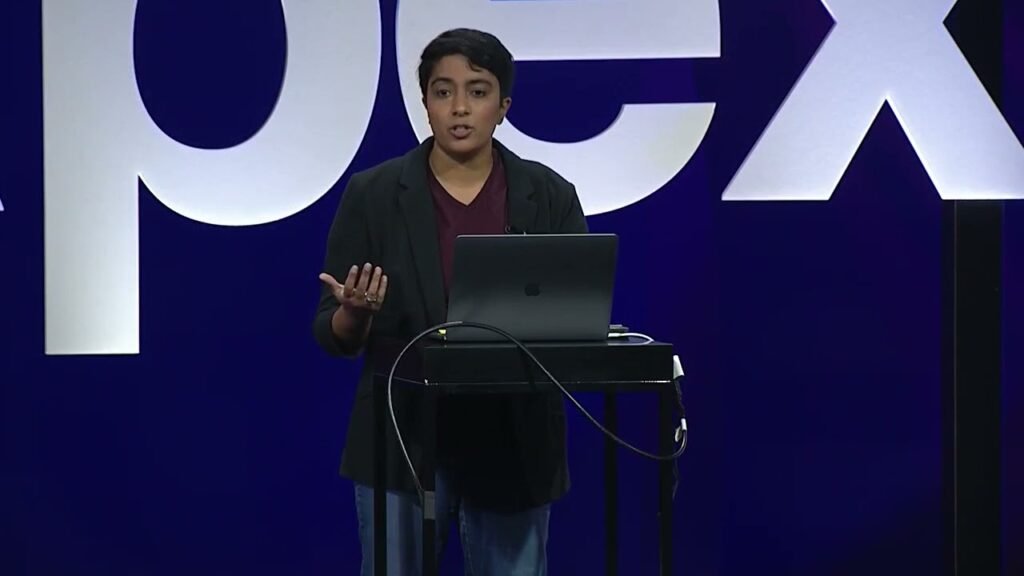

Developer Mayukha Vadari pointed out this difference when comparing XRPL to Ethereum. On Ethereum, users set a maximum gas limit, and if the transaction uses less gas, the leftover is refunded. But on XRPL, no such refund exists. The network assumes the maximum compute cost, just to be safe.

“The transaction fee is just the worst-case scenario compute on the hook,” Vadari explained. “So you’re almost always paying too many fees.”

Can’t Fees Be Refunded?

This question came up when Vet, co-founder of the NFT platform XRP Cafe, challenged the idea that users must always pay the full amount. He argued that if someone pays more than what’s actually needed, the extra should go back to them.

While Vadari explained that the fee structure was static by design, the suggestion gained momentum. Protocol developer tecqu chimed in with a concern: if users expect refunds, won’t they start overbidding fees just to get priority in the network? That could distort the market and overload the system.

It was at this point that David Schwartz entered the discussion with his proposal.

The Proposal: Refund the Extra, Keep the Minimum

Schwartz suggested a refined fee model where users still pay upfront, but the system refunds anything above what’s actually needed to get the transaction into the ledger.

“Compute the fee level required to get one more transaction into the ledger after the consensus transaction set is determined, and rebate any fee above that level,” Schwartz wrote.

This idea maintains user incentives and system efficiency, while also rewarding users with refunds when they overpay, similar to Ethereum’s gas refund mechanism.

However, Schwartz did recognise one critical challenge: XRPL’s validators may disagree on what the “minimum required fee” actually is, which could potentially cause splits in ledger history, a major issue for any blockchain network.

The Alternatives: Median Fee or Minimum Rule

To address the risk of validator disagreement, Schwartz also offered a fallback option: refund any amount above the median fee for that ledger. This approach is simpler and more predictable, making it easier to implement while avoiding complex consensus issues.

He also suggested a safety mechanism for times when network traffic is low. If fewer than 10 transactions are processed in a ledger, refunds could be disabled or replaced with a minimum fixed fee, to prevent gaming the system.

Why This Matters: Fairness, Utility, and Supply

Currently, all transaction fees on XRPL are burned, including any extra portion that users didn’t actually need to spend. While this reduces the total XRP supply (potentially benefiting long-term holders), it also means users are regularly overpaying, especially when using Hooks.

Schwartz is not trying to stop fee burning entirely. Instead, his proposal offers a smarter, fairer system that gives users back their unused portion, aligning costs more closely with real resource use.

This small change could have big implications:

- More fairness for users.

- More efficient fee markets.

- Better adoption of XRPL’s advanced features like Hooks.

- And more trust in how the ledger operates.

What’s Next?

Right now, this refund idea is just a public proposal, but it’s gaining traction. Coming directly from Ripple’s CTO, it’s clear the idea has serious weight behind it.

If adopted, this model could bring the XRPL closer to Ethereum in terms of smart fee handling, without compromising its core advantages: fast, low-cost, and secure transactions.

Whether it becomes a standard or stays a suggestion, this proposal shows that the XRPL community is actively thinking about fairness, innovation, and sustainability that’s great news for XRP users and developers alike.