Polygon-based non-fungible tokens (NFTs) have achieved a major milestone, surpassing $2 billion in all-time sales volume. This surge in activity highlights the growing appeal of Polygon’s NFT ecosystem, even as the broader digital collectibles market faces headwinds. The network’s success in 2025 has been significantly driven by the rise of tokenised real-world assets (RWAs), with the Courtyard marketplace leading the charge.

Steady Monthly Growth in 2025

According to data from CryptoSlam, Polygon’s NFT sales have shown a consistent upward trend since November 2024. Starting with $16.3 million in monthly sales that month, the network witnessed a steady increase over the next several months. In December, sales rose to nearly $20 million, followed by $25 million in January 2025 and $37 million in February.

Momentum continued through the spring, with March sales reaching $62.5 million. April recorded $71 million, and May marked the highest point so far at $74.7 million in sales volume. These figures reflect growing user engagement and strong interest in the network’s NFT offerings, especially in contrast to broader market trends.

Courtyard’s Rise in RWA NFT Space

A key driver behind Polygon’s NFT boom is Courtyard, a marketplace focused on tokenised real-world assets. In 2025, Courtyard has emerged as one of the top collections on the Polygon network, rivalling long-standing leader DraftKings. As of May, Courtyard boasts $277 million in all-time sales, just shy of DraftKings’ $287 million.

The RWA sector has shown significant promise, with many investors drawn to the tangible value backing these digital assets. Courtyard’s rapid growth positions it as a potential frontrunner in the coming months. If current trends continue, it could surpass DraftKings as the top-selling collection on Polygon.

User Engagement and Transaction Volume on the Rise

Polygon’s NFT ecosystem has also experienced a sharp rise in transaction activity and user participation. From March to May 2025, the network recorded over 800,000 NFT transactions per month. Unique buyer numbers have remained strong, with February peaking at 134,000 active users.

In addition to higher transaction volumes, the average value of NFT sales has increased markedly. In May, the average sale price hit nearly $89, a 242% increase from the $26 average recorded in November and December 2024. This suggests not only greater activity but also a rise in high-value transactions.

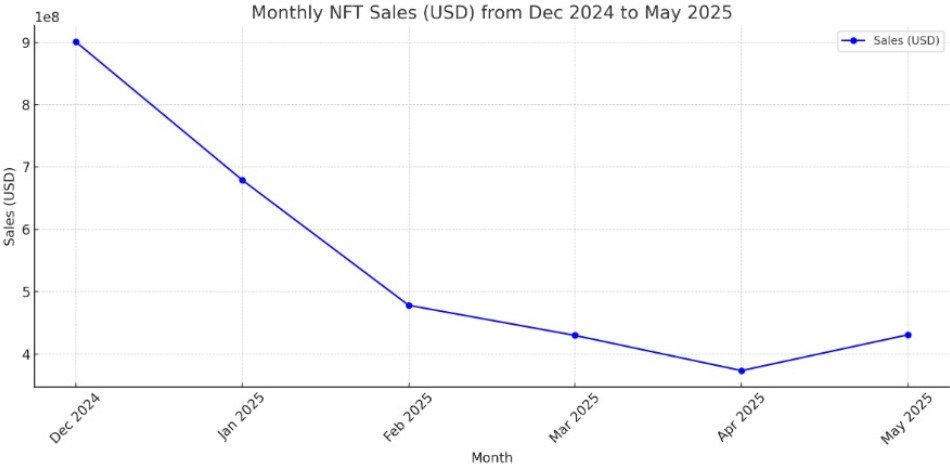

Polygon Thrives Amid Broader NFT Market Slump

While Polygon celebrates record-breaking growth, the broader NFT market has experienced a notable decline. After peaking at $900 million in December 2024, global NFT sales went on a five-month slide, dropping to a low of $373 million in April 2025.

Despite this downturn, May brought signs of recovery, with total NFT market sales increasing by 15% to $430 million. The number of buyers also surged, climbing to over 900,000, an increase of 50% compared to April.

Polygon’s ability to defy this bearish trend underscores the network’s resilience and the effectiveness of its RWA-focused strategies. By tapping into real-world value and diversifying NFT use cases, Polygon has managed to carve a distinctive niche within the digital collectibles space.

Looking Ahead

With user engagement rising and Courtyard poised to become the leading collection on the network, Polygon’s NFT ecosystem appears set for continued growth in the second half of 2025. If interest in tokenised real-world assets continues to rise, the network may attract even more creators, investors, and collectors, further solidifying its position as a leader in the evolving NFT landscape.