Pump.fun, a Solana-based memecoin launchpad, made headlines after raising $500 million in just 12 minutes during its initial coin offering (ICO) on 12 July 2025. The record-breaking sale, driven by viral hype and rapid user participation, marks a pivotal moment in the evolution of decentralised token distribution and retail investor psychology.

A Viral Sale Backed by Strategic Moves

The ICO offered 125 billion PUMP tokens, representing just 12.5% of the total 1 trillion supply. Transfers were locked for 72 hours post-sale, a tactic that created urgency and amplified fear of missing out (FOMO) among retail buyers. More than 10,000 wallets joined the offering, many pre-funded through PumpSwap. Of the $500 million raised, $448 million was processed directly on Solana, with the remainder coming from centralised exchanges like Kraken, KuCoin and Bybit.

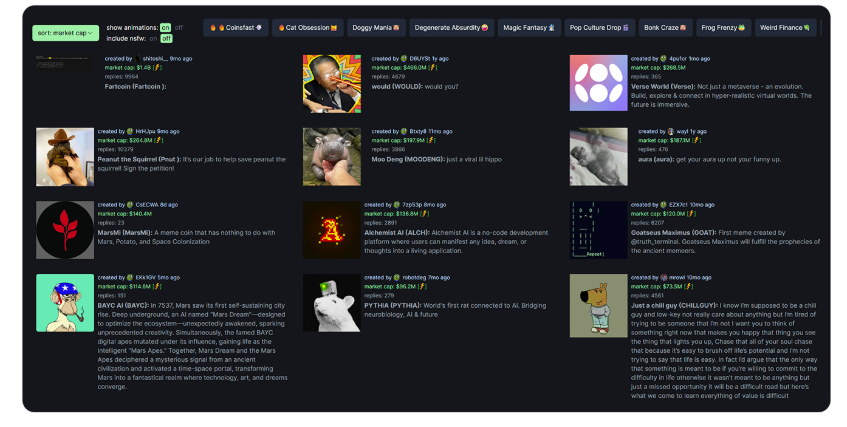

Pump.fun’s rise has been fuelled by its promise of frictionless, code-free token launches. Since launching in early 2024, it has emerged as the go-to platform for Solana-based meme coins, allowing anyone to create and trade tokens within minutes.

Following the ICO, the team announced strategic acquisitions including Kolscan, a Solana-native wallet analytics tool, and laid out plans for real-time, permissionless token contract visibility. Pump.fun also committed to token buybacks funded by a share of its PumpSwap trading fees, which crossed $60 million within the first 48 hours.

Behind the Hype: Manipulation and Regulatory Gaps

On-chain analysts observed patterns of manipulation during the sale. One whale reportedly distributed funds to over 500 wallets, each seeded with around $400, likely to bypass anti-Sybil mechanisms and give the illusion of widespread organic participation. Similar tactics were identified across platforms such as Binance Square and Bitcoin Insider, where large holders fragmented their stakes across multiple wallets.

The sale excluded users in the US and UK due to tightening regulatory scrutiny. Despite the restriction, the token’s price surged on Hyperliquid, trading at a 40% to 75% premium over its $0.004 ICO price and peaking near $0.007 before settling around $0.006. These rapid gains fuelled further FOMO as speculative traders raced to capitalise on momentum.

The Dark Side of Retail Frenzy

Pump.fun’s design is optimised for fast, high-volume token launches, but critics argue it resembles a digital casino more than a financial innovation. The platform’s livestreamed launches and viral mechanics attract users hoping to catch the next 100x memecoin. However, according to Solidus Labs, over 98% of the seven million-plus tokens launched on Pump.fun have failed, either through rug pulls or collapse, with only around 97,000 retaining more than $1,000 in liquidity.

This raises serious concerns about investor protection, especially in the absence of project fundamentals. While Pump.fun promotes itself as a leader in accessible DeFi, its business model heavily monetises virality and retail speculation.

Regulatory and Technical Setbacks

Pump.fun’s $500-million ICO was followed by a wave of criticism. In the US, a class-action lawsuit was filed in the Southern District of New York, accusing the platform of selling unregistered securities and enabling pump-and-dump schemes. The UK’s Financial Conduct Authority also flagged Pump.fun as unauthorised and issued warnings that led to a ban for users in the country.

Additionally, several exchanges experienced technical issues during the token event. Kraken and Bybit reported API outages, preventing some users from participating. Pump.fun responded by issuing refunds via airdrops, but the technical setbacks sparked wider questions about infrastructure readiness in the face of large-scale DeFi launches.

A Glimpse into the Future or Just Another Bubble?

Pump.fun’s rapid rise is seen by many as ushering in a new era of DeFi launches. Unlike traditional ICOs, which often required technical knowledge and long wait times, platforms like Pump.fun offer instant token creation, retail access and creator revenue sharing. Half of PumpSwap fees, for instance, are directed to meme coin creators, merging content and finance in a gamified feedback loop.

However, the speed, volatility and speculative nature of these launches suggest that many retail traders may be left holding tokens with little to no value. With regulators cracking down and criticism mounting, the long-term sustainability of Pump.fun and similar platforms remains uncertain.

For now, Pump.fun stands at the forefront of a new retail-driven crypto trend. Whether it becomes a foundational player in the DeFi space or simply a footnote in another speculative cycle will depend on its ability to balance innovation with investor protection.