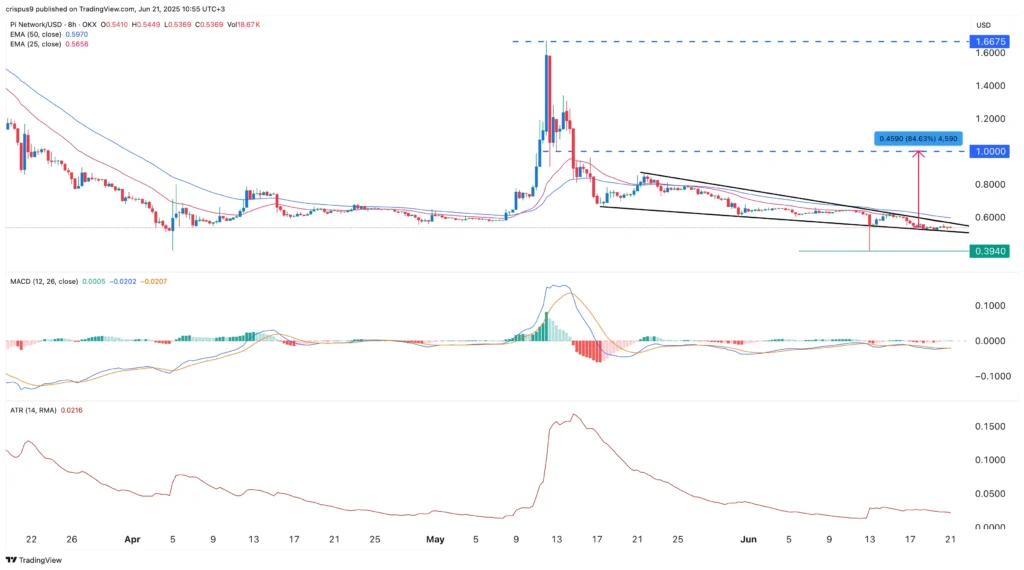

Pi Network (PI) is showing signs of a potential comeback after a steep 60% drop from its May highs. The token, which once soared to $1.6675 during the Consensus event hype, has since crashed to $0.5370 as of June 21. Trading volume has also plunged dramatically, from a February peak of $3 billion to just $74 million, indicating waning market interest.

However, technical indicators suggest the worst may be over. On the 8-hour chart, Pi Coin is forming a falling wedge, a classic bullish reversal pattern marked by descending and converging trendlines. The narrowing of the wedge lines, combined with a drop in volatility, often precedes a strong breakout. If momentum builds, Pi Coin could target the $1 mark, a potential 85% surge from current levels.

Technical Indicators Hint at Accumulation Phase

The MACD (Moving Average Convergence Divergence) for Pi Coin continues to trend lower, highlighting the ongoing absence of major price swings. Similarly, the Donchian Channels which track volatility through recent highs and lows have significantly narrowed, pointing to a consolidation phase.

Such low-volatility environments typically reflect investor accumulation, where informed players quietly position themselves ahead of a breakout. If Pi Coin breaks above the upper trendline of the wedge, it could attract new buyers and regain market momentum. That said, the bullish thesis would be invalidated if the price falls below $0.3940, the key monthly support level.

Pi Day 2 and Domain Auctions

Beyond technicals, upcoming ecosystem events may serve as bullish triggers. Pi Network is gearing up for Pi Day 2, also called Tau Day, set for June 28. This celebration, an alternative to the traditional Pi Day on March 14 is expected to stir community engagement and possibly bring new announcements from the team.

Coinciding with Tau Day is the conclusion of the much-anticipated .pi domain auction, which has drawn over 123,000 active bidders and over 3 million individual bids. The strong response reflects growing interest in Pi’s decentralised web ecosystem, and successful domain allocations could further legitimise the project.

Ecosystem Expansion Supports Long-Term Growth

The developers are also laying down the foundation for long-term utility. Recent updates include the launch of Pi Network Ventures, a $100 million fund aimed at supporting ecosystem startups. Although the announcement initially triggered a price dump, the strategic intent behind this fund points to serious development plans.

In addition, small-scale apps such as FruityPi, a fruit-matching game, are beginning to populate the Pi Network. While still early-stage, these applications show that Pi’s ecosystem is inching toward usability beyond mining.

Another external factor working in Pi Coin’s favour is the potential for a more dovish U.S. Federal Reserve. Fed Governor Christopher Waller recently hinted at a possible rate cut as early as July. Such a move could inject liquidity back into risk assets like cryptocurrencies, potentially lifting sentiment across the board, including for Pi.

Rebound Likely but Not Without Risk

Pi Coin’s sharp correction has shaken short-term holders, but technical patterns and upcoming catalysts are painting a more optimistic picture. If the falling wedge breakout plays out and investor interest returns ahead of Pi Day 2, Pi Coin could stage a notable recovery, possibly reclaiming the $1 level.

Still, risks remain. A drop below $0.3940 would signal further downside, and the token’s future depends heavily on how well the ecosystem develops post-mainnet. For now, Pi is in a delicate but promising phase and all eyes are on late June.