A seven figure Bitcoin payment sent over the Lightning Network has sparked fresh discussion around whether the technology is ready for serious institutional use. In a first of its kind public test, a 1 million dollar Lightning transfer between two regulated crypto firms settled in less than a second, challenging long held assumptions about the network’s limits.

Seven Figure Payment Moves Across Lightning

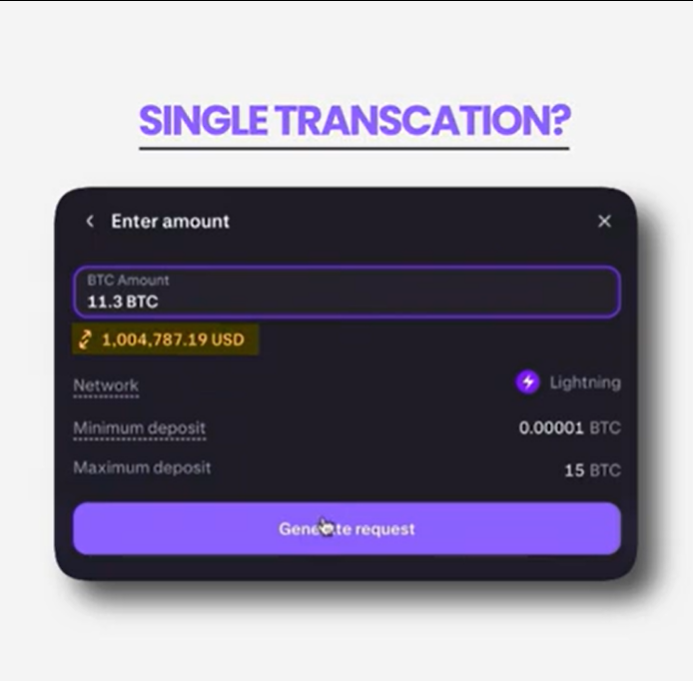

Institutional trading and lending desk Secure Digital Markets announced that it successfully sent a 1 million dollar Bitcoin payment to cryptocurrency exchange Kraken using the Lightning Network on Jan. 28. According to the firm, the transfer is the largest publicly disclosed Lightning payment so far.

The transaction cleared in just 0.43 seconds. It was routed through Voltage’s managed Lightning infrastructure, which provides node operations, liquidity provisioning, and uptime guarantees tailored for exchanges and professional trading desks.

SDM described the transfer as a proof of concept showing that Lightning can support high value payments between regulated counterparties, not just small retail transactions.

Why the Transfer Matters

Until now, large Lightning payments have been rare and mostly experimental. The previous widely reported record for a single Lightning payment was around 1.24 Bitcoin, worth roughly 140,000 dollars at the time. That gap highlights how unusual a clean seven figure Lightning transfer is, especially one completed in a single payment without splitting it across multiple routes.

Voltage CEO Graham Krizek called the transaction an important moment for Lightning and institutional Bitcoin payments, noting that it demonstrated the network’s ability to meet enterprise level requirements around speed, reliability, and settlement certainty.

For institutions that move capital frequently, fast settlement and predictable execution are often more important than novelty. This test suggests Lightning may be edging closer to meeting those expectations.

Lightning Network Usage Still Skews Small

Despite the milestone, Lightning remains modest in scale compared to Bitcoin’s overall market value. Public channel capacity declined from more than 5,400 BTC in late 2023 to about 4,200 BTC by mid 2025 before rebounding to a new high of over 5,600 BTC by December.

Most documented Lightning activity still involves small payments such as tips, retail purchases, and micro transactions. Large transfers remain the exception rather than the norm.

Exchanges have historically limited Lightning usage for this reason. Bitfinex, for instance, previously capped Lightning deposits at 0.04 BTC. That limit was later raised to 0.5 BTC per payment and 2 BTC per channel, reflecting growing confidence but also lingering caution.

Exchanges and Issuers See Institutional Signals

In a statement shared alongside the discussion, Paolo Ardoino, CEO of Tether and chief technology officer at Bitfinex, described the Lightning Network as a powerful solution that started as a retail payments experiment but is steadily proving its value for larger users.

He said Bitfinex has seen Lightning handle higher volumes with predictable settlement, lower fees, and reduced pressure on the Bitcoin base layer. Those characteristics, he noted, are increasingly relevant for institutional use cases.

As exchanges lift limits and improve liquidity management, the ceiling for Lightning based payments continues to rise.

Fidelity and Blockstream Point to Long Term Potential

Large financial players have also begun paying closer attention. Fidelity Digital Assets published a 2025 report on the Lightning Network using data from Voltage, arguing that Lightning enhances Bitcoin’s utility while strengthening its investment case.

Fidelity noted that average Lightning capacity has grown by 384 percent since 2020 and described the network as a transformative opportunity for both new and established financial institutions.

Blockstream echoed a similar view in its Q4 2025 update. The company highlighted recent Core Lightning releases aimed at reducing latency and improving support for Lightning Service Providers. It also promoted its Greenlight platform, which allows apps and exchanges to offer Lightning services with minimal infrastructure overhead, while keeping control in the hands of users.

Blockstream’s roadmap explicitly targets enterprise deployments, signaling that institutional Lightning use is no longer a fringe idea.

A Signal, Not a Conclusion

The 1 million dollar Lightning transfer does not mean institutions are about to move billions over the network overnight. Capacity constraints, liquidity management, and operational complexity remain real challenges.

Still, the transaction stands as a clear signal. Lightning is no longer limited to coffee sized payments and experiments. For the first time, a publicly disclosed seven figure transfer has shown that with the right infrastructure and counterparties, Lightning can operate at an institutional scale.