Riot Platforms offloaded a significant portion of its Bitcoin reserves in December, selling 1,818 BTC for $161.6 million as the company accelerates a strategic shift away from a mining only focus. The Texas based miner said the Bitcoin was sold at an average net price of $88,870 per coin.

Despite producing 460 Bitcoin during the month, Riot’s total holdings declined. As of December 31, the company held 18,005 Bitcoin, including 3,977 BTC classified as restricted. This marked a drop from the 19,368 Bitcoin it held at the end of November.

Restricted Bitcoin refers to digital assets pledged as collateral under Riot’s debt arrangements and kept in segregated custody accounts, as outlined in its regulatory filings.

From mining output to infrastructure monetization

The December Bitcoin sale reflects a broader rethink of Riot’s long term business model. The company has made it clear that pure Bitcoin mining is no longer its primary objective. Instead, Riot is focusing on extracting more value from its power assets and data center infrastructure.

In October, Riot said it plans to repurpose parts of its energy capacity to support a proposed 1 gigawatt data center campus designed for artificial intelligence workloads. The company believes its large scale access to power and existing facilities position it well to serve customers beyond the crypto sector.

This shift comes at a time when Bitcoin mining economics have tightened. Following the April 2024 halving, block rewards were cut in half, putting pressure on margins and forcing miners to seek alternative revenue streams.

End of monthly production updates

Alongside the strategic pivot, Riot announced that December will be its final monthly production and operations report. Going forward, the company will move to quarterly disclosures that emphasize overall business performance rather than just mining statistics.

Future updates will focus on data center development, infrastructure strategy, power monetization efforts, and Bitcoin mining as one part of a broader portfolio. The change signals Riot’s intent to be evaluated more like an infrastructure and energy company than a traditional crypto miner.

Riot’s standing among public Bitcoin holders

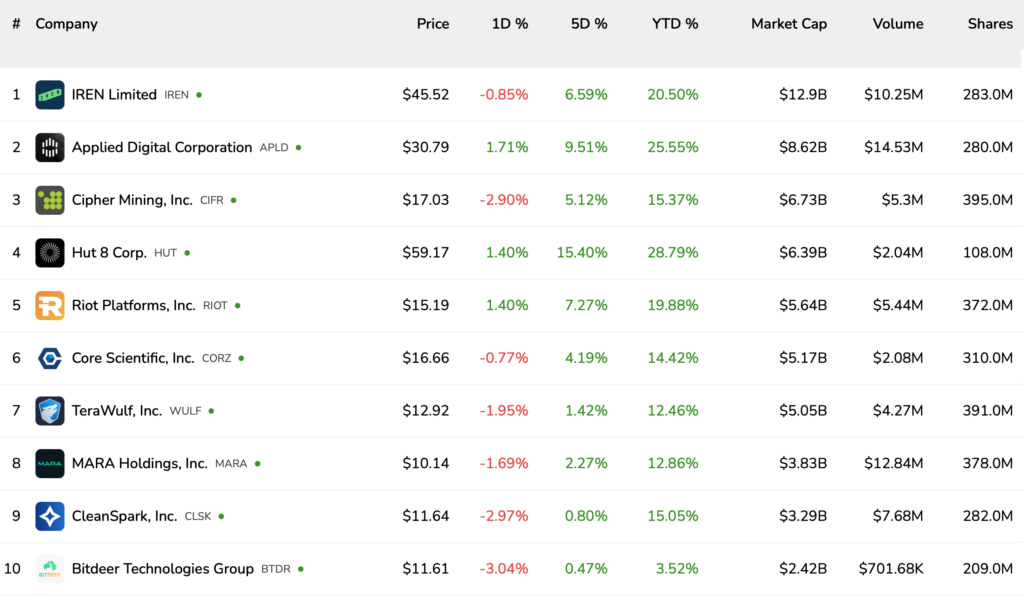

Even after the December sale, Riot remains one of the largest corporate holders of Bitcoin. Data from Bitcointreasuries.net places the company seventh among publicly listed firms by BTC holdings.

Maintaining a sizable Bitcoin balance continues to play a role in Riot’s strategy, though the company has shown it is willing to actively manage those holdings to fund expansion and reduce reliance on mining revenues alone.

AI firms and miners move closer

Riot’s shift mirrors a wider trend across the Bitcoin mining industry. As mining costs rise, miners are increasingly partnering with major technology companies looking for reliable power and data center capacity to support artificial intelligence computing.

Bitcoin miners operate energy intensive facilities with direct access to large scale electricity. This has drawn interest from AI firms that need massive, stable power supplies for high performance computing.

Several notable deals highlight this growing convergence. In August, Google became the largest shareholder of TeraWulf, acquiring roughly 14 percent of the miner after expanding a financial backstop tied to a long term colocation lease with Fluidstack. The arrangement supports AI workloads hosted in TeraWulf’s data centers.

In September, Google also took a 5.4 percent stake in Cipher Mining as part of a multi year, $3 billion data center agreement involving Fluidstack. Under that deal, Google guaranteed $1.4 billion of Fluidstack’s obligations under a decade long contract to lease computing capacity from Cipher.

In November, IREN signed a five year agreement worth $9.7 billion with Microsoft to host Nvidia GB300 GPUs in its data centers. During the same month, the largest Bitcoin miner by market capitalization announced a $5.8 billion deal with Dell Technologies to acquire GPUs and related equipment for large scale AI deployment.

Together, these developments underscore how Bitcoin miners are repositioning themselves as critical infrastructure providers in an increasingly power hungry digital economy.