Retail Investors Offload 6,000 BTC to Binance in January

Retail Bitcoin investors have been cashing in on their holdings, sending a total of 6,000 BTC—valued at approximately $625 million—to Binance this month. However, large-scale investors, known as whales, have largely refrained from major selling.

New data from on-chain analytics platform CryptoQuant, published on 31 January, reveals that small-scale holders are opting to sell, seemingly convinced that the current bull market has peaked. In contrast, whales, who traditionally anticipate market trends and influence short-term price action, have been far more conservative in their transactions.

Whales Stay Cautious While Retail Investors Exit

CryptoQuant analyst Darkfost highlighted the ongoing divergence in behaviour between retail traders and whales, describing the current trend as a classic example of contrasting market psychology.

“This is exactly what is happening now when analysing data from Binance in the short term,” Darkfost stated in a market update.

Despite Bitcoin trading at around $102,000, whale inflows to Binance in January amounted to only 1,000 BTC (roughly $104 million), indicating minimal profit-taking from these major players.

“This is a perfect example of the contrasting behaviours between whales and retail traders, and it is often considered a better choice to follow whales rather than retail investors,” Darkfost added.

Accompanying data from CryptoQuant suggests that retail investor inflows to Binance are rising, while whale inflows are trending in the opposite direction.

Retail Interest Resets Ahead of ‘First Cycle Top’

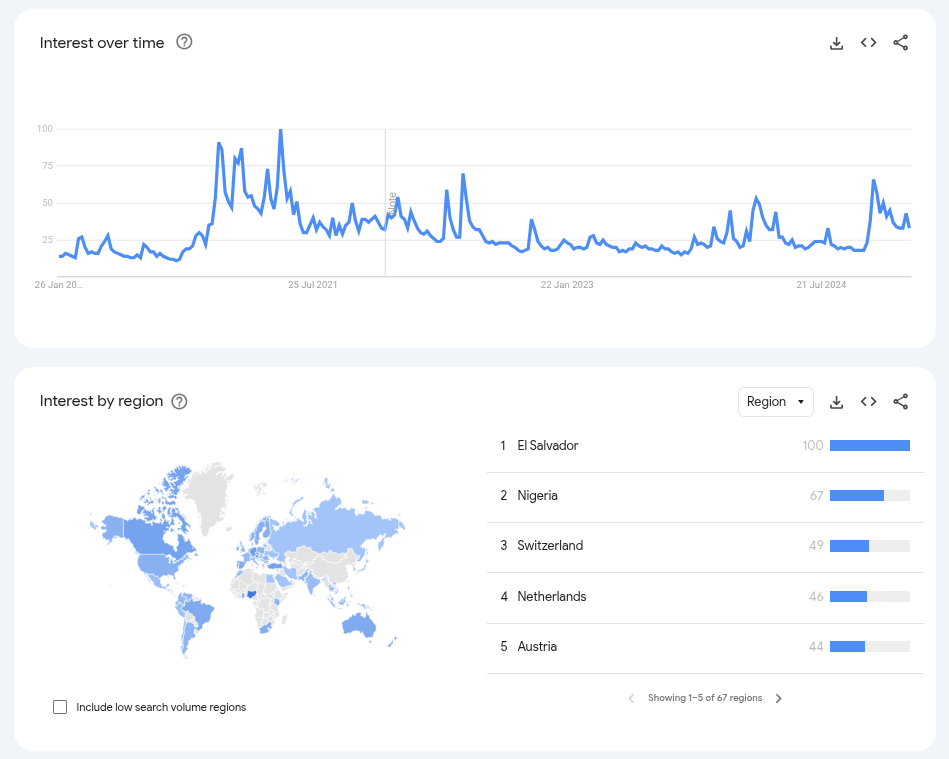

Further data on retail interest in Bitcoin suggests a cyclical pattern, with mainstream attention cooling off after an initial surge when BTC/USD reached new all-time highs last year.

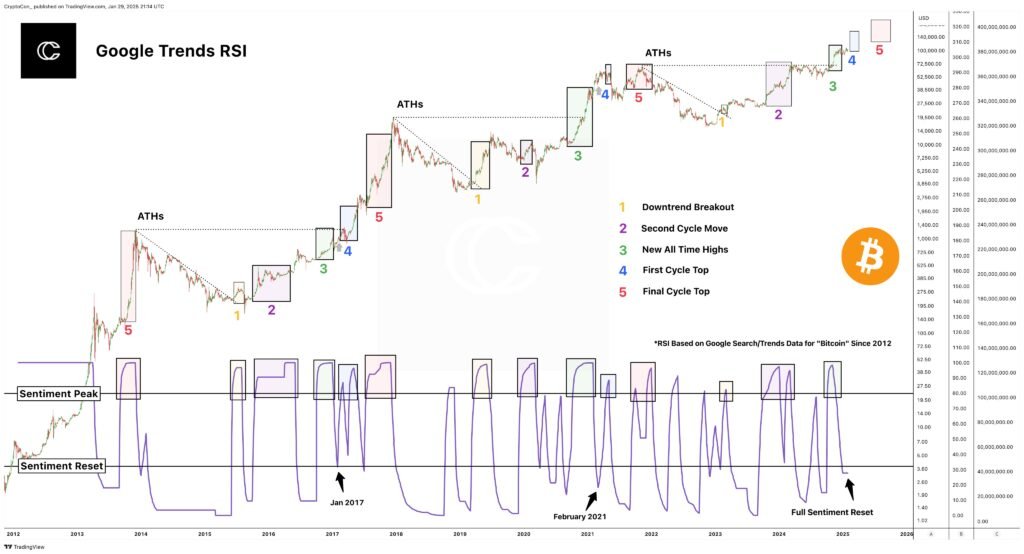

Analyst CryptoCon has applied the relative strength index (RSI) volatility indicator to Google Trends data, tracking retail engagement with Bitcoin searches.

“Using the RSI of Google Trends data for Bitcoin searches, we can see when people start to get interested and use that to determine where we are in the cycle,” CryptoCon wrote in an X (formerly Twitter) post on 30 January.

His analysis identifies five key phases of retail interest during each Bitcoin cycle, with the current phase closely mirroring past trends.

“As you might expect, interest starts to ramp up during major price rises. It seems that after enough increase, people start to get bored, and interest drops just before major highs are put in,” he explained.

CryptoCon believes Bitcoin has just completed “phase 3,” marked by its all-time high (ATH) move, with the RSI fully resetting. This, he argues, indicates the beginning of “phase 4,” which he calls the “First Cycle Top.”

Bitcoin Bull Run Still Has Room to Grow

Despite the ongoing retail sell-off, analysts maintain that the current Bitcoin bull run is far from over.

As previously reported, various market predictions place BTC’s potential peak at $150,000 or more before the cycle concludes. While retail investors may be opting to cash out early, historical trends suggest that significant gains could still be on the horizon.