Pump.fun has taken another step toward becoming a full stack trading platform with the acquisition of crypto trading terminal Vyper. The deal brings analytics and execution tools directly into Pump.fun’s ecosystem as Vyper prepares to shut down its standalone product and migrate users to Pump.fun’s in house terminal.

The move signals a clear shift in strategy for Pump.fun, which rose to prominence as a Solana based memecoin launchpad but is now expanding deeper into trading infrastructure as speculative activity in the memecoin sector slows.

Vyper to Wind Down Standalone Platform

Vyper confirmed that key parts of its product will begin shutting down starting Tuesday. While some limited features will remain accessible for a short period, users have been directed to continue their trading activity through Pump.fun’s Terminal, formerly known as Padre.

By folding Vyper’s tools into its own platform, Pump.fun gains access to established analytics and execution features without asking users to juggle multiple services. For Vyper, the transition marks the end of its independent product as its technology and user base move under the Pump.fun umbrella.

Financial terms of the acquisition were not disclosed. Pump.fun did not respond to media queries prior to publication.

Building a Broader Trading Ecosystem

The Vyper deal follows a series of moves by Pump.fun to expand beyond simple token launches. In October 2024, the company acquired trading terminal Padre, citing the need for stronger liquidity support and better execution for tokens created on its platform. Padre was later rebranded as Terminal and positioned as a core part of Pump.fun’s trading workflow.

With Vyper now added to the mix, Pump.fun is steadily assembling an integrated environment that covers the full lifecycle of a token, from creation to trading, analytics, and execution. This approach reduces reliance on third party tools and keeps users within a single ecosystem.

A Shift Away From Pure Memecoin Focus

In January, Pump.fun signaled a broader pivot with the launch of Pump Fund, an investment arm aimed at supporting early stage projects. The initiative debuted alongside a $3 million hackathon designed to back new ideas, including ventures that are not directly tied to memecoins or even crypto itself.

This diversification reflects an effort to future proof the business. While memecoins fueled Pump.fun’s rapid rise, the company appears to be preparing for a market where speculation alone may no longer drive growth.

Expansion During a Market Cooldown

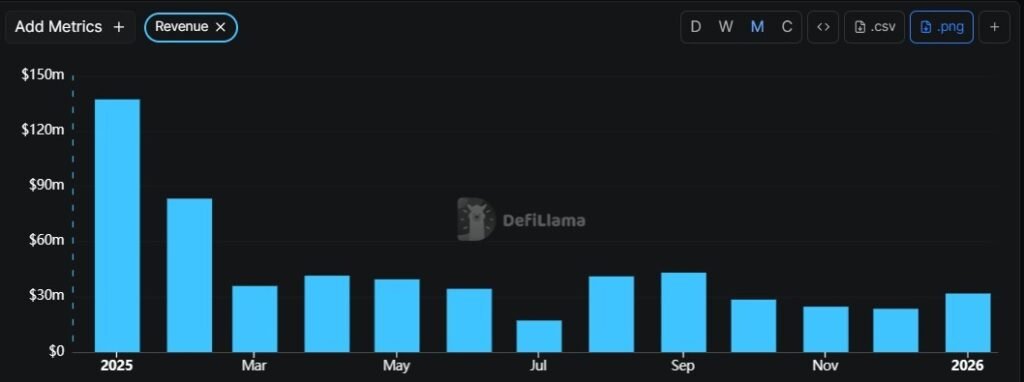

Pump.fun’s infrastructure push comes at a time when memecoin enthusiasm has cooled significantly from its peak in late 2024 and early 2025. That period saw celebrities and even government figures launching their own tokens, driving massive volumes on Solana.

According to DefiLlama data, Pump.fun’s monthly revenue reached a high of over $137 million in January 2025. By January 2026, that figure had dropped to around $31 million, a decline of roughly 77 percent over the year.

The broader memecoin market has followed a similar trajectory. CoinMarketCap data shows the combined market capitalization of tracked memecoins surpassed $100 billion in December 2024. At the time of writing, that valuation has fallen to about $28 billion, representing a drop of around 72 percent.

Positioning for the Next Phase

By absorbing Vyper and continuing to build out its trading stack, Pump.fun is positioning itself for a more mature phase of the market. Instead of relying solely on viral token launches, the platform is aiming to become a central hub for traders who want launch tools, execution, and analytics in one place.

Whether this strategy can offset the slowdown in memecoin activity remains to be seen. What is clear is that Pump.fun is no longer content to be just a launchpad. With each acquisition, it is reshaping itself into a broader trading infrastructure player within the Solana ecosystem.